Investing in the stock market is often about finding the right balance between risk and return. While the Nifty 50, comprising India’s top 50 large-cap stocks, has long been a favored benchmark for investors looking to tap into the stability of big firms, those seeking broader market exposure and the potential for higher returns might find the Nifty 500 an attractive alternative.

The Nifty 500 index encompasses a wider array of sectors and market capitalizations, including large-cap, mid-cap, and small-cap stocks, thereby offering a comprehensive reflection of the Indian economy.

One of the most compelling benefits of investing in the Nifty 500 is its extensive market coverage. The index includes the top 500 companies by market capitalization, representing over 90% of the total market capitalization of the National Stock Exchange (NSE). This extensive coverage allows investors to gain exposure to a broader economic spectrum, including sectors and industries that are not heavily represented in the Nifty 50. For instance, beyond the typical heavyweights like IT and Financial Services, the Nifty 500 includes companies from capital goods, realty, textiles, and media & entertainment sectors.

Diversification is a key element of investment strategy, aimed at reducing risk by spreading investments across various financial instruments, industries, and other categories. Investing in the Nifty 500 naturally offers more diversified sector exposure than the Nifty 50. While sectors like Financials and IT dominate the Nifty 50, accounting for more than 65% of its weight, the Nifty 500 provides a more balanced exposure across more than 20 sectors. This reduces the risk associated with sector-specific downturns and smoothens the volatility in the investment portfolio.

Source: NSE

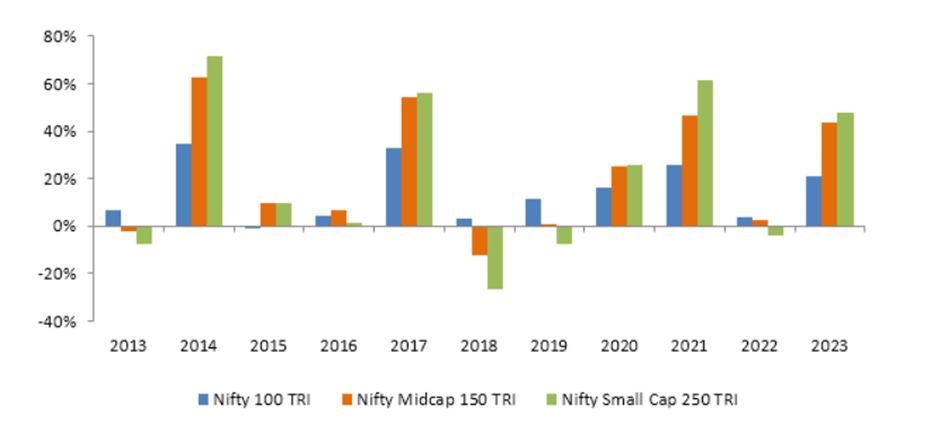

The inclusion of mid-cap and small-cap stocks in the Nifty 500 is particularly significant for investors looking for growth opportunities. Historically, mid and small-cap stocks have presented higher growth potential compared to large-cap stocks, especially during bullish market phases. These stocks, often representing emerging industries or innovative companies, can deliver substantial returns as they grow in market size and operational scope.

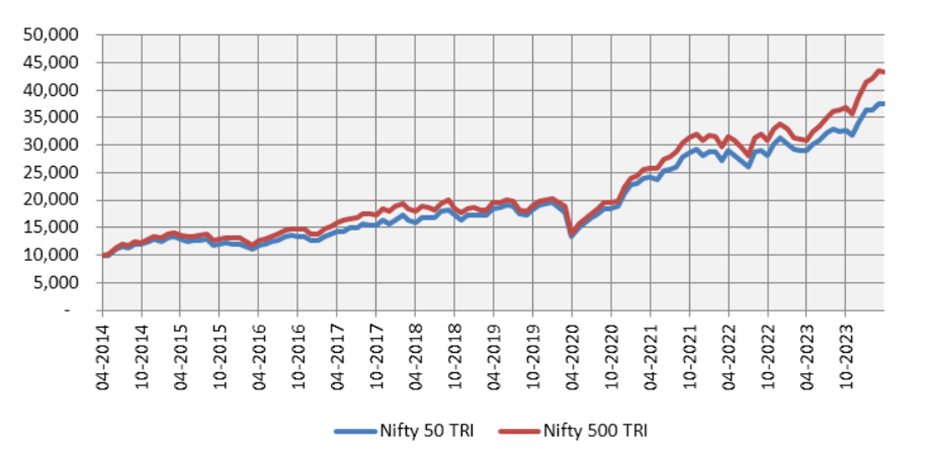

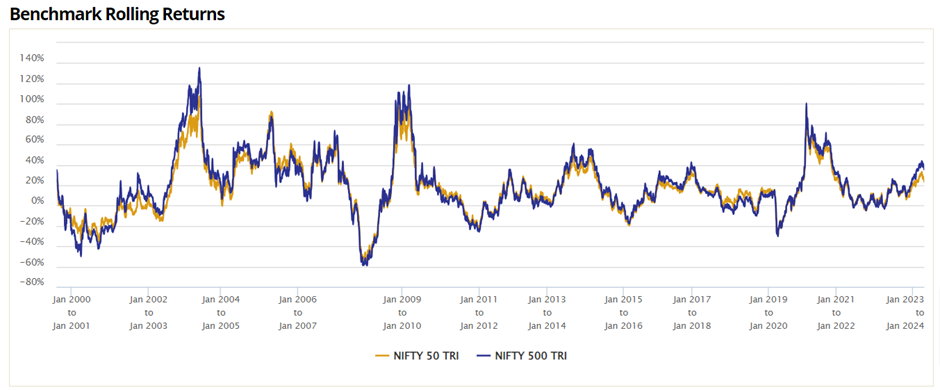

Data suggests that the Nifty 500 has historically provided better returns over certain periods compared to the Nifty 50. For example, over the decade, the Nifty 500 has outperformed the Nifty 50, delivering an average 1-year rolling return of 17.6% compared to 15.89% by the Nifty 50. This can be attributed to the broader market recovery and growth that benefit a wider range of stocks included in the Nifty 500.

| Particulars | Return Statistics (%) | ||||

| Benchmark Name | Average | Median | Maximum | Minimum | Negative |

| NIFTY 50 TRI | 15.89 | 12.65 | 109.82 | -56.55 | 24.21 |

| NIFTY 500 TRI | 17.6 | 13 | 137.07 | -59.06 | 22.79 |

| Particulars | Return distribution (% of times) | ||||

| Benchmark Name | 0 – 8% | 8 – 12% | 12 – 15% | 15 – 20% | Greater than 20% |

| NIFTY 50 TRI | 14.97 | 9.04 | 8.05 | 8.95 | 34.77 |

| NIFTY 500 TRI | 16.21 | 9.18 | 5.47 | 7.03 | 39.32 |

The Nifty 500 Index Fund is suitable for investors with varying risk appetites, looking to capitalize on the potential of the entire stock market through a single investment vehicle. It offers a passive investment strategy that minimizes the risk of fund manager bias, comes at a lower cost compared to actively managed funds, and provides a straightforward solution for investors looking to diversify across different market caps and sectors.

For investors seeking an investment avenue that aligns with a comprehensive market approach, the Nifty 500 offers a compelling choice. It not only captures the dynamism of India’s broader economic landscape but also allows investors to benefit from the growth trajectories of smaller companies, all the while maintaining a core of stability through large-cap stocks. With its diversified and extensive coverage, the Nifty 500 Index Fund stands out as a robust foundation for building a diversified investment portfolio that is responsive to the shifts and opportunities of the Indian market.

Ready to watch your savings grow? Try our SIP Plan Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: May 9, 2024, 5:07 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates