Bajaj Finserv Mutual Fund has launched an Open-Ended Equity Scheme, Bajaj Finserv Large Cap Fund, aimed at generating long-term capital appreciation and income distribution. The fund primarily invests in large-cap company equities. The New Fund Offer (NFO) opened on July 29, 2024, and closes on August 12, 2024. There is no entry load, but an exit load of 1% applies for redemptions within 6 months of allotment. The minimum investment amount is Rs. 500.

The objective of the Bajaj Finserv Large Cap Fund is to generate long term capital appreciation and income distribution to investors by predominantly investing in equity and equity related instruments of large cap companies. However, there is no assurance that the investment objective of the Scheme will be achieved.

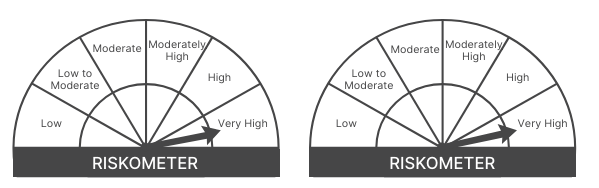

This NFO of Bajaj Finserv Large Cap Fund is suitable for investors who are seeking wealth creation over long term and want to invest predominantly in equity and equity related instruments of large cap companies

| Types of Instruments | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equities & Equity related securities of large cap companies | 80 | 100 |

| Equities & Equity related securities of other than large cap companies, equity & equity related securities of foreign companies | 0 | 20 |

| Debt & Money Market instruments | 0 | 20 |

| Units issued by REITs & InvITs | 0 | 10 |

The performance of the Bajaj Finserv Large Cap Fund will be benchmarked to the performance of the Nifty 100 Total Return Index (TRI).

Mr. Nimesh Chandan has over 23 years of experience in the Indian Capital Markets. He has spent 17 years in Fund Management- managing and advising domestic and international investors, retail as well as institutional. Prior to joining Bajaj Finserv Asset Management Ltd, he has worked with Canara Robeco Asset Management as Head Investments, Equities (Domestic and Offshore). He has also worked with other asset management companies including Birla Sunlife Asset Management, SBI Asset Management and ICICI Prudential Asset Management.

Mr. Sorbh Gupta has over 16 years of experience in the Indian Capital Markets. In November 2022, he was appointed as Senior Fund Manager – Equity at Bajaj Finserv Asset Management Limited. Before joining Bajaj Finserv Asset.

Mr. Siddharth Chaudhary joined the Company in July 2022 as Senior Fund Manager – Fixed Income. Prior to this he was associated with Sundaram Asset Management Co. Ltd from April 2019 – July 2022 as Head Fixed Income – Institutional Business, from April 2017 – March 2019 as Senior Fund Manager – Fixed Income, from August 2010 – March 2017 as Fund Manager – Fixed Income. During June 2006 – September 2010 he was working as Senior Manager, Treasury Dept in Indian Bank.

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | 5 Years Returns (%) | 10 Years Returns (%) | Since Launch Ret (%) |

| ABSL Frontline Equity | 29107.64 | 1.66 | 34.03 | 19.09 | 14.11 | 19.75 |

| Kotak Bluechip | 8849.48 | 1.75 | 35.17 | 20.23 | 14.76 | 19.6 |

| DSP Top 100 Equity | 4010.86 | 1.98 | 38.12 | 18.25 | 12.43 | 19.59 |

| HSBC Large Cap | 1896.38 | 2.13 | 34.72 | 18.06 | 13.17 | 19.56 |

| Franklin India BlueChip | 8160.81 | 1.82 | 31.04 | 17.56 | 12.73 | 18.86 |

| ITI Large Cap | 332.28 | 2.35 | 38.21 | – | – | 18.65 |

| HDFC Top 100 Fund | 35437.12 | 1.61 | 35.15 | 18.94 | 14.08 | 18.6 |

Data as of July 29, 2024

Dreaming of financial freedom? Use our Mutual Fund SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jul 30, 2024, 3:33 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates