The Union Budget speech would be typically divided into two parts. The first part would contain all the government allocations and resources and the second part contained the key changes pertaining to direct and indirect taxes. Effective July 2017, most of the indirect taxes including excise duty, VAT, CENVAT, Sales Tax and Service Tax were subsumed into GST. The Union Budget 2018 will make the second part of the budget redundant and also serve to remind us about the GST focus.

Tinkering with GST rates is the prerogative of the GST Council and hence the Union Budget will not overly focus on that. However, the Union Budget 2018 will look to address 4 key issues pertaining to the GST…

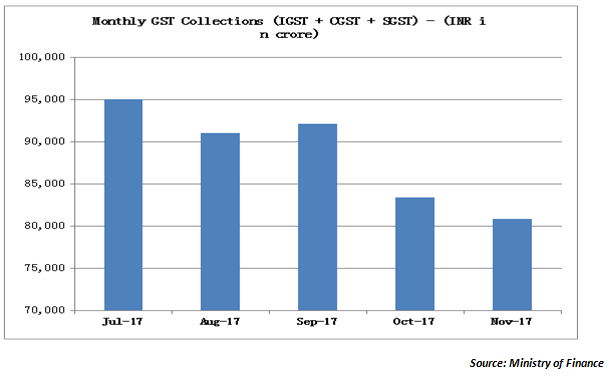

One only has to glance at the chart below to understand how the GST revenues of the government have been tapering since its implementation on July 01st 2017.

There will be some adjustments due to lagged reporting and due to refunds. But this broadly captures the trend of GST collections in the last 5 months. The fall can be attributed to two factors viz. lower rates announced in October and the shifting of small businesses to quarterly filing format. The challenge for the government is to ensure that the overall revenue does not go below the earlier indirect tax collections. One of the purposes of the government spending and investment in infrastructure is to propel GDP growth. A 100 basis points fall in GDP has had a deep impact on indirect tax collections and that is evident in the GST numbers. That is something the government will look to urgently address in this Union Budget.

One of the major justifications for the GST in other countries was the simplification of the rate structure. For example, excise duties were extremely complex with multiple rates within the same product. Further, there were specific rates and ad valorem rates. But, GST rates have also become quite complex. For example there is a 0% slab, 5% slab, 12% slab, 18% slab and 28% slab. Then there is gold with a special 3% GST. There are additional levies and the entire structure gets a lot more complex. The Union Budget will have to look at simplifying the whole thing structurally. It can probably reduce it to just 3 rates for essential goods, all other goods and demerit goods respectively.

We see this as a distinct possibility in this Budget. There may be incentives for GST registration and timely payment of GST which will act as an incentive for more people to register and also pay on time. Like the government has incentivised digital payments for small businesses, the budget can look at special incentives on those lines. This will push more businesses into the organized segment.

Exports growth has faltered and the trade deficit in December touched a high of $15 billion. One reason is that nearly $10 billion is stuck up in Exporter GST refunds. There are some quick answers we can expect in the budget. Providing liquidity to exporters against refunds, giving credit adjustment against past dues or even offering an amnesty scheme to tide over legacy issues of excise and service tax are likely in this budget. All in all, GST could be one of the key themes underlying the budget.

Published on: Jan 22, 2018, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates