Open interest and FII/DII analytics for options, separate home page for ETFs, GTT OCO orders and much more await you in our latest Android version. Update your Angel One app today!

What’s New?

- You can now view detailed analytics data on the changes in open interest of option contracts over time. You can also track changes in the FII and DII trading and movements.

- We now have a separate page dedicated to ETFs. It is designed to help you navigate ETFs efficiently with intuitive categories.

- You can now place GTT orders in the ‘One Cancels Other’ Mode.

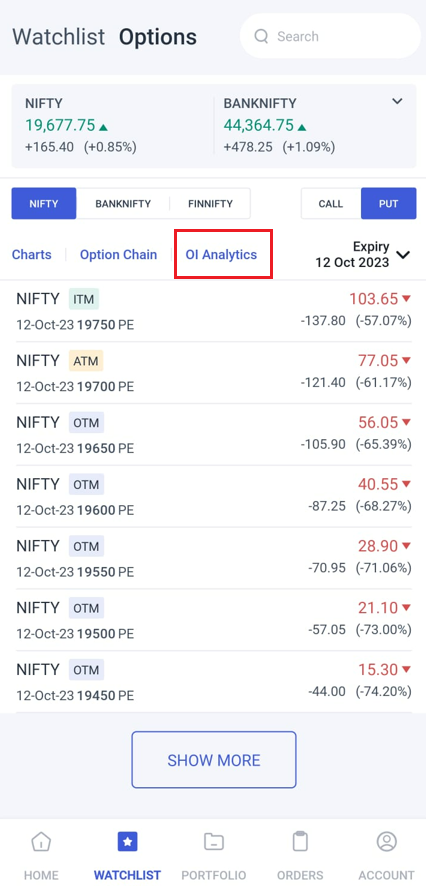

Options Watchlist OI Analytics

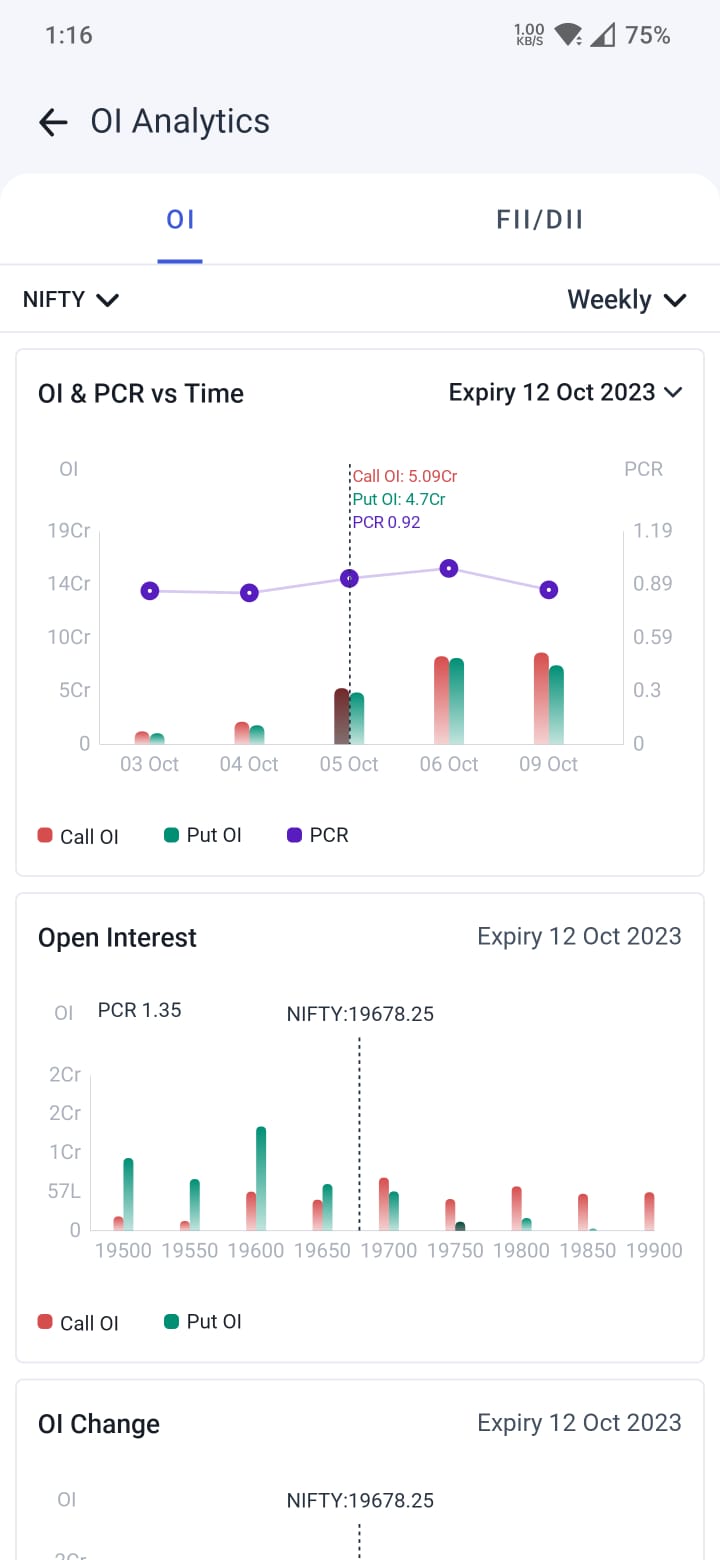

Open interest (OI) represents the number of outstanding or open options or futures contracts that have not yet been settled. It is a key parameter that helps you decode the market sentiment towards an asset. It only makes sense that you be able to look at this metric more closely and in multiple contexts.

To accomplish this, we are introducing OI analytics for Options! It is a page dedicated to helping you understand and check the patterns in the OI of the option contracts of an index so that you can plan your options strategy better.

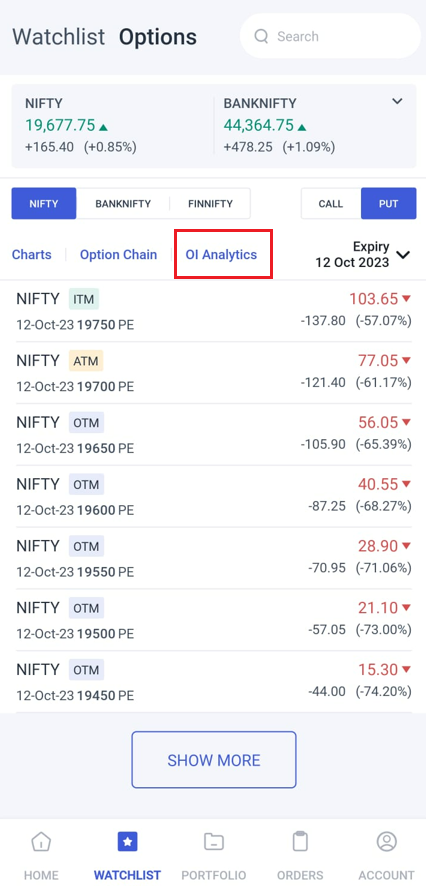

To reach the page:

- Just go to Watchlist in the app and click on the Options Watchlist.

- Thereafter, click on ‘OI Analytics’ next to ‘Option Chain’ right above the Watchlist.

Once you reach the page:

- Choose the index whose options OI data you want to view. The indices that you can currently choose to watch are Nifty, BankNifty, and Finnifty.

- Choose whether you want to view weekly or monthly option contracts.

- Choose the expiry date whose options you want to view.

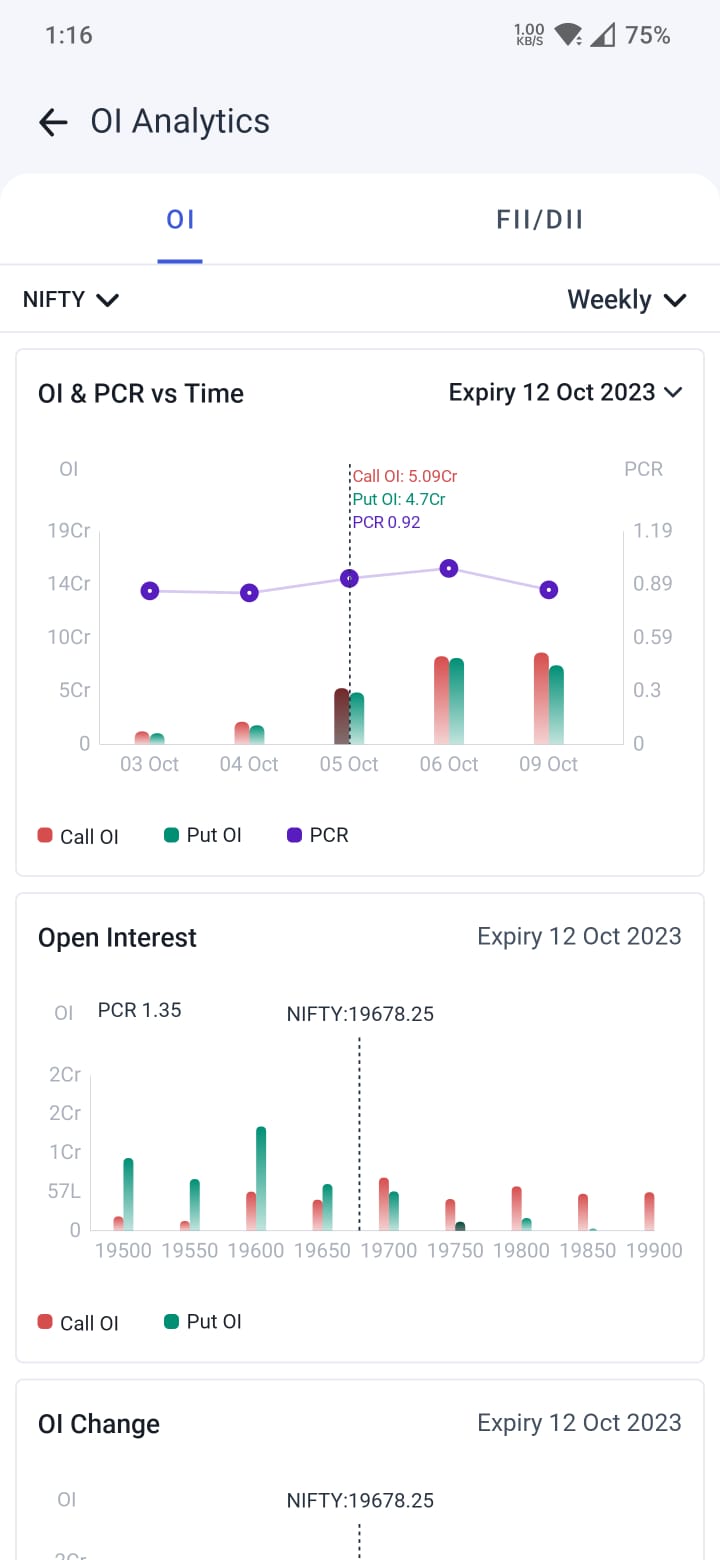

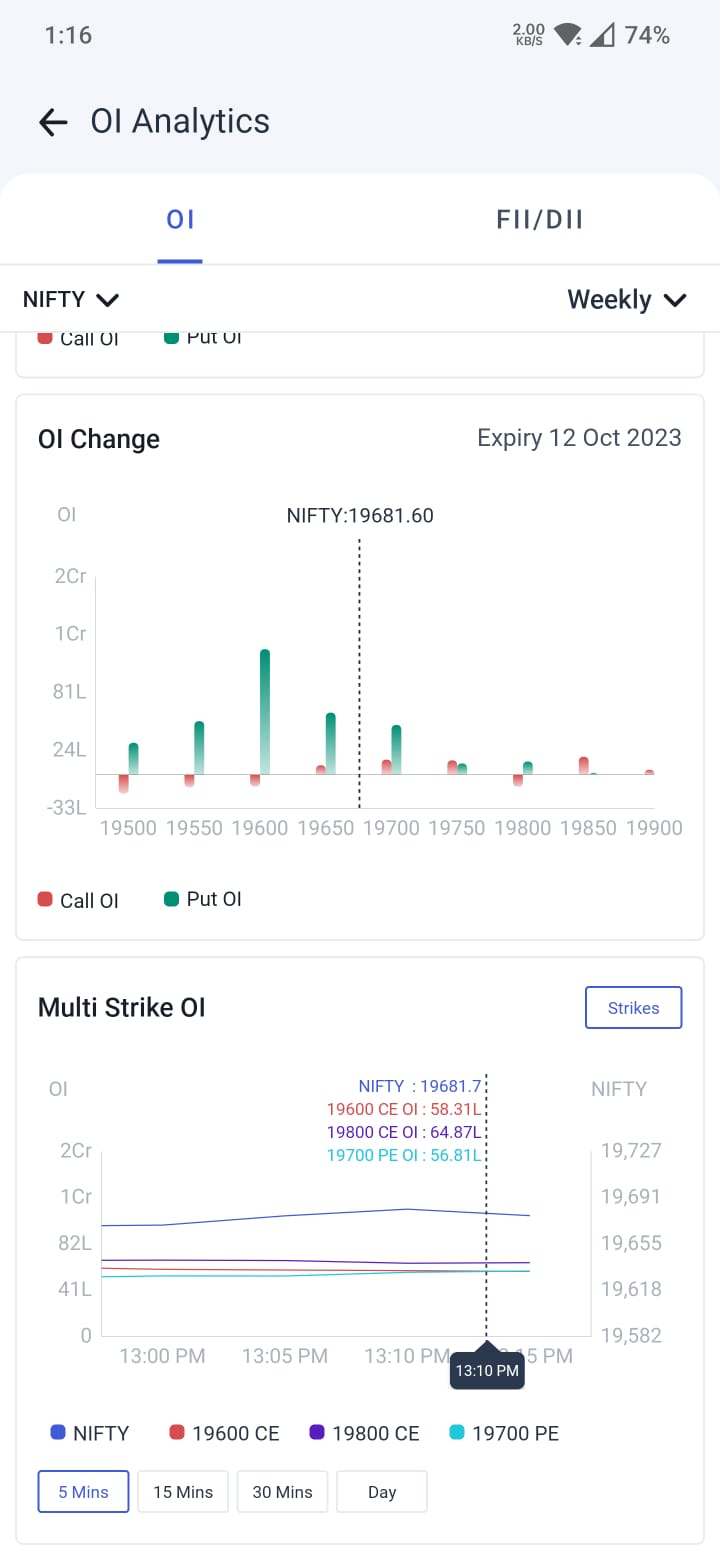

Thereafter, you can view the following data on the Options OI analytics page:

- OI vs PCR vs Time – Here we are comparing the OI with the Put-Call Ratio for the previous 5 trading days. The PCR value of the day is given in violet and measurable as per the vertical axis on the right of the graph. The vertical axis on the left gives the OI. The red bar is the call OI and the green bar is the put OI.

- Open Interest – While the above graph shows data of previous trading days, this graph shows the real-time data on OI for 1 ATM, 4 ITM and 4 OTM contracts with strike prices closest to the spot price.

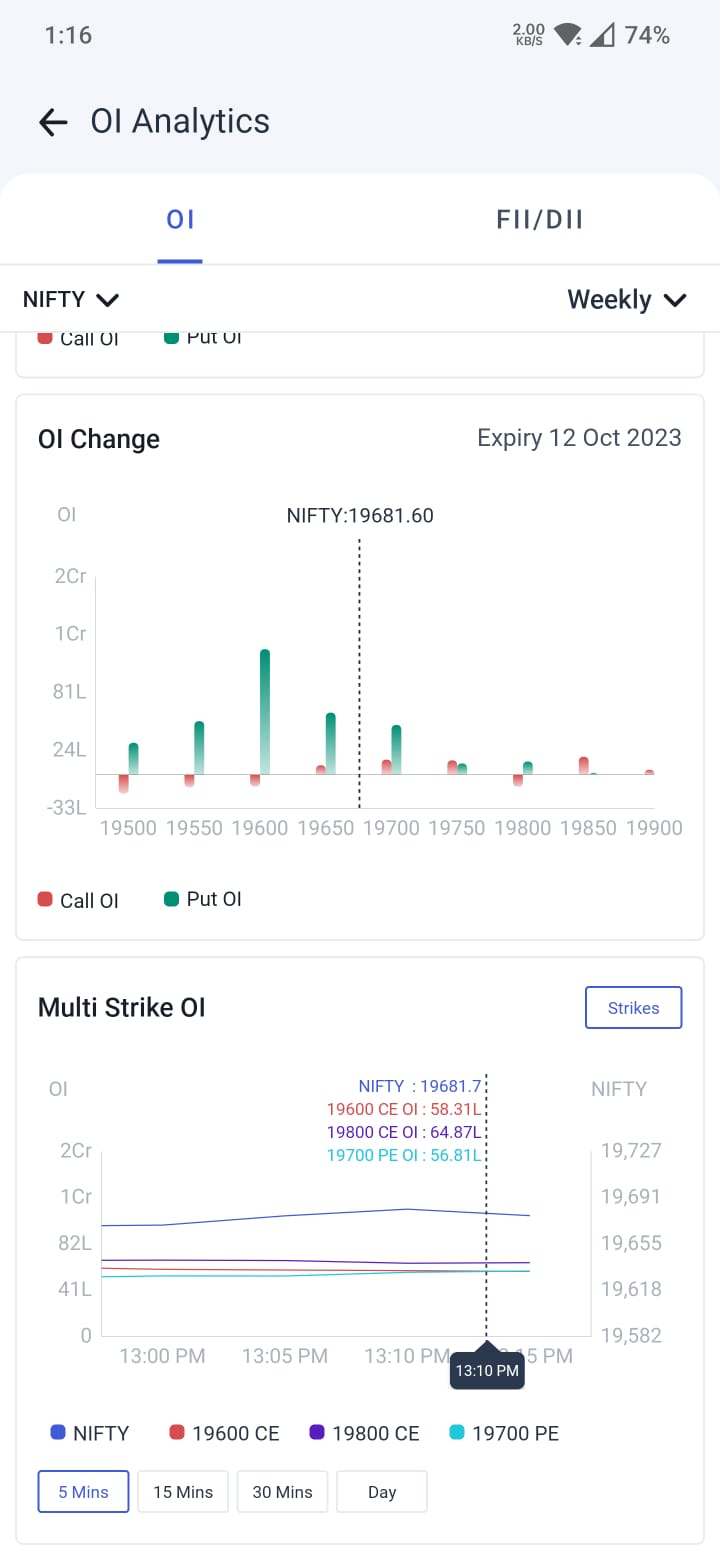

- OI Change – Here we are showing the real-time data on the change in OI of the 1 ATM, 4 ITM and 4 OTM contracts since the previous day’s closing.

- Multi-Strike OI – This will show you real-time data on the current OI of option contracts with 4 different strike prices, in comparison to the index itself, from 9:15 AM. You can click on ‘Strikes’ and choose the strike price that you want to view.

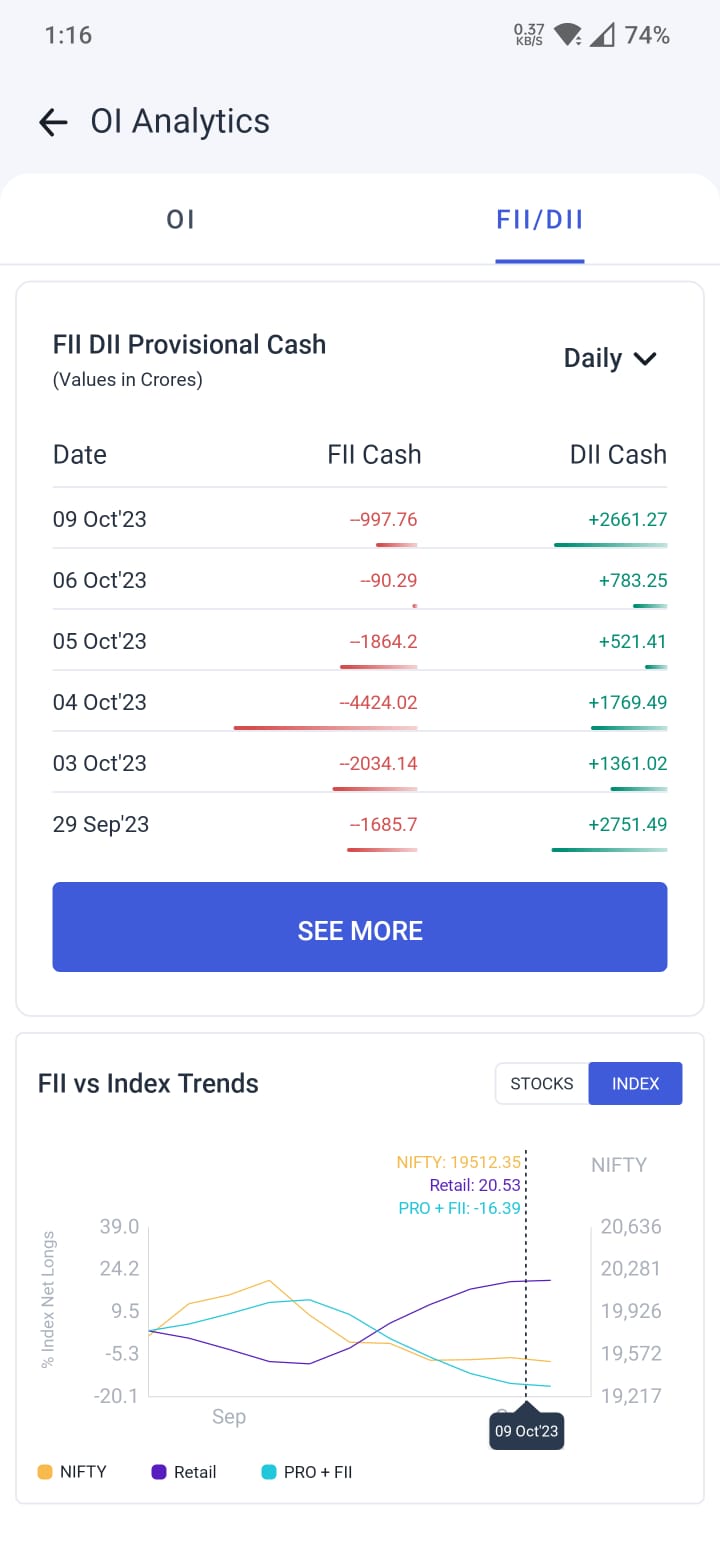

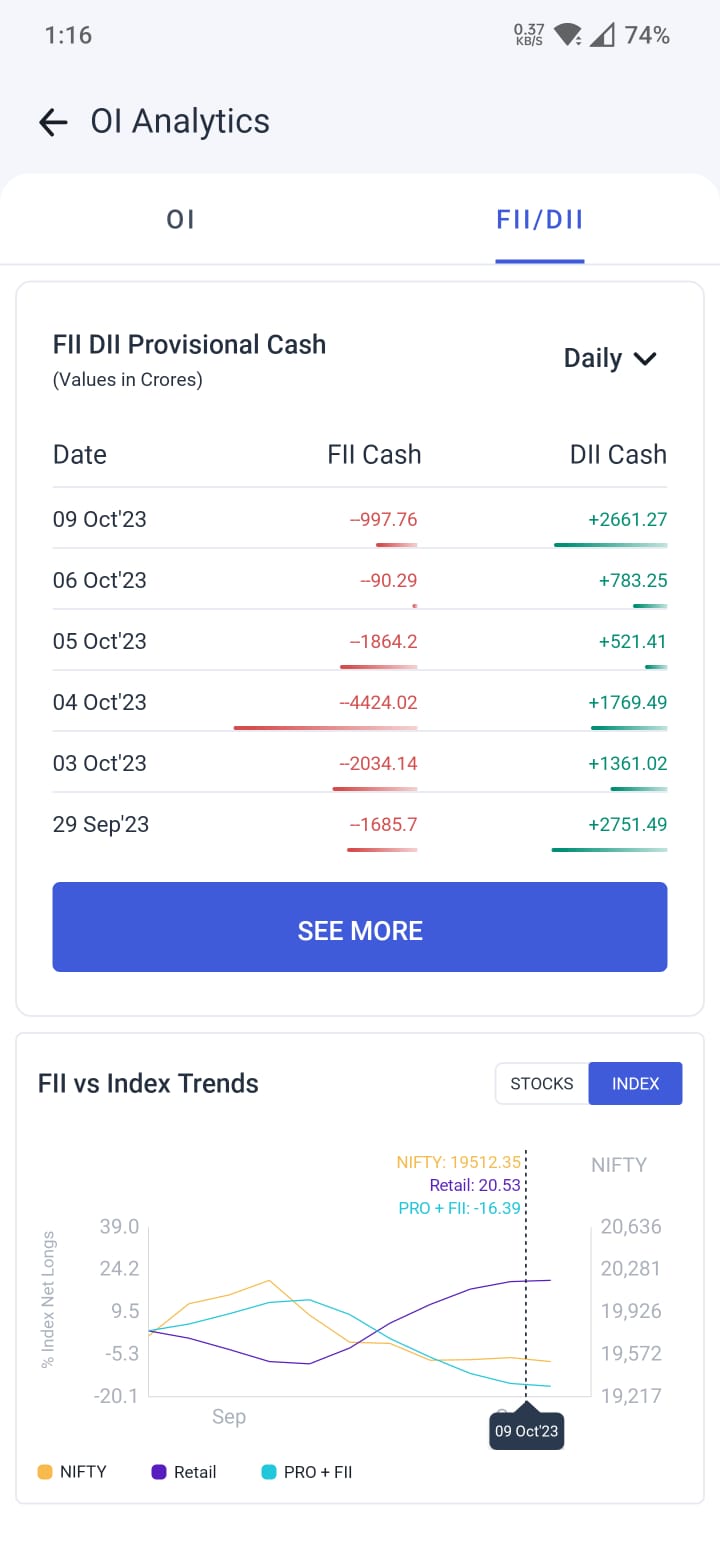

However, in addition to OI analytics, you can also check the data related to the Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) trading option contracts.

Under the ‘FII/DII’ section, you can find the following:

- FII Provisional Cash – Here we are showing you the investments and withdrawals made by FIIs and DIIs in the Indian stock market on each trading day. You can choose to view daily or monthly data.

- FII vs Index Trends – Here you can check the data for last 3 months data comparing Nifty 50’s value against the percentage of net longs in case of Retail, Pro+FII and FII traders.

In addition to the OI analytics page, we have another page for you, this time on ETFs!

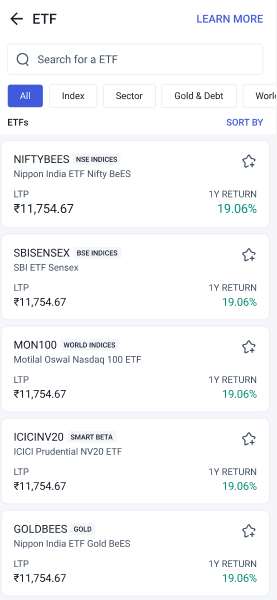

Enhanced ETF Discovery

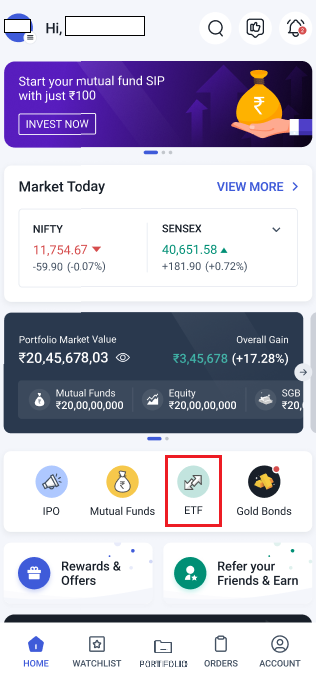

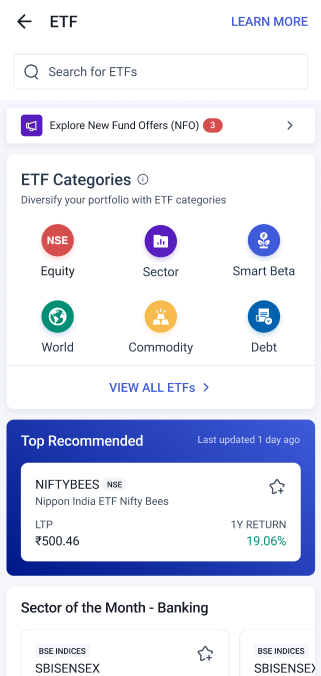

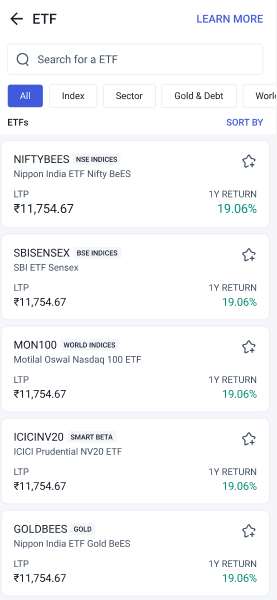

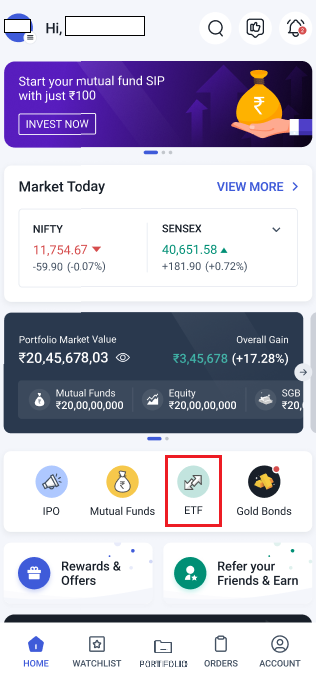

We wanted you to experience the same level of efficiency and special care while investing in Exchange-Traded Funds (ETFs) as you do while investing in IPOs, SGBs and mutual funds. Hence, we now bring to you a separate portal for ETFs, accessible directly from your HOME page on Angel One!

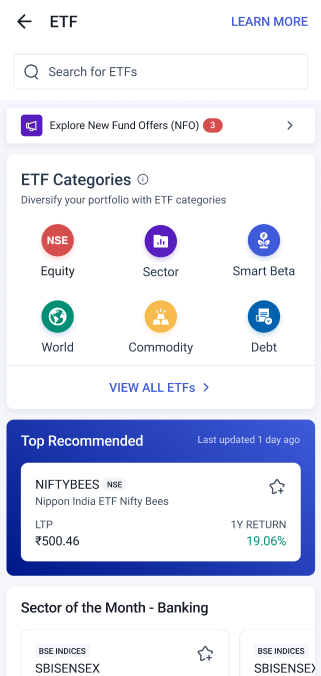

The separate portal will make searching for the ETFs you want to view a much easier task. With this new feature, you can:

- Screen the list of ETFs based on categories, e.g. debt, equity, sector, commodity, world and smart beta.

- Check out the top recommended individual ETFs as well as ETFs from the best-performing sectors. These recommendations are based on research by our top SEBI-registered experts and they are designed to help you begin your ETF investment journey with a successful note.

- Check out ETFs that fall in the categories of ‘Most Bought’, ‘Budget-friendly ETFs’ and ‘Highest Returns’.

Fig.: Access ETF portal from the HOME page (left), ETF portal with categories (middle), VIEW ALL ETFs(right).

In addition to the increased ease of searching for ETFs, you now have the following advantages in ETF investments:

- You can now put in place an SIP solely for your ETFs. While placing an ETF order, you will automatically be given the option to choose either an SIP (daily, weekly or monthly) or a one-time payment. You can also set up an SIP by going to Stock SIP under ORDERS section and following the same process as you used to follow for Stock SIP.

- You can also click on the LEARN MORE section in order to access video and written content on ETFs.

- You can add ETFs to your Watchlist. You can filter the watchlist as per ETFs as well.

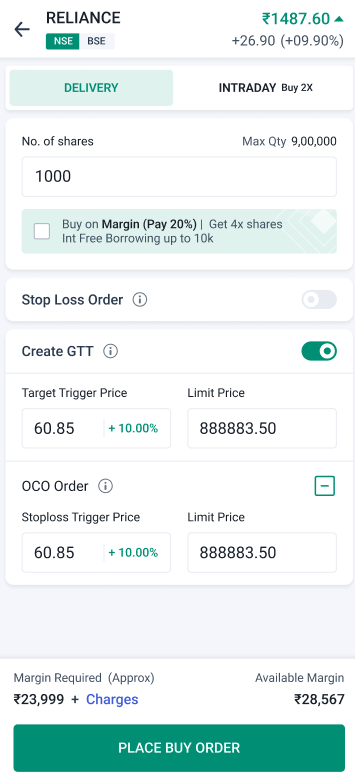

GTT One Cancels Other

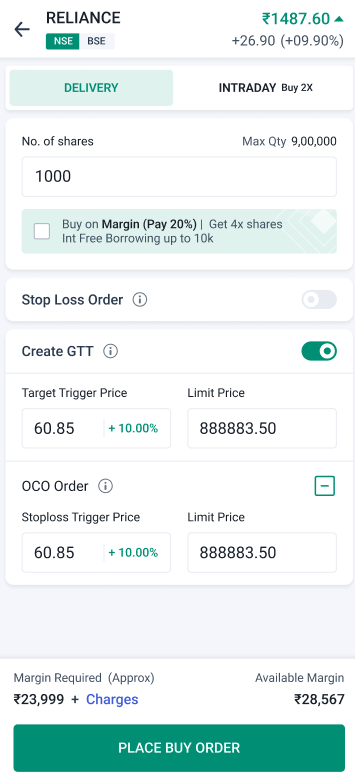

A GTT OCO or One Cancels Other order helps you place two orders at once. The first order is a buy order with a target price and the other is a stop-loss order attached to it. The triggering of one automatically cancels the other. GTT order will be valid for one year or until contract expiry. An OCO order will be counted as one order and not two.

To place a GTT OCO order:

- Go to the orderpad and click on Create GTT under Smart Orders.

- Below, you will find the option to add OCO Order. Click on the ‘+’ sign.

- Add the Stop Loss Trigger Price and Limit Price and place your GTT OCO order.

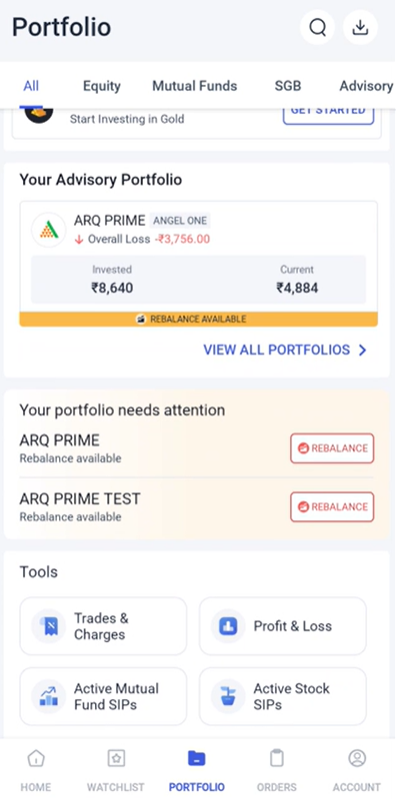

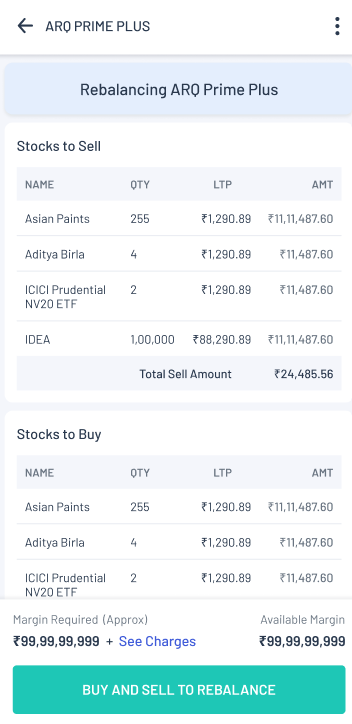

Portfolio Rebalancing Journey

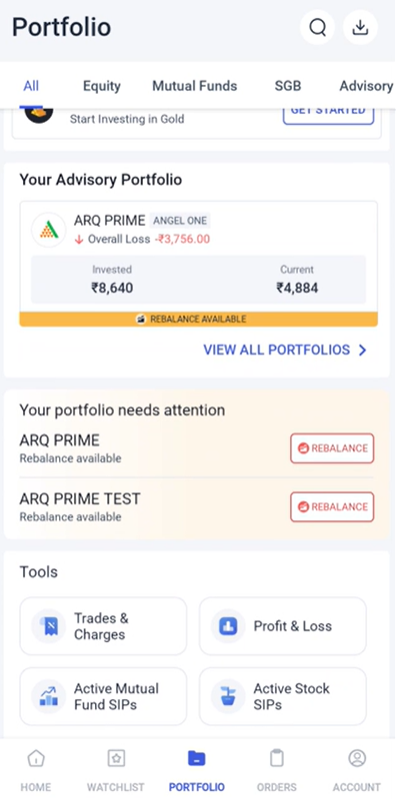

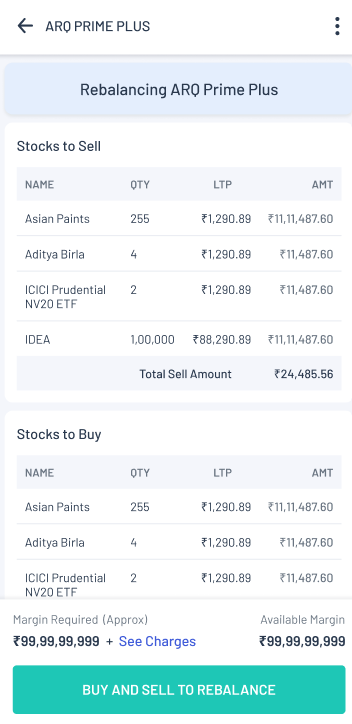

If you have bought a portfolio based on the recommendations of ARQ Prime (Angel One’s own portfolio advisory software), then we will be providing you with regular suggestions on how to rebalance your portfolio as per changing market trends. The suggestions will include multiple sell and buy calls with the quantity modified as per your portfolio.

To rebalance your portfolio you will simply have to:

- Go to the ‘All’ page under the ‘PORTFOLIO’ section of Angel One.

- Scroll down to ‘Your Advisory Portfolio’. If a rebalancing is needed, you will see the option to ‘REBALANCE’ here.

- You can also find the ‘REBALANCE’ option under the Advisory section of the PORTFOLIO.

- Choose the buying and selling actions that the app recommends and click on ‘CONFIRM’ to place the orders with a single click.

Fig.: Journey to rebalance portfolio

Portfolio rebalancing thus makes it easy to adjust your portfolio based on the suggestions given by ARQ Prime.

Other Features

- You can now quickly search for stocks based on your preferred strategy by using Angel One’s enhanced stock discovery tool. You can check out the details of this feature in this blog.

- There is now a separate page dedicated to showing you the different subscription plans that are available to you. You can access this page directly from the HOME page itself, next to Refer and Earn.

- You can also access a separate portal for e-voting by directly clicking the ‘E-voting’ button under the ‘Tools’ section on your HOME page.

Final Words

This October has seen some incredible features being launched on the Angel One Super app. Be sure to check out our future product updates and other market news under the Angel One blog or on the Angel One Community page!