“Worrying doesn’t empty tomorrow of its sorrows, it empties today of its strengths.” – Corrie Ten Boom – timekeeper

The Indian stock market has not shown much growth in the past 1 year. While the Nifty 50 has grown by only 2.03%, the S&P BSE Sensex has grown by 2.43%. You might be wondering that the SBI savings account can give a return of 2.70% (for amounts below ₹10 cr). Plus, it’s risk free!

The situation is bound to make any investor think if the Indian stock market is at all capable of giving them the returns that any stock market enthusiast dreams of gaining over and above the risk-free rate. The feeling is made worse by the fact that the economy seems to be surrounded by various threats such as inflation and disruptions in FPI investment inflows.

But hey! Perhaps we need to look at the big picture and not just short term data.

In spite of the above predicament, if we look at the kind of conditions that the Indian economy has already survived over the past two decades, we will feel much more confidence – for that, we need to think more in the longer term than the shorter.

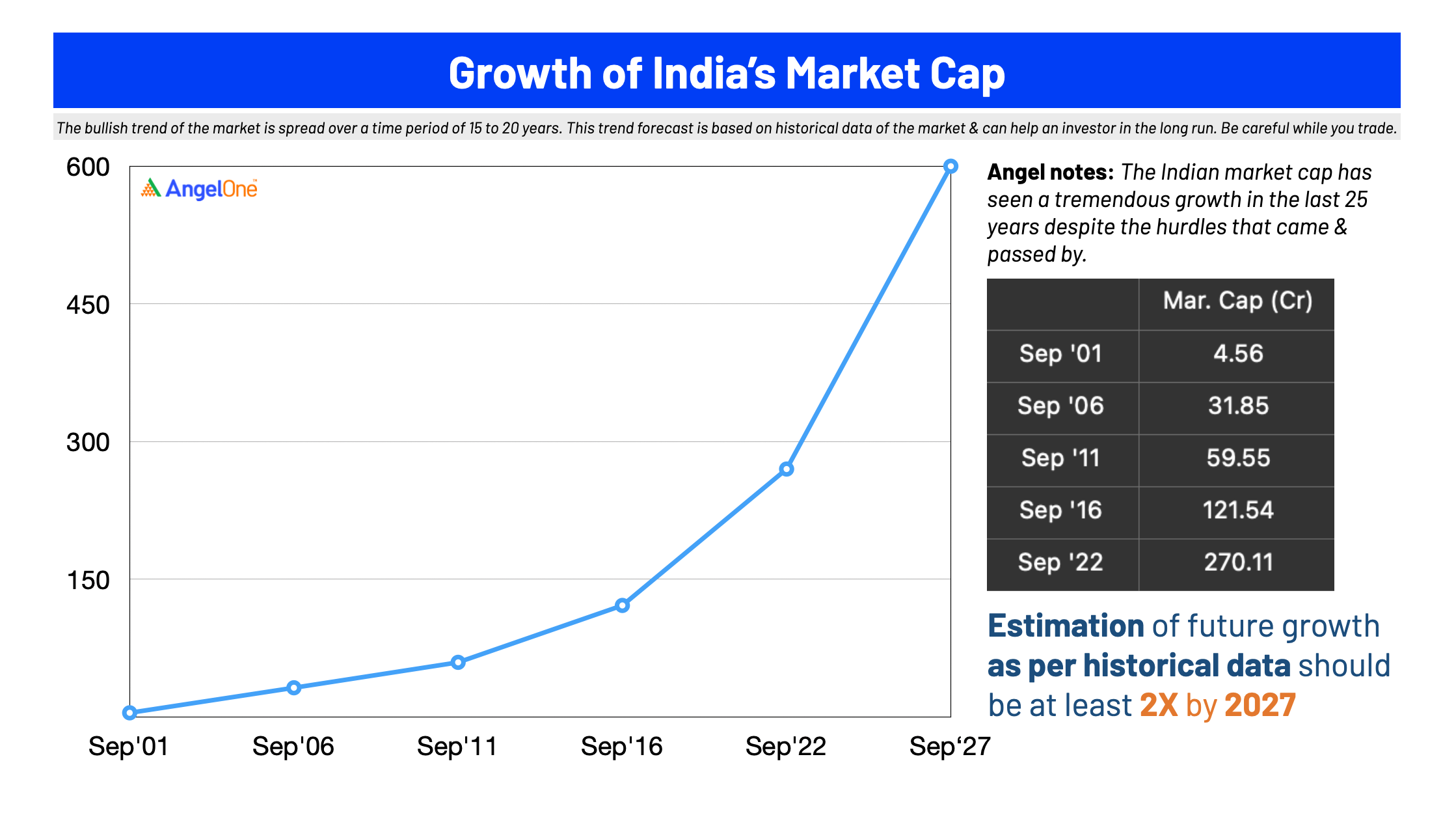

In 2001, the total market capitalization of the Indian stock market was roughly ₹4.56 lakh cr. At the time, the US had suffered 9/11, following which there was an invasion of Iraq (India’s biggest oil supplier). Like today, crude oil prices had shot up. Moreover, the fall of the NDA government had also come as a negative shock. Despite this, in the five year period of 2001-06, the Indian stock market had grown in total market cap to ₹31.85 lakh cr (a 598% increase).

In the next five years, the stock market faced the recession of 2007-09, an uncertain Lok Sabha election, swine flu while the USA long-term credit rating was downgraded to AA-plus by the S&P in 2011. Yet in that period, the market cap of the Indian stock market almost doubled to ₹59.55 lakh cr. In the following ten years, there were various other crises in foreign markets such as the Eurozone crisis, Brexit, Chinese market crash and real estate crisis, rise of ISIS in oil rich lands and the US-China trade war.

Challenges at home were not too few either – the IL&FS crisis and most importantly, the sufferings of the ordinary people due to demonetisation and issues related to the GST had made both domestic and foreign investors feel uneasy about the future of the Indian economy. The final blow came in the form of COVID and the consequent lockdown and market crash.

And yet, despite the long list of crisis after crisis given above, the Indian stock market has grown to over ₹270 lakh cr today. More importantly, the India that faced the Y2K, 26/11 and NPA crisis in the 2000’s is long gone – the new India has far more robust balance sheets, foreign exchange reserves and tax collections. It also has a thriving culture of start-ups along with a drive to build infrastructure rarely seen before.

There is no doubt that there are multiple causes of concern in the current economy. The inflation this year has stayed above 6.7% (more than the RBI’s upper limit of 6%). The Ukraine conflict has caused global crude oil prices to rise while tapering by the US Fed via increments of the policy rate by 75 bps four times in a row has made FIIs (Foreign Institutional Investors) transfer funds worth more than ₹1.5 lakh Cr out of the country since April 2022.

| Date | Fed Rate Hike |

| 16th March, 2022 | 25 bps |

| 4th May, 2022 | 50 bps |

| 15th June, 2022 | 75 bps |

| 27th July, 2022 | 75 bps |

| 21st September, 2022 | 75 bps |

| 2nd Nov, 2022 | 75 bps |

Table 1: US Fed increasing the policy rates by 25 to 75 bps

However, in the same period, DIIs (Domestic Institutional Investors) have increasingly bought stocks in the cash segment. Moreover, the Fed tapering has not had any significant impact on the Indian stock market, which increasingly seems to be decoupled from the events of the US market. So no, the current situation is far better than anytime in the 2000’s.

| Month | No. of Banks live on UPI | Volume (in Mn) | Value (in Cr.) |

| Oct-22 | 365 | 7,305.42 | 12,11,582.51 |

| Sep-22 | 358 | 6,780.80 | 11,16,438.10 |

| Aug-22 | 346 | 6,579.63 | 10,72,792.68 |

| Jul-22 | 338 | 6,288.40 | 10,62,747 |

| Jun-22 | 330 | 5,862.75 | 10,14,384 |

| May-22 | 323 | 5,955.20 | 10,41,506 |

| Apr-22 | 316 | 5,583.05 | 9,83,302.27 |

Table 2: Volume of UPI transactions since April 2022. Data sourced from the NPCI website.

The point here is that despite all the volatility in the foreign markets, the Indian economy and stock market is only going to expand in the long run. If the Indian economy has survived so well under far worse circumstances in the recent past, then it is definitely more prepared now to grow by leaps and bounds in the long-term future.

The impact on investment strategies of Indian investors can be the following;

Although the Indian economy seems robust, we would like all investors to look out for the following negative signs to stay safe:

We are sure the article has given you a clear picture of why you shouldn’t be worried about the Indian economy. It’s growing strong. If you are feeling positive about investing in this growth, come forward and open a demat account today with India’s trusted stockbroker!

Published on: Nov 23, 2022, 9:35 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates