Do you know the basic difference between futures and forwards? Futures represent an improvement over forwards in two ways. Firstly, futures are traded on a recognized stock exchange and hence are extremely liquid. More importantly, future are standardized while forwards are not standardized, which is why they are often referred to as over the counter (OTC) products. When we refer to futures as standardized what does it mean? One of the implications is that there is standardization of trading lots, strike prices, expiry. The market lot in India is also referred to as lot size and the lot size of the stock or the Nifty differs based on the current market price. The whole idea of lot sizes is about standardization. When a stock has a lot of size of 1000 shares, then trades can only be put in the system in multiples of 1000 shares. You cannot buy 500 shares nor can you buy 1500 shares in this case. You can either buy 1000 shares (1 lot), 2000 shares (2 lots) and so on. That is the concept of a market lot in Futures and options.

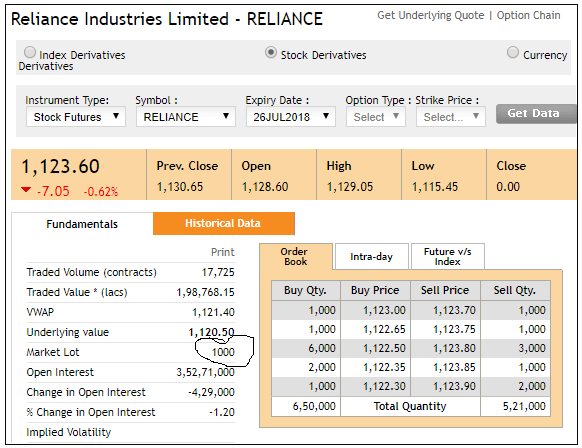

Remember, the concept of lot size is only applicable to stocks and indices that are included in F&O; not for others. Look at the live illustration below, which is a price snapshot of RIL August 2018 futures. The lot size of RIL has been circled. Since the Reliance Futures are current quoting at Rs.1123.60, the value of 1 lot of RIL will be Rs.11,23,600/-.

Effectively, when you buy and sell RIL futures or RIL options, your minimum order size has to be worth Rs.11,23,600/-. You really do not need to panic as this is the notional value of the contract and you will only be required to pay a margin of around 15% to 20% to initiate a buy or sell trade in the RIL stock futures.

When futures were first introduced into India, the lot value was fixed at approximately Rs.2 lakhs. The idea back then was to keep the minimum investment at a slightly higher level so that retail investors are deterred from participating too aggressively in the F&O market. SEBI was always worried that too much retail participation in the F&O market would lead to unnecessary speculation and losses for small investors. While SEBI had initially fixed Rs.2 lakh as the indicative lot size, it was hiked to Rs.5 lakhs in the year 2015 with a view to discouraging retail investors from speculating in F&O. In fact, new additions to the F&O list are being included with a minimum lot value of Rs.7.50 lakh and there is a proposal to change the lot value to Rs.10 lakh so that only informed investors and traders actually trade in the F&O market. Most traders look at F&O not in terms of lot sizes but in terms of the margin requirement. When the Nifty lot value was at Rs.2 lakh, the initial margin required for 1 lot of Nifty was just about Rs.25,000 and that made it accessible to small traders. In most cases, they did not understand the actual implications of F&O and ended up with huge losses.

| Underlying | Lot Size | CMP (11-May-2018) | Lot Value |

| Nifty | 75 | 11,095 | Rs.8.32 lakh |

| Bank Nifty | 40 | 27,056 | Rs.10.82 lakh |

| ACC | 400 | 1,297 | Rs.5.19 lakh |

| Britannia Industries | 200 | 6,440 | Rs.12.88 lakh |

| Reliance Industries | 1000 | 1,124 | Rs.11.24 lakh |

| Tata Steel | 1061 | 518 | Rs.5.50 lakh |

| Tata Motors | 1500 | 258 | Rs.3.87 lakh |

Source: NSE

Obviously lot values cannot be standardized because stock prices keep moving dynamically. In the above case, you find that lot value of Britannia at Rs.12.88 lakhs and RIL at Rs.11.24 lakhs. However, the lot value of ACC is just Rs.5.19 lakhs while the lot value of Tata Motors is a mere Rs.3.87 lakh. This is driven by price movement. For example, in the last 1 year RIL and Britannia have been strong outperformers while ACC and Tata Motors have been the rank underperformers. As a result, while all these stocks started out around the same lot value, over time they diverged due to the price movement in opposite directions.

The lot sizes are essentially pegged to the indicative lot values but these lot values keep changing along with the stock price over time. For example, a stock with a lot size of 1000 shares with a price of Rs.710 will have a lot value of Rs.7.10 lakh. However, if the price of the stock goes up to Rs.950 over the next 1 year then the lot value automatically changes to Rs.9.50 lakhs. In such cases, SEBI will look to modify the lot size at an appropriate time. Once the lot sizes are modified, there will be a greater parity in the lot values.

Just as lot sizes are reduced when prices go up, the lot sizes are also increased when prices correct sharply. For example, in the case of Tata Motors, there is a genuine case to take the lot size up from 1500 to 3000 in the light of the sharp price correction. SEBI routinely revises the lot sizes on the upside and on the downside. Since lot values keep changing in tandem with stock price movements, it becomes essential to shift lot sizes accordingly.

Published on: Jul 27, 2018, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates