If you did a casual search for “Indian pharma companies” on Google, then there will be a typically depressing story that will be underlying these search results. Consider a few of them…

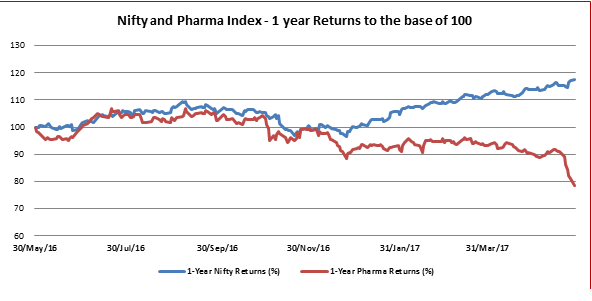

The crux of the matter is that the state of pharma in India seems to be depressed. Look at the NSE Pharma Index and its relative performance versus the Nifty…

The above chart tracks the divergence in the performance of the Nifty and the Pharma index over the last 1 year. While the Nifty has given returns of (+17.4%) over the last 1 year, the Pharma index has given a return of (-21.6%). The Nifty and the Pharma index were actually moving in tandem till November 2016, post which the divergence between the Nifty and the Pharma index actually started to manifest itself. Before getting into the reasons for this pressure on pharma stocks, let us look at how some of the key pharma company results panned out in the fourth quarter of 2016-17.

How the quarterly result panned out for pharma?

Across the board almost all the pharma companies in India saw tremendous pressure on top-line and bottom line. Consider the following instances…

What exactly is ailing Indian pharma companies?

Actually there are a lot of factors that are ailing Indian pharma, factors that are external and internal. The reality is that the pharma model, which had thrived on generics for the last 3 decades, is undergoing a paradigm shift. Here are some of the key reasons that are driving the poor performance of pharma companies…

Weak exports and Form 483 objections:

Form 483 is a warning issued by the US Food & Drug Administration (FDA) when they find shortcomings in the quality of manufacturing and testing processes of generics. Most pharma companies in the last couple of years have faced flak from the US FDA. That has put manufacturing in investigated plants on hold negatively impacting exports to the US. Incidentally, the US accounts for close to 40% of Indian pharma exports and remains the biggest market for Indian generics.

The process of approvals is getting delayed…

This is a major problem that Indian pharma companies are facing today. The US FDA is going slow in new drug approvals to Indian companies so that they can be perfectly sure on the testing front. This delay in approvals is negatively impacting the Indian product pipeline.

More ANDAs of non-India companies is a challenge…

Even as inspections and investigations of the US FDA are on in India, there is a new kind of problem that is cropping up for India. The FDA is planning to speed up its process of Abbreviated New Drug Application (ANDA) approvals in the US. More ANDA approvals imply that there will be more competition in the generics market. In fact, this emerging competition is one of the key factors that are pushing the price of generics down. That impact is evident in the form of lower sales volumes and in lower prices.

More consolidated decisions mean less fragmented buying…

In a nutshell, the Indian generics are losing bargaining power vis-à-vis the pharma buyers in the US market. The pharma supply chain has been consistently consolidating with the result there are just a handful of buyers who now have greater bargaining chips and therefore more pricing power. That is squeezing growth and also profit margins, which is evident from the sharp fall in EBITDA margins of most pharma companies.

Competition from new entrants…

For a very long time, the US generics market was virtually dominated by India and was later joined by Israel. But over the last few years, new players in the generics space have become key suppliers in the US market. The US has also been keen to welcome the new players who are willing to operate on wafer-thin margins leading to a squeeze in sectoral EBITDA margins. In fact, there are countries like Turkey, Taiwan and even Bangladesh that are giving a run for their money to India.

Finally, there is also the domestic side to the story…

Of late, Indian prices in the generics pharma markets are in sync with Trump’s philosophy of bringing down healthcare costs drastically. The National Pharmaceutical Pricing Authority (NPPA), which is the central regulator for the pharma Industry in India, has cut the prices of over 50 drugs by 5% to 44% in the last 1 year and have put price caps on over 29 formulations. The average price reduction in India was around 25% and that also impacted profits, although India accounts for a small share of the sales of these pharma companies. Also the R&D budgets of these pharma companies has been growing consistently at around 20-25% over the last 4 years and that has also contributed to pressure on pharma company profits.

To cut a long story short, Indian pharma is plagued by falling sales, weak profit growth and compressing margins. India may have to rapidly re-invent its pharma model if it wants to regain its pre-eminent position. The ball is entirely in the Indian pharma industry’s court.

Published on: Jun 15, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates