Aditya Birla Sun Life Fixed Maturity Plan-Series UU (98 days) is a close-ended income scheme launched by Aditya Birla Sun Life Mutual Fund. It invests in fixed-income securities maturing within the 98-day scheme tenure and aims to generate income for investors. There is no guarantee of returns, and investors cannot redeem their units before maturity. The plan has no entry load, but exit before maturity is only possible through the stock exchange, and exit loads may apply in that case. The minimum investment amount is Rs. 1,000. The new fund offer is open for subscription from April 30, 2024, to May 6, 2024.

Aditya Birla Sun Life Fixed Maturity Plan-Series UU (98 days) seeks to generate income by investing in a portfolio of fixed-income securities maturing on or before the tenure of the Scheme. The Scheme does not guarantee/indicate any returns. There is no assurance that the investment objective of the Scheme will be achieved.

This NFO of Aditya Birla Sun Life Fixed Maturity Plan-Series UU (98 days) is suitable for investors who are seeking Income with capital growth over the short term and investments in debt and money market securities maturing on or before the tenure of the scheme

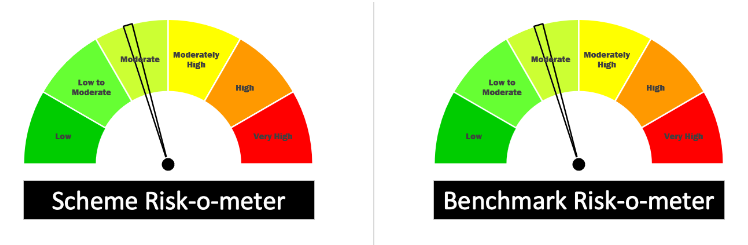

Potential Risk Class: it’s a close-ended scheme, with relativelylow interest rate risk and relatively moderate credit risk (B – I).

| Investments | Indicative Allocation | Risk Profile |

| Debt Securities including Government securities, State Development Loans (SDLs), and Money Market

Instruments |

Minimum 0% – Maximum 100% | Low – Moderate |

Aditya Birla Sun Life Fixed Maturity Plan-Series UU (98 days) will benchmark against CRISIL Ultra Short Term Debt Index.

Mr. Mohit Sharma is an accomplished fund manager with a robust educational background, holding a PGDCM from IIM Calcutta and a B.Tech from IIT Madras. At 44 years old, he brings over 17 years of diverse professional experience, including a significant 10-year tenure in financial markets. Since October 2015, Mr. Sharma has been contributing his expertise to Aditya Birla Sun Life AMC Limited. Prior to this, he ventured into entrepreneurship by running his own healthcare-tech business from June 2012 to May 2015. His earlier career includes roles in the banking sector, where he worked as an Interest Rates Trader at Standard Chartered Bank from May 2007 to June 2011 and at ICICI Bank Ltd from June 2006 to April 2007. Mr. Sharma started his career in equity research at Irevna Ltd, where he worked from June 2005 to June 2006, laying a solid foundation for his later achievements in the financial domain.

| Funds | 1Y Returns | 3Y Returns | 5Y Returns | Since Inception |

| Nippon India Interval Fund-Monthly Interval Fund-Series-I- Direct Plan – Growth | 6.40% | 5.30% | 4.90% | 6.50% |

Ready to watch your savings grow? Try our SIP Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Apr 30, 2024, 3:28 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates