TRUST Mutual Fund has launched a new open-ended equity scheme named TRUSTMF Flexi Cap Fund. This fund aims to provide long-term capital growth and income by actively investing in a diversified portfolio of equity and equity-related securities across all market capitalizations (Large, Mid, and Small Cap) along with debt and money market instruments.

The New Fund Offer (NFO) is open for subscription from April 5, 2024, and will close on April 19, 2024. There is no entry load, but an exit load of 1% applies if redeemed or switched out within 180 days from the allotment date. No exit load applies after 180 days. The minimum subscription amount is Rs. 1000.

The investment objective of the TRUSTMF Flexi Cap Fund (NFO) is to provide long-term growth in capital and income to investors, through active management of investments in a diversified portfolio of equity and equity-related securities across the entire market capitalization spectrum and in debt and money market instruments. There is no assurance or guarantee that the investment objective of the Scheme will be achieved.

This NFO of TRUSTMF Flexi Cap Fund is suitable for investors who are seeking long-term capital appreciation and investment in equity and equity-related securities of companies across market capitalization. Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Investments | Indicative Allocation | Risk Profile |

| Equity & equity-related instruments of large-cap, mid-cap, and small-cap

companies |

Minimum 65% – Maximum 100% | Very high |

| Debt & Money Market Instruments | Minimum 0% – Maximum 35% | Low to Medium |

| Units issued by REITs & InvITs | Minimum 0% – Maximum 10% | Very High |

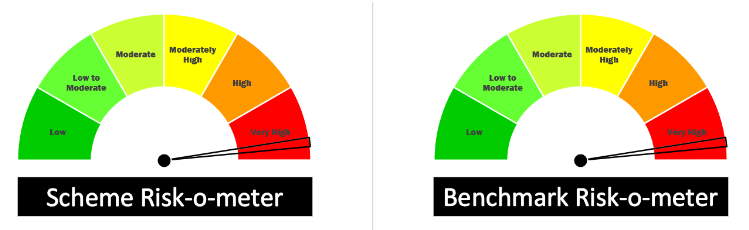

The performance of the TRUSTMF Flexi Cap Fund is benchmarked against the NIFTY 500 TRI index.

Mr. Mihir Vora, a seasoned Fund Manager with 29 years of extensive experience in financial services, boasts a comprehensive skill set honed across Mutual Funds, Insurance, and Sovereign Funds. Holding a CFA from the CFA Institute, USA, along with a PGDM from IIM Lucknow and a Bachelor of Engineering from Maharaja Sayajirao University, Vadodara, Mr. Vora brings a wealth of knowledge and strategic acumen to the table.

Mr. Aakash Manghani, a proficient Fund Manager, brings over 14 years of expertise in equities to the table. Holding an MBA from SP Jain School of Global Management and a B.E. from Sardar Patel College of Engineering, University of Mumbai, Mr. Manghani has excelled in research and portfolio management, showcasing a sharp analytical focus spanning diverse sectors. With a solid foundation in both academia and practical experience, Mr. Manghani is well-equipped to contribute to the success of the scheme from its inception.

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as on – 04-04-2024 in % | ||||

| 2024 | 2023 | 2022 | 2021 | 2020 | ||||

| Equity: Flexi Cap | – | – | – | 6.89 | 28.28 | 0.2 | 32.98 | 17.68 |

| NIFTY 500 TRI | – | – | – | 6.23 | 26.91 | 4.25 | 31.6 | 17.89 |

| Parag Parikh Flexi Cap Reg Gr | 05-05-2013 | 58900.52 | 1.31 | 7.63 | 36.57 | -7.23 | 45.51 | 32.29 |

| HDFC Flexi Cap Gr | 01-01-1995 | 49659.20 | 1.51 | 8.02 | 30.6 | 18.29 | 36.17 | 6.44 |

| Kotak Flexi Cap Gr | 05-09-2009 | 45111.78 | 1.48 | 6.44 | 24.2 | 5 | 25.37 | 11.79 |

| UTI Flexi Cap Gr | 05-08-2005 | 24684.31 | 1.66 | -1.34 | 19.81 | -13.42 | 33.98 | 31.55 |

Flexi-cap funds are equity mutual funds that invest across all company sizes, from large established firms (large-cap) to smaller, high-growth businesses (small-cap). Unlike funds limited to a single market cap, flexi-cap funds offer diversification and the freedom for the fund manager to choose stocks based on potential, regardless of size. This flexibility allows the fund to potentially capture growth across the market while balancing risk. They are considered less risky than pure small-cap funds but may not offer the same potential high returns

Ready to watch your savings grow? Try our SIP Plan Calculator today and unlock the potential of disciplined investing. Perfect for planning your financial future. Start now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Apr 5, 2024, 12:22 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates