Ever wondered if you could become the ultimate shareholder, owning a tiny slice of every company on Earth? While it might sound like a billionaire’s daydream, there’s a surprising strategy that brings this fantasy closer: the MSCI ACWI Index. Buckle up, because we’re about to embark on a journey through global stock markets!

What’s the MSCI ACWI Index?

Imagine a giant basket filled with fruits from all over the world: apples from the USA, mangoes from India, and kiwis from New Zealand. The MSCI ACWI Index is kind of like that, but instead of fruits, it holds stocks from thousands of companies across 23 developed and 24 emerging markets with 2,920 constituents (85% of the global investable equity opportunity set). By owning this index, you’d indirectly own a piece of each company in that basket, giving you a taste of the global economy.

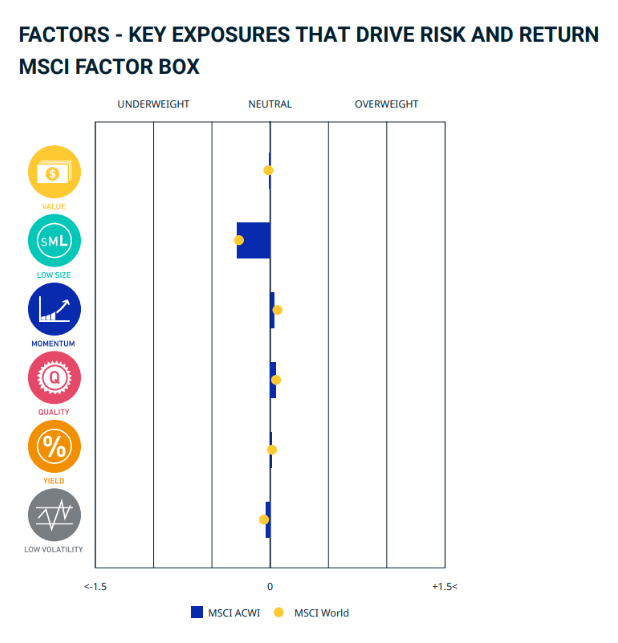

Factor Exposures

The index exhibits factor exposures in value, low size, momentum, quality, yield, and low volatility.

Source: MSCI ACWI Index

But Can You Really Own Everything?

Hold your horses, shareholder extraordinaire! While the ACWI grants you exposure to a vast swathe of the market, it doesn’t guarantee you’ll own every single share. Here’s why:

So, It’s Not Quite World Domination

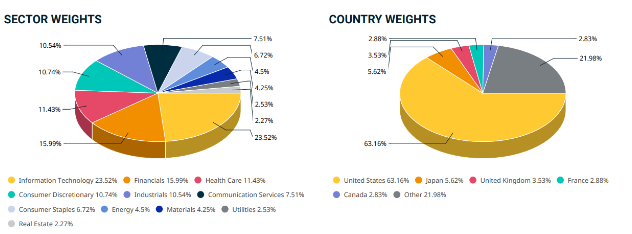

Source: MSCI ACWI Index

Don’t be discouraged! Owning the ACWI still gets you pretty close to global market ownership (85%), with some impressive benefits:

Performance

Remember, This Isn’t Financial Advice!

While the ACWI offers exciting possibilities, it’s crucial to remember:

The Takeaway

Owning every share on the planet might be a fantasy, but the MSCI ACWI Index gets you pretty close. It’s a powerful tool for diversification and passive investing, but remember, responsible research and personalized planning are key to making informed financial decisions.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Feb 12, 2024, 1:18 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates