Indian equity markets in the past few days witnessed some FII outflow. However, despite the consistent outflow, the benchmark Indices have remained resilient and outperformed the emerging market peers. The Benchmark indices have remained resilient, and a few of the broader indices like Small-Cap and Mid Cap have witnessed some profit booking. Amid all these challenges faced by the market participants, another challenge to be expected in the coming months. While we are already facing the challenges of economic growth amid Covid-19, the liquidity provided by developed countries has been acting as strong support. However, the possibility of US Federal tapering expects to keep the investors cautious. In the past, we have witnessed the impact of the US taper in 2013.

It is a simple fact that as the liquidity supports moves out, the risky asset class like emerging markets and even commodities witness an outflow. As we stated earlier in 2013, global markets had come across a similar event as in May- June 2013; the US Fed has indicated the tapering to occur from December 2013. With Jerome Powell also indicating towards slowing down the monthly purchase of bond purchases or we can say begin ‘tapering’ towards the end of 2021 – there would be a question in the minds of investors about what impact it would make on the Indian equity markets?

As we stated earlier that a similar kind of event occurred in 2013 too, the first and foremost strategy would be to understand how the Indian equities had reacted then? Let’s first take a look at how the Indian benchmark indices and the sectoral indices had performed in 2013 ahead of the tapering and after the tapering.

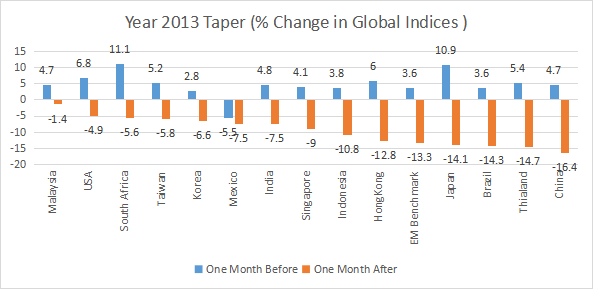

While we speak about the Indian Equity indices, we have also provided data on how the other global indices had performed in 2013.

If we look at the performance of the indices above, it indicates that all the global indices have seen a sell-off in the equities. In simple words, a month ahead of Taper, the Indices had moved northwards. The most severely affected markets were China, Thailand, Brazil, and Japan. One inference here is the export-oriented, and secondly, commodity-driven markets witnessed a significant fall. It is a known fact that as the taper starts, the US financial markets would be a more attractive option for investors. The simple reason being as the liquidity starts waning, the funds would move towards a safe haven.

While we spoke about the other markets with exposure to the commodities and exports-oriented ones, let’s see how the Indian markets had performed in similar periods. The chart shows the Indian Benchmark Index witnessed a positive move of 4.80 percent one month before the taper. The decline after the taper was 7.50 percent. While speaking about the performance a month before and after, the short-term traders would also like to know how the indices moved one week before and after the taper.

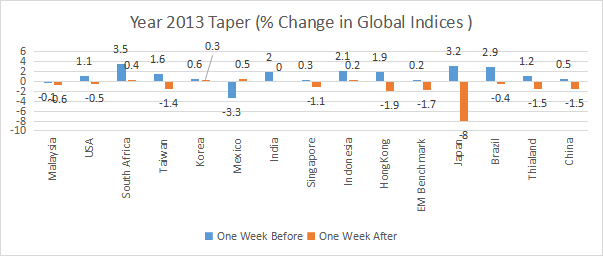

The following chart gives detailed data regarding the same.

If we look at a week’s performance before and after the taper, Only Japanese indices had witnessed a significant decline. The Indian market remained flat for one week after the taper. It clearly indicates the taper impact was seen over the period gradually.

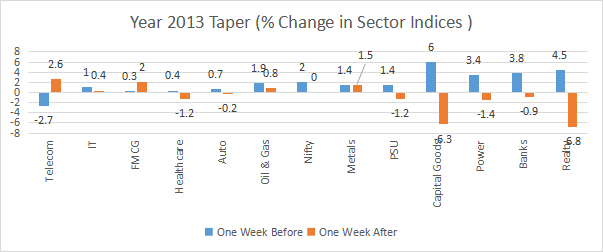

The sectoral impact was most visible on the sectors with rate-sensitive sectors. Capital goods and realty witnessed a higher negative impact after one week of taper. Capital intensive sectors also saw some amount of selling. However, IT and Telecom observed some positive moves. Probably the INR depreciation helped the IT Sector, and the domestic consumption story helped the FMCG sector as a whole.

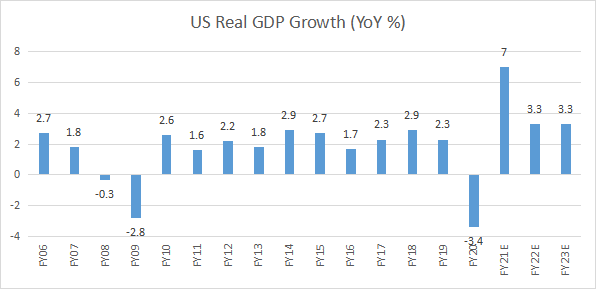

It is a known fact that the liquidity supports growth (may result in some inflation), and once liquidity has taken away, the growth may get affected. Let’s see how the US Growth was after the taper and how the growth was in India.

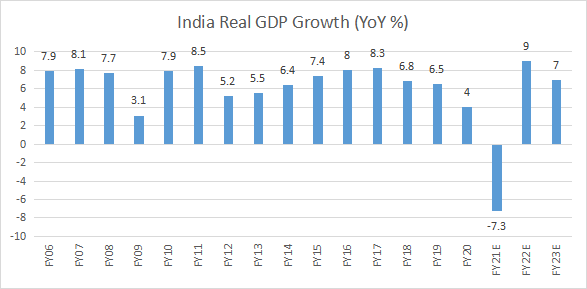

The above chart shows even after the taper, the growth was good in US markets. Similarly, the India growth story was intact even after the taper.

If the growth was visible then, what would the impact on the development be if the taper happens this time? In the current scenario, most of the experts feel this time as well; the growth scare may be temporary. No wonder the discussion on the start of tapering by the Fed has made markets worry about a repeat of the 2013 “taper tantrum. However, with the Lessons learned from previous global meltdowns, the Governments globally have taken the right steps and are ready to face the scenario. In simple words, we opine, the Indian economy is on a much stronger footing than in 2013, which should allow the reflation trade to return as the market digests the clarity on this taper in the coming weeks.

Another factor is, recently the Indian markets have outperformed the EM peers and with some amount of profit booking the possibility of catching up is there. So one can expect India to give some of its recent outperformance. However, one must understand the impact would be sector-specific.

The recent Fed minutes have raised concerns of an earlier start to taper by the end of 2021. A lot was dependent on what Powell said at a Symposium. AS the Way Powell has stated – the Central Bank would start slowing down its monthly bond purchases towards the end of 2021. However, it would be in no hurry to raise the Fed’s benchmark short-term rates.

To put the numbers in perspective, since March 2020, the Fed has been purchasing USD 80 billion US treasuries and USD 40 billion mortgage-backed securities every month. We opine a smaller taper would start by the end of FY21.

As regards the Indian markets now, experts suggest that – the Indian economy is on a far stronger footing now to prevent a repeat of the 2013 mishap. A massive rise in India’s forex reserves (19.4 months of coverage of current account deficit now versus 3.3 months in 2013), a much-less alarming CPI inflation rate (5.6 percent now versus 9.4 percent in 2013), a more robust GDP growth outlook (5.5 percent in FY13 versus 9.0 percent /7.0 percent in FY22/23), and possibly a more vigilant RBI currency policy are some noteworthy differences.

Inflation Data – Still Under Tolerance Level

Similarly, the Forex Reserves Also Provide a Solace

While the US Taper, the impact is expected to be seen when the actual taper occurs. Indian Markets are much more resilient this time. The macro Factors like GDP Growth, Inflation control, Currency Fluctuation, and the RBI Forex Reserve indicate that the Impact of the US Taper won’t be as severe as it was in 2013. However, the sector-specific impact would be visible as the taper starts.

Published on: Oct 14, 2021, 12:02 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates