Aditya Birla Sun Life Nifty PSE ETF is an open-ended Exchange Traded Fund (ETF) launched by Aditya Birla Sun Life Mutual Fund on May 2nd, 2024. The scheme aims to track the performance of the Nifty PSE Index, which means its returns will be similar to the index, barring minor tracking errors. The minimum investment amount is Rs 500 and the offer closes on May 16th, 2024.

The investment objective of the Aditya Birla Sun Life Nifty PSE ETF is to generate returns that are in line with the performance of the Nifty PSE Index, subject to tracking errors.

This NFO of Aditya Birla Sun Life Nifty PSE ETF is suitable for investors who are seeking Investors seeking returns that are in line with the performance of the Nifty PSE Index, subject to tracking errors and investments in the stocks belonging to the Nifty PSE Index

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

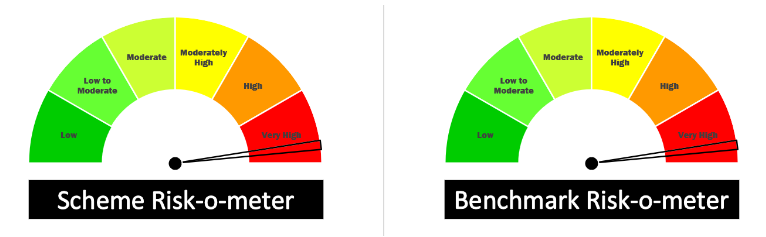

| Equity and Equity related instruments constituting Nifty PSE Index | Very High | 95 | 100 |

| Cash, Money Market & Debt instruments | Low to

Moderate |

0 | 5 |

The performance of the Aditya Birla Sun Life Nifty PSE ETF is benchmarked against the Nifty PSE Index.

Mr. Haresh Mehta, a 39-year-old with a B. Com. and MBA (International Business Management) from Sikkim Manipal University, brings over 16 years of experience in dealing with his role at Aditya Birla Sun Life AMC Limited. Before joining Aditya Birla, he spent over 4 years at Baroda BNP Paribas Asset Management India Pvt. Ltd as a Dealer and Investment Support professional. He also has over 11 years of experience as an Institutional Equities Trader at First Global Stockbroking Pvt. Ltd.

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as on – 30-04-2024 in % | ||||

| 2024 | 2023 | 2022 | 2021 | 2020 | ||||

| HDFC NIFTY PSU BANK ETF | 25-01-2024 | 15.29 | 0.35 | – | – | – | – | – |

| CPSE ETF | 05-03-2014 | 36231.32 | 0.05 | 30.1 | 75.62 | 27.95 | 46 | -13.5 |

| Kotak Nifty PSU Bank ETF | 08-11-2007 | 1427.63 | 0.49 | 32.9 | 32.52 | 73.49 | 43.44 | -30.94 |

| Nippon India ETF Nifty PSU Bank BeES | 25-10-2007 | 2653.66 | 0.49 | 32.9 | 32.46 | 73.53 | 43.64 | -30.84 |

| ICICI Pru Nifty PSU Bank ETF | 15-03-2023 | 44.36 | 0.4 | 32.95 | – | – | – | – |

| DSP Nifty PSU Bank ETF | 27-07-2023 | 16.57 | 0.45 | 32.97 | – | – | – | – |

| ETFs | – | – | – | 7.8 | 24.46 | 3.44 | 21.68 | 13.63 |

There is not a single similar ETF comparable to Aditya Birla Sun Life Nifty PSE ETF

Dreaming of financial freedom? Use our Mutual Fund SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: May 2, 2024, 3:02 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates