The US Federal Reserve (Fed) announced on 24th May the minutes of the Fed meet held on 03rd May 2017. It may be recollected that in the May 03rd FOMC meet the Fed had chosen to maintain status quo on rates. The big debate now is over the number of rate hikes that the Fed will implement during the calendar year 2017. But the most important announcement from the markets perspective is that the Fed will not start unwinding its Bond Portfolio of $4.5 trillion until the Fed rates reach close to normalcy…

Fed’s review of macroeconomic data…

In its macroeconomic review, the Fed has highlighted some key points pertaining to the American economy. Firstly, the average job gains have been buoyant and the unemployment levels have also remained at all time lows. This satisfies the labour market condition for future rate action. Secondly, household spending grew only modestly and this could be an aftermath of the first quarter ended March 2017 when the economy grew at below 1%. This variable obviously needs to show some genuine traction before the Fed can consider further rate hikes. Thirdly, the all-critical inflation number has been closer to the 2% mark on a sustainable basis. Of course, the US Fed will be closely looking at the outcome of the OPEC meet to take a final view on inflation. Of the three variables, inflation and labour conditions are conducive for a rate hike. However, the Fed may be a little concerned by the tepid performance of the US economy in the first quarter and may want to watch the second quarter performance too. That may leave the Fed to decide whether to hike the rates in its June meet or wait for the second quarter consumption data and then take a decision on rate hikes in late July.

How the rates trajectory is likely to pan out for the Fed…

Going ahead, the rate action will be determined by the Fed expectations on maximum employment and 2% inflation. However, there are 3 statements by the Fed which indicate that the Fed may be inclined to go easy on rate hikes, compared to what the market is making out. Firstly, the Fed has specifically spoken about the need to factor in international variables. The US Fed will be worried about the likely impact of BREXIT on Europe and an economic tightening on China. Secondly, the Fed has underlined that expected inflation could be the key. Expected inflation will be contingent on oil prices globally as well as a pick-up in consumption spending in the US, which will in turn depend on how aggressively Trump goes about cutting taxes for individuals. Thirdly, the Fed minutes also underlines that the economic environment may evolve in such a manner as to impel the Fed to keep rates below the long term rates for a considerable period of time. That means that the actual rate hikes by the Fed may be a lot more calibrated and gradual than what the markets are expecting.

How many rate hikes can we expect from the Fed in calendar year 2017?

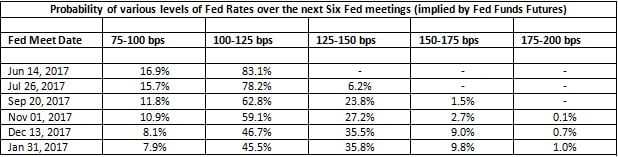

One of the best ways to understand this is by looking at the probabilities implied by the Fed Fund Futures trading on the Chicago Mercantile Exchange (CME). Popularly known as the “CME FEDWATCH”, this tool helps to understand the probabilities of a rate hike for the next 6 Fed Policy meetings. The table below captures the probabilities assigned for different levels of Fed rates over the next 6 Fed meetings. It needs to be noted that these probabilities are derived from trading data and are subject to constant change. The data presented here is as on May 24th 2017…

The markets have got a lot less hawkish in terms of pricing of Fed futures. Over the next 6 months, the peak probability assigned to 2 additional rate hikes of 25 basis points each is only 45%. Considering that the Fed is already at a rate level of 75-100 bps, the original fear that the Fed may hike rates 3 times, now almost appears to be ruled out. The worst case scenario is that the Fed may announce two more rate hikes in this calendar year.

Will the Fed announce its next rate hike in June? Based on an analysis of the probabilities, it does appear likely that the Fed may hike in June and then wait till the end of the year for its second hike. Alternatively, the Fed may choose to await the economic growth data for the June quarter and then take the rate hike decision in its July meet. Either ways, the Fed surely sounds a lot less hawkish than it sounded earlier in the year.

What does this Fed stance mean for the Indian economy…

For the Indian economy, there are 3 key takeaways from the Fed minutes…

A less hawkish Fed view suits India, especially at a time when the RBI rate action appears to be in a state of flux. The June Fed meet may provide more clarity on this subject!

Published on: May 29, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates