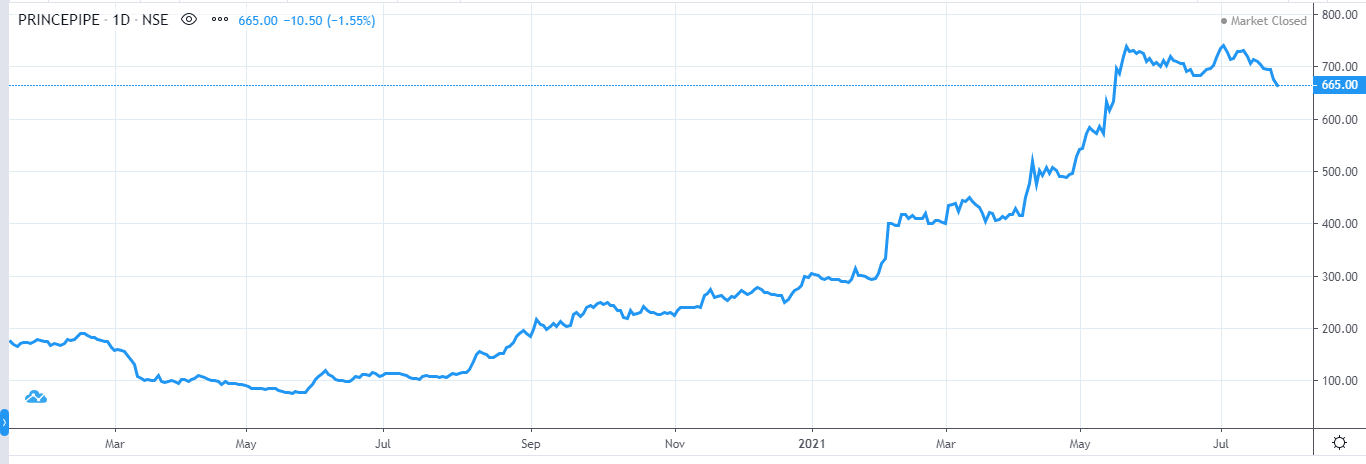

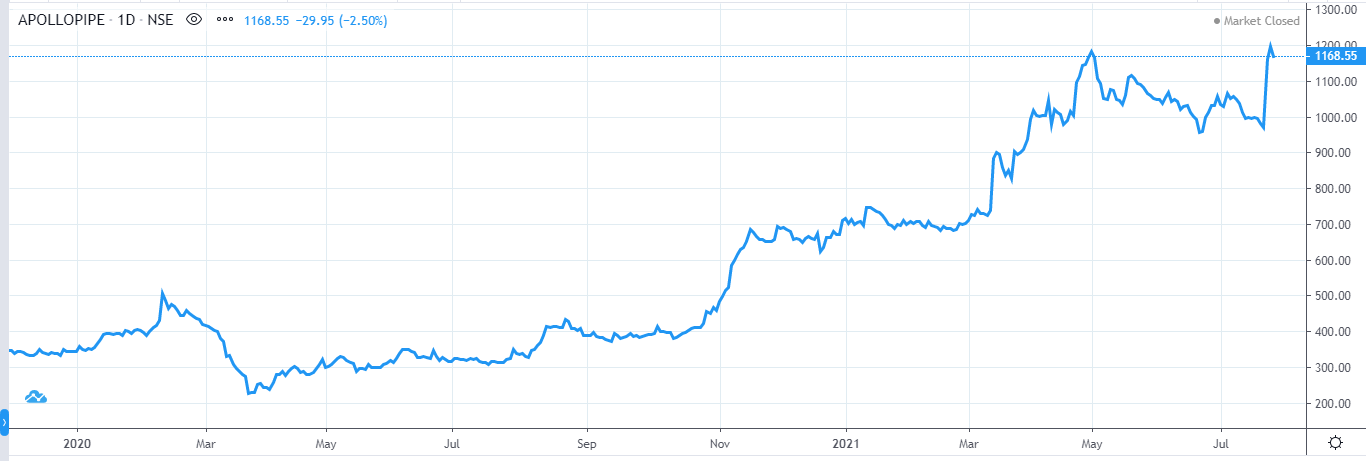

Everyone in the market is looking for an opportunity to generate higher returns. Rather we can say, everyone is looking for an opportunity to find a multibagger that can give them an edge and help them achieve their financial goals. And finding a multibagger has got a lot of research work to be done by the investors. However if we have to filter down to a potential multibagger there are few parameters attached to it. To put it in simple words, t o find a potential multibagger we should look for a fast growing company- which is not necessarily from the fast growing sector. The second parameter is – the business sounds ridiculous or mundane. Hardly there is any institutional holding in the same. Now if you take a look back there are many such examples that have turned multibagger. Especially over the past one and half year where the benchmark indices itself have moved up more than 100 percent from the March 2020 lows. If we try to apply the above three mentioned parameters to one company – APL Apollo Tubes, Prince Pipes, Finolex Industries and Astral PolyTechnik are some of the examples from the so called mundane sector –But turned multibagger. As to explain the segment, the companies are either plastic or steel pipe manufacturers. No one from the investor’s fraternity had a fancy about the sector. There were a few of the leaders from the sector that were on the buying list of investors. However with few macro changes the whole sector got much needed impetus and the so called smaller companies are in a different league altogether.

Let’s first understand what is the Jal Jeevan Mission? Government’s Jal Jeevan Mission, is envisioned to provide safe and adequate drinking water through individual household tap connections by 2024 to all households in rural India. The programme will also implement source sustainability measures as mandatory elements, such as recharge and reuse through grey water management, water conservation, rain water harvesting. With a project cost estimated at Rs 2,87,000 crore the steel tube manufacturers and even the plastic pipe manufacturers got a much needed demand driver. Just to put it in perspective, the pipe demand was estimated at around 35 percent of the overall project cost. No wonder, the segment which was considered as a smaller segment got a potentially higher demand driver. Further being a pan India kind of a project – the beneficiaries were not limited to any region or a cluster. Further, many critics had raised doubts over the execution of the Jal Jeevan Mission project. However, execution has been very good and even in Covid-19 period the process of expansion did not face any halt.

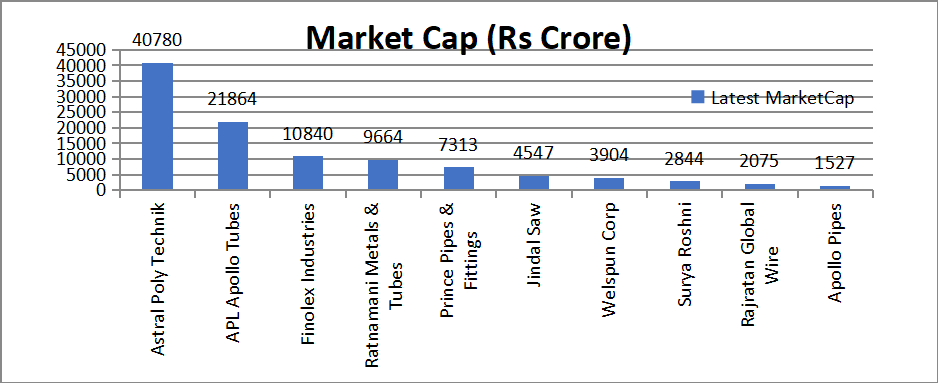

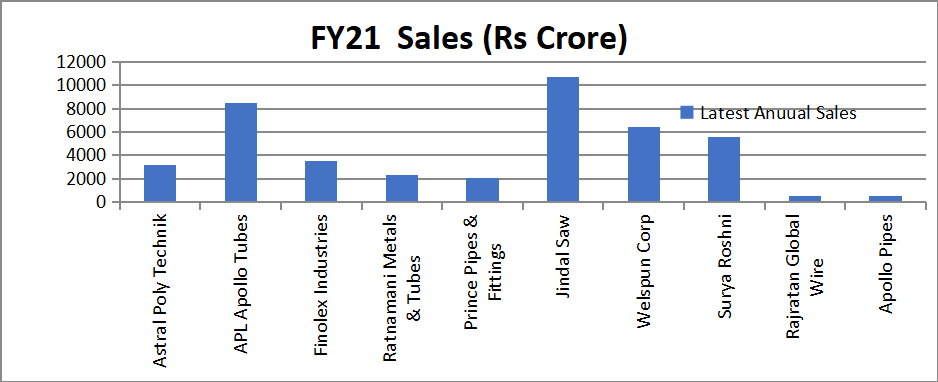

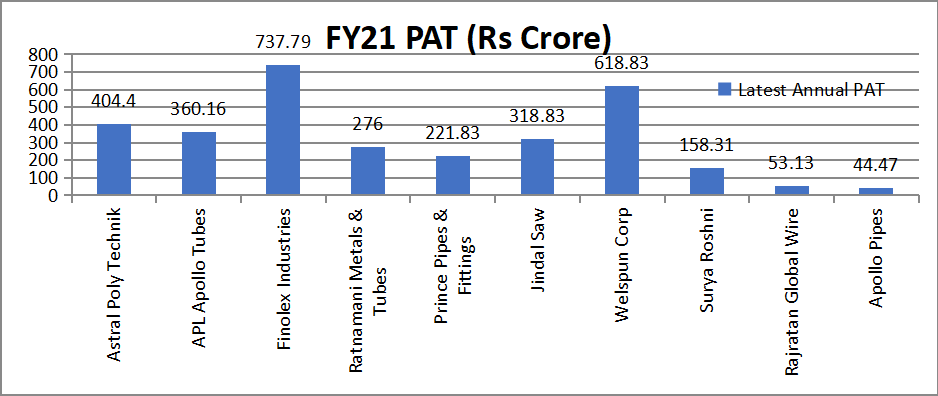

As expected the topline of companies witnessed traction and the better capacity utilisation resulted in operating leverage. Not only the margins improved but the cash flows also improved significantly for the companies from the pipe sector. Here we are providing a list of the companies that are top ten in terms of market capitalisation from the metal and plastic pipes sector.

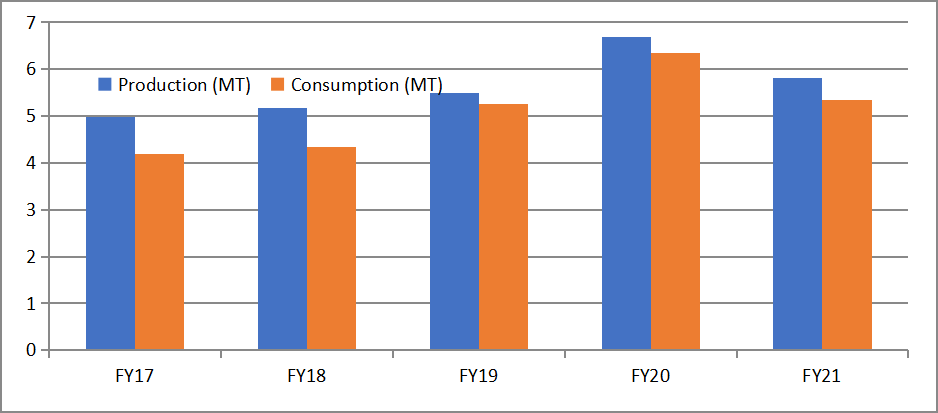

India’s iron and steel pipe and tubes industry, valued at nearly Rs. 60,000 crore, accounts for around 8 percent of the global steel pipe market. The production has grown at a CAGR of 7.69% from 4.97 million tonne in FY17 to 6.68 million tonne in FY20 attributable to incremental demand emanating from growth in domestic water infrastructure mainly driven by Jal Jeevan Mission, oil exploration, construction, infrastructure, and expansion of gas pipelines such as national gas grid and city gas distribution. As a result, the consumption growth outpaced the production growth and expanded with a CAGR of 11.03 percent over the period FY17 to FY20. The following chart shows how the demand has increased for metal pipes over the years.

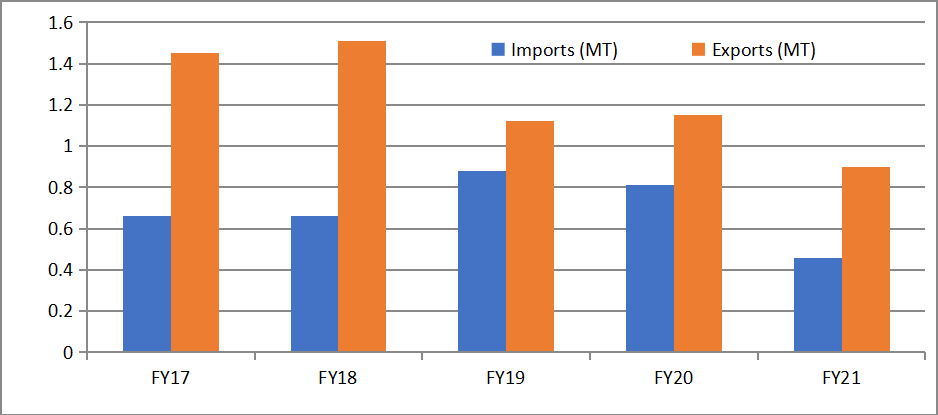

Further with a cost advantage Indian players had an upper hand in Exports as well. However the domestic demand has increased significantly.

As regards the growth prospects, the Oil and Gas has been a major contributor and going ahead it is expected to be similar. To put the numbers in perspective, As per industry estimates, there are a total of 1,103 pipeline projects currently ongoing across the globe with a pipeline demand of 63,600 KMT worth approximately USD 468 billion (nearly Rs.34.16 lakh crore) to be completed over the period 2019-2022. Another major demand centre for pipes is natural gas transportation and distribution. As per PNGRB, the 9th and 10th round of bidding for city gas distribution organized in late 2018 covered 50.61 percent population spread over 41.74 percent of the geographical area and is expected to require 1.74 lakh inch-Km of the pipeline.

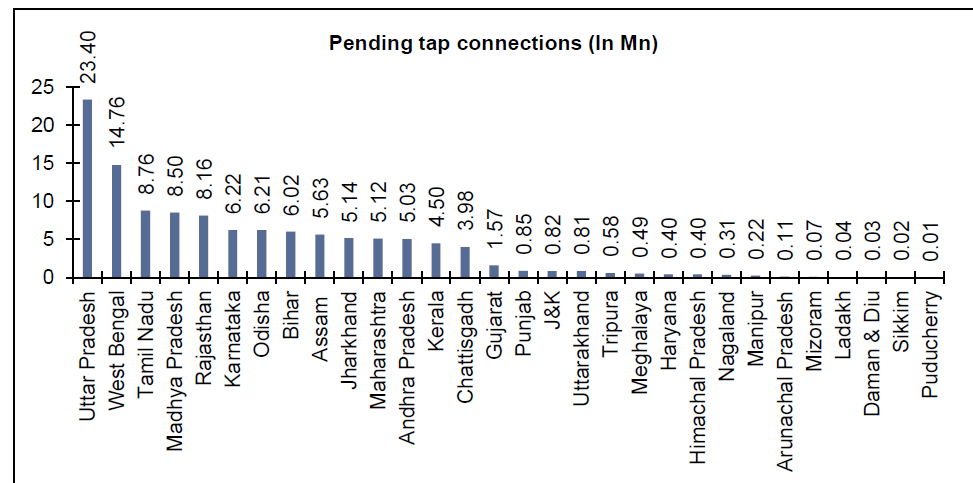

In addition to this the Water transportation is another growth driver for the sector as whole. Putting the numbers in perspective, From FY16-FY20, Rs.5,000 crore was allocated by the government to AMRUT Scheme which has been increased in the union budget FY22 to Rs.7,300 crore. With such high budgetary allocations for these projects which have piped supply of water as their fundamental aim, it is expected that Indian players would stand to benefit. Following chart shows, number of pending Connections as per the plan, indicating good revenue visibility for the plastic pipe companies.

If we take a look at the current position of The Sector, there are still many smaller players in the sector. With the rising demand, pan India project aspect and increasing working capital needs along with technological advancements in the sector, consolidation holds the key. We feel a lot of consolidation is expected in the sector resulting in re-rating of larger players.

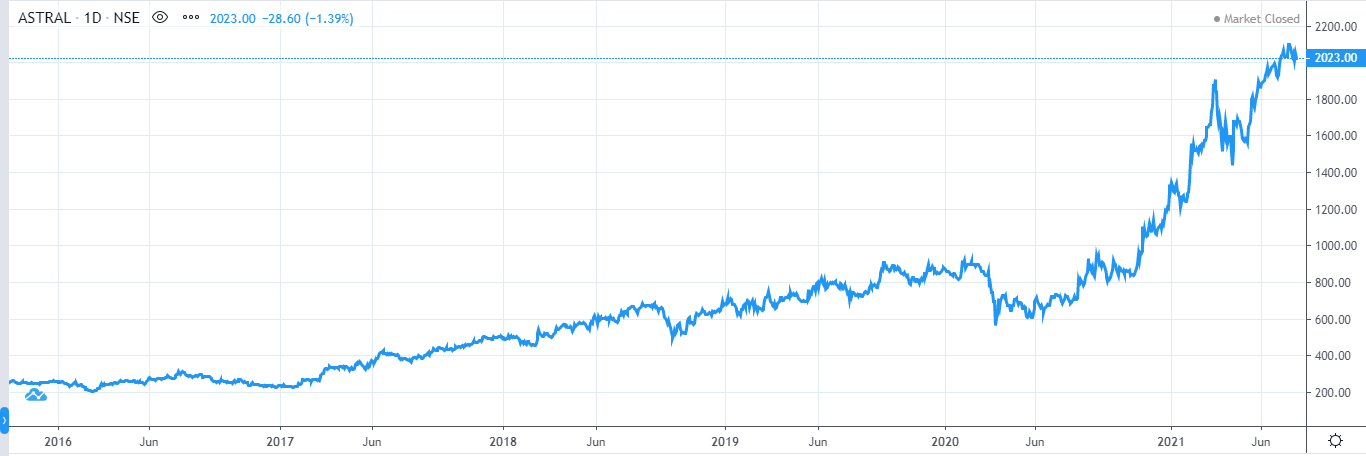

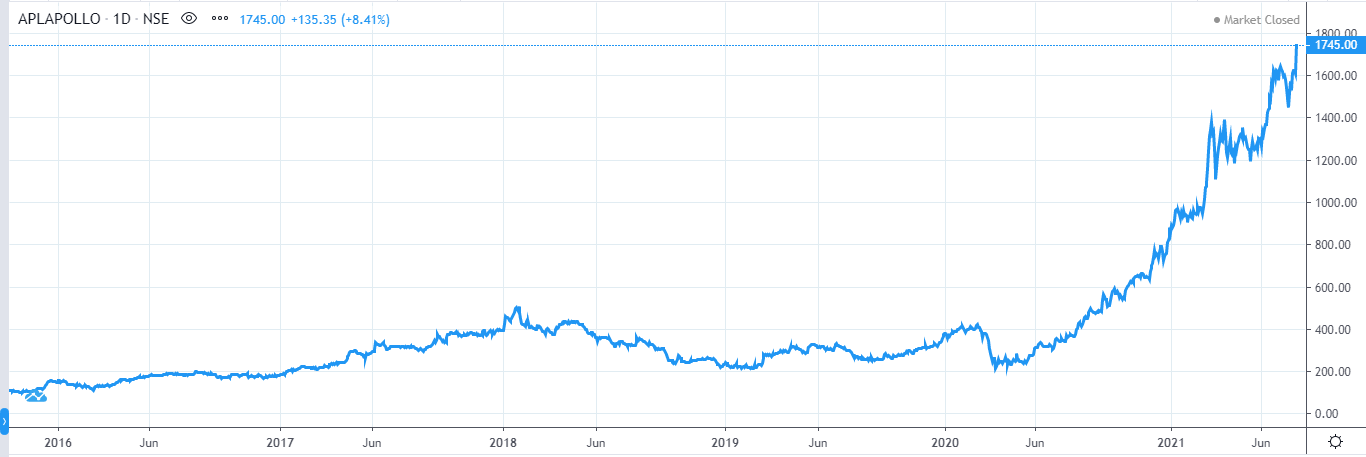

As we mentioned earlier a lot of multibaggers came from the pipe sector. No wonder the market cap has increased significantly over the past few years. The likes of APL Apollo Tubes, Astral PolyTechnik and the newly listed Price Pipe are some of the examples of the same and they do appear in the list. A Few other old stocks but relatively unknown companies are also featured in the list.

Following is the chart showing the list of Top ten companies based on their market capitalization. Along with the same we have also provided the charts of sales and PAT posted by the companies for FY21. Along with such details we have provided the 52 week high and low prices and dates of the respective high and low are provided.

PAT for FY21

PAT for FY21

Astral Polytechnik as mentioned earlier has been a Real multibagger with a broad based wealth creation. The Company now enjoys a market cap of Rs 40,780 crore as on July 27, 2021. The topline for FY21 stands at Rs 3176.30 crore and PAT is Rs 404.40 crore. The 52 week high was Rs 2134 posted on July 13, 2021 and the 52 week low has been Rs 686 posted on July 20, 2020.

The APL Apollo Tubes has been one company which was not under coverage of many large brokers and analysts. However it had all qualities of to become a multibagger stock. The promoters had a vision and understood their business thoroughly. No wonder the stock has created wealth for its stakeholders. The company enjoys a market cap of Rs 21864 crore and FY21 sales stands at Rs 8499.75 crore. The PAT For FY21 Stood at Rs 360.16 crore. The 52 week high price for the stock is 1678 posted as on July 1, 2021 and the 52 week low was Rs 360 posted on July 31, 2020.

It is one old Economy stock that had been on the on investors list since long. Rather it had been the leader in the segment. The company enjoys a market cap of Rs 10840 crore and the FY21 revenues stood at Rs 3462.82 crore. The PAT for FY21 was Rs 737.39 crore. As Regards the 52 week high price, it was Rs 197.85 as on June 28, 2021. And the 52 week low was Rs 87.60 posted on August 6, 2020.

Market Cap Rs 9664 crore. 52 Week (High Rs 2147 on June 21, 2021, Low Rs 1025 on July 27, 2020)

Market Cap Rs 7313 crore. 52 Week (High Rs 794 on May 24, 2021, Low Rs 105 on July 28, 2020)

Market Cap Rs 4547 crore. 52 Week (High Rs 318 on July 26, 2021, Low Rs 54.30 on August 3, 2020)

Market Cap Rs 3904 crore. 52 Week (High Rs 165.9 on June 09, 2021, Low Rs 79.55 on July 28, 2020)

Market Cap Rs 2844 crore. 52 Week (High Rs 573 on June 28, 2021, Low Rs 112 on July 31, 2020)

Market Cap Rs 2075 crore. 52 Week (High Rs 1945 on July 26, 2021, Low Rs 235 on July 31, 2020)

Market Cap Rs 1527 crore. 52 Week (High Rs 1221 on July 26, 2021, Low Rs 313 on July 27, 2020)

Published on: Aug 31, 2021, 1:18 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates