Since India gained independence in 1947, the BFSI (Banking, Financial Services, and Insurance) sector has undergone a significant transformation, evolving from a budding industry into a robust and dynamic component of the Indian economy. This growth has been driven by a series of reforms, policy changes, and technological advancements.

In the immediate aftermath of independence, the BFSI sector in India was characterised by a limited number of financial institutions and a lack of regulatory framework. The Indian banking sector was largely dominated by private banks, with minimal government oversight. The Insurance sector was similarly fragmented, with foreign companies holding a significant share.

In 1949, the Reserve Bank of India (RBI) was nationalised and has been regulating India’s monetary policies and managing the country’s banking system.

A major turning point came in 1969 when the Indian government nationalised 14 major commercial banks. The Central Bank of India, UCO Bank, Syndicate Bank, Indian Bank, Punjab National Bank, Bank of Baroda, Indian Overseas Bank, Allahabad Bank, Union Bank, Dena Bank, Bank of Maharashtra, Canara Bank, Bank of India and United Bank of India were nationalised.

Meanwhile, in 1968, the Insurance Act was amended to regulate investments and set minimum solvency margins. The Tariff Advisory Committee was also set up then.

Later, the nationalisation of banks was followed by the establishment of institutions like the National Bank for Agriculture and Rural Development (NABARD) in 1982, which focused on rural development and agricultural finance.

The early 1990s marked a watershed moment with the economic liberalisation reforms initiated in 1991. The Indian government introduced sweeping changes aimed at deregulating the BFSI sector, encouraging private sector participation, and improving efficiency. The key developments included:

Banking Sector Reforms (1991): The Reserve Bank of India was empowered to regulate and supervise banks more effectively. The liberalisation led to the entry of private sector banks, and the banking industry saw a surge in competition and innovation.

Insurance Sector Reforms (1999): The Insurance Regulatory and Development Authority (IRDA) was established, and the Insurance Act of 1938 was amended to allow private players to enter the insurance sector. This led to the privatisation of insurance and the emergence of numerous new insurance companies.

The turn of the millennium saw rapid technological advancements that transformed the BFSI sector. The adoption of IT and digital technologies revolutionised banking and financial services. Key developments included:

Banking Technology (2000s): The introduction of electronic banking, ATMs, and online banking services made banking more accessible and efficient.

The National Payments Corporation of India (NPCI) was established in 2008 to promote electronic payment systems and innovations. It provides an array of innovative retail payment solutions, such as the Immediate Payment Service (IMPS), RuPay card, Bharat Interface for Money (BHIM), Unified Payments Interface (UPI), BHIM Aadhaar, Bharat BillPay and National Electronic Toll Collection (NETC). NPCI also advanced the field with the introduction of UPI 2.0, offering enhanced security and a broader range of services for both consumers and merchants.

Insurance Innovations: The insurance sector saw the launch of various innovative products and services, including online insurance policies and new types of coverage, enhancing customer experience and outreach.

In recent years, the BFSI sector has continued to evolve, driven by technological advancements and changing consumer expectations.

The RBI and SEBI have also implemented various regulations to enhance transparency, protect consumers, and promote financial stability. The Insolvency and Bankruptcy Code (IBC) of 2016 has improved the process of resolving distressed assets.

The rise of fintech companies has introduced new financial products and services, including digital lending, robo-advisors, and blockchain technology. The government’s push for financial inclusion through initiatives like Jan Dhan Yojana has expanded access to banking services.

The Pradhan Mantri Jan-Dhan Yojana (PMJDY) aims to provide financial services to underserved and low-income groups by ensuring access to basic savings bank accounts, credit based on needs, remittance facilities, and insurance and pension services.

In 2014, the RBI introduced initial guidelines for establishing Small Finance Banks (SFB). Created under the direction of the Government of India, these banks were designed to enhance financial inclusion by providing essential banking services to underserved and unserved populations. Their focus includes small and marginal farmers, small business units, micro and small industries, and unorganised sectors. Capital Small Finance Bank became the first SFB to commence operations, opening its branches in April 2016.

In 2023, total assets in the public and private banking sectors were US$1,686.70 billion and US$1,016.39 billion, respectively.

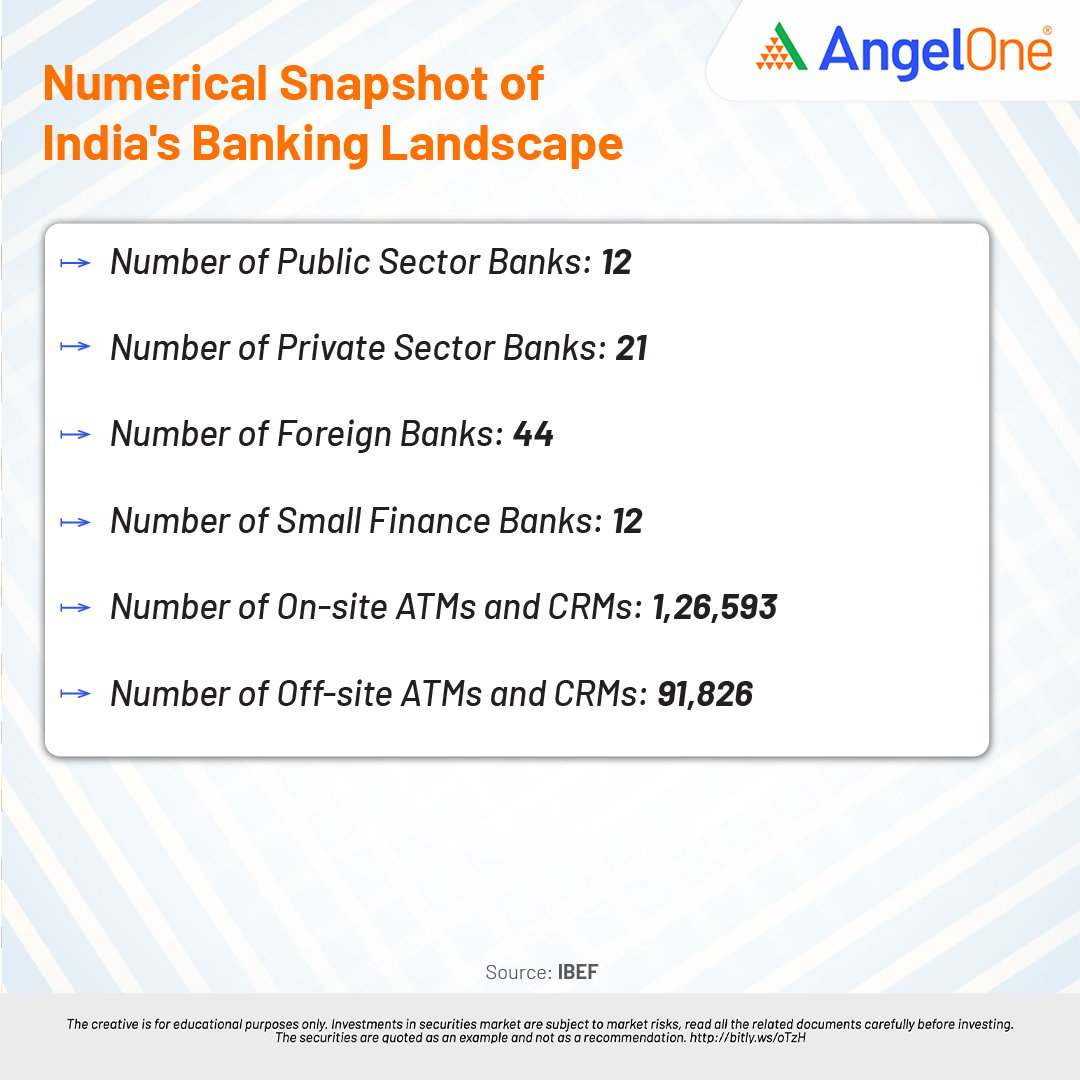

As of April 2024, 581 banks were actively using UPI. The total number of digital transactions during this period amounted to 15.08 billion, with a total value of US$25.27 billion. The Indian banking system comprises 12 public sector banks, 21 private sector banks, 44 foreign banks, and 12 small finance banks. India has a total of 17,36,972 micro-ATMs. Additionally, there are 1,26,593 on-site ATMs and Cash Recycling Machines (CRMs), along with 91,826 off-site ATMs and CRMs.

According to the RBI, bank deposits stood at ₹209.36 trillion (US$2,507.62 billion) as of May 3, 2024.

There is a growing emphasis on sustainable and green finance, with institutions focusing on investments that support environmental sustainability.

Several banks and financial institutions are contributing to the sector, along with huge support from the RBI and the government.

As of August 12, 2024, the top 5 financial companies in India according to the market capitalisation are, HDFC Bank Ltd (₹12,57,036.77 crore), ICICI Bank Ltd (₹8,24,954.78 crore), State Bank of India (₹7,35,655.80 crore), Life Insurance Corporation Of India (₹7,16,906.86 crore) and Bajaj Finance Ltd (₹4,09,328.75 crore).

The Indian fintech industry is projected to reach US$ 150 billion by 2025, making India the third-largest fintech ecosystem in the world. According to BCG (Boston Consulting Group), digital payments are expected to account for 65% of transactions by 2026.

Additionally, the Indian digital consumer lending market is anticipated to exceed US$ 720 billion by 2030, capturing nearly 55% of the total US$ 1.3 trillion digital lending market opportunity in the country.

The Indian BFSI sector has witnessed remarkable growth since independence, with significant policy changes, technological advancements, and increased private sector participation. As India continues to evolve, the BFSI sector is poised to play a crucial role in shaping the country’s economic future, with ongoing innovations and reforms driving further development.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Aug 20, 2024, 5:34 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates