The 24th of August must have certainly been a day of irony for Mr. Nandan Nilekani. The Supreme Court upheld the Right to Privacy as a fundamental right under the Constitution. This right to privacy had become a major bone of contention with respect to Aadhar where there have been increasing concerns about data security and the public availability of biometric data. Interestingly, Aadhar was the brainchild of Nandan Nilekani during his stint as the Chairman of UIDAI during the UPA regime. The Supreme Court Judgement in a way builds a circumference wall around the Aadhar.

But, on August 24th there were no circumference walls at Infosys as Nandan Nilekani walked back to take over as the non-Executive Chairman of Infosys. He will also be a non-independent director on the board of Infosys which means that Nandan and the promoter group will largely script the growth story of Infosys from here on. In fact, the return of Nandan Nilekani was always on the cards after domestic mutual funds and global investors made a clamour for his return. At the current juncture, Nandan is undoubtedly the most acceptable face for the clients, investors and the employees. After all he was the CEO of Infosys between 2002 and 2007 with a sterling track record, as we shall see later. Above all, he has remained neutral in the entire fracas over the last few months!

The existing board of directors is disbanded…

In fact, there was little doubt that it would happen. The biggest objection that Narayanamurthy had raised was against the silence of the Board on key corporate governance issues. It must be said that the board did not cover itself in glory by literally remaining silent spectators in the open battle between Murthy and Vishal Sikka. Murthy had also remonstrated that the board had failed to uphold the highest standards of corporate governance. But the last straw on the camel’s back came when the board had written an open letter blaming Murthy for the resignation of Vishal Sikka. That action had made it quite clear that the current board was incompatible with the DNA of the original founders. The fact that Vishal Sikka is being relieved immediately with full notice benefits clearly indicates that there had to be a clear shift from the past. Both the co-chairmen, Seshasayee and Ravi Venkatesan have already resigned and others could follow.

Why Nandan is the right man at the right time…

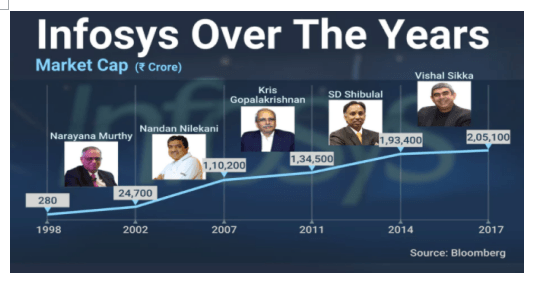

Murthy has himself maintained that while he was the driver of the vision, Nandan was unmatched when it came to executing mega projects of tremendous size and complexity. Taking Infosys to the next level of growth was one example and spreading the Aadhar cult was another. It is this combination of Nandan’s ability to handle scale and also focus on the micro issues that makes him invaluable at this point of time. The chart below captures the growth in market capitalization of Infosys under its 5 CEOs over the last 20 years…

The chart captures the wealth creation by the 5 CEOs. The major wealth creation at Infosys occurred during the regime of Murthy and Nilekani when the market cap of the company increased almost 400 times. Nandan’s regime was especially important as it came in the immediate aftermath of the global technology meltdown of 2000-01, which had resulted in massive wealth destruction for Indian IT companies including Infosys. The period 2002-07 was also a trying period for Infosys and it was the turnaround that Nilekani worked during this period that will make me the right man for the job.

It is not just about market cap but about revenues too…

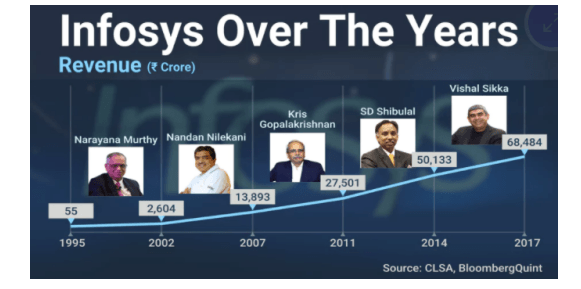

In a way, Nandan brought scale to Infosys as is evident from the chart below…

It was during the tenure of Nandan Nilekani that Infosys crossed the $1 billion revenue mark as well as the $2 billion revenue mark. In fact, if you consider that the rupee had actually strengthened to 45/$ by 2007, Infosys actually crossed the $3 billion mark also during Nandan’s 5 years. It was during Nandan’s tenure that Infosys actually achieved global scale, which has kept the revenue momentum growing for the last 10 years. Above all, as Murthy has himself admitted, “The only Infoscion who knew most of the Fortune 500 CEOs on a first name basis was Nandan Nilekani”.

A tricky agenda for Nandan Nilekani and for Infosys…

While Nandan comes with a formidable reputation, both at Infosys and at UIDAI, there are some key challenges that he will have to address in his new role…

In a way, Murthy and Nandan wielded the magic wand for Infosys till 2007. In the 10 years since the global financial meltdown, revenues have grown five-fold at Infosys but wealth creation for shareholders has been at a measly rate of 7% CAGR per annum. That is the one dichotomy that Nandan will have to immediately focusing on bridging!

Published on: Aug 29, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates