The primary goal of any business is to maximize its profits. However, without a comprehensive understanding of margins and how to assess them, it becomes challenging to determine the current profitability and future earning potential. Margins are influenced by factors such as volume, pricing, and various other elements. Margins play a crucial role in evaluating the profitability, operational efficiency, cost management, financial stability, and growth potential of a company.

Profit margin, also known as margin, is a percentage used to assess the profitability of a business once expenses have been subtracted from revenues. While revenue offers an initial indication of a business’s performance, it is essential to consider expenses to accurately determine the actual profit.

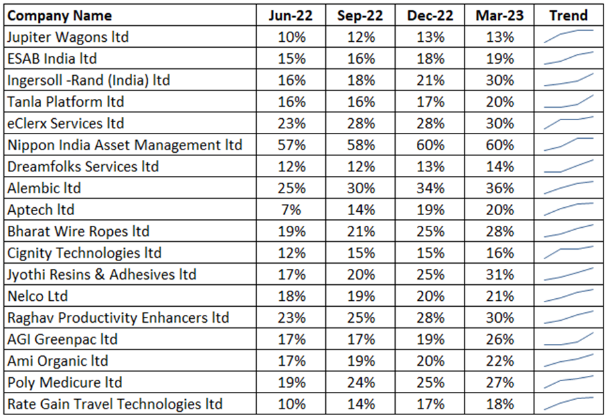

When an investor intends to invest in a company within the same sector and wishes to compare their profitability, it can be challenging to directly compare the absolute numbers. To achieve better comparability, investors can utilize margins as a standardized measure. This is because companies often differ in terms of their size, revenue, geographical presence, and profits, making direct comparisons difficult. Analyzing margins helps investors and stakeholders gain valuable insights into a business’s financial performance and make informed decisions.

Three essential margins to consider are the Gross Profit Margin, Operating Profit Margin, and Net Profit Margin.

Let’s analyse and discuss one of the companies mentioned in the table above.

Jupiter Wagons Ltd is engaged in the business of manufacturing metal fabrication comprising load bodies for commercial vehicles, rail freight wagons, and components. The company has a market cap of Rs 5295 crore. Stock is trading at life time high and potential to trade in Blue Sky Zone. It has given a CAGR return of about 152% in the last three years and 125% in the last one year.

Companies compounded sales growth for the last three years is 154%, whereas compounded profit growth is 175% for the same period. ROCE and ROE are 16.8% and 24.4% respectively.

DII has also increased the stake from 1.49% to 2.70%.

Overall, improvements in profitability margins have a cascading effect on various aspects of a business, contributing to financial strength, competitiveness, sustainability, investor confidence, Increase in Valuations. Investors must keep these stocks in the radar.

While margins are an important consideration, investors should not solely rely on them when selecting small-cap companies for investment. Several other factors should be taken into account. These include aspects such as ethical management practices, ROE, ROCE, price-to-book ratio, debt burden, promoter pledge percentage, trust or investments from domestic institutional investors (DII) and foreign institutional investors (FII), and more. These additional factors provide a more comprehensive assessment of a company’s financial health, management practices, and market potential.

Published on: May 29, 2023, 1:29 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates