Any tech product, however successful, cannot survive without constant improvement in keeping with the changing times. We sensed that Angel One users are increasingly looking towards diversifying their investments via stocks, F&O, Mutual Funds and sovereign gold bonds. To help them manage their diverse investments better, we came up with the Super Portfolio, along with an assortment of other key features!

The principle here was that investors should be able to track all of their investments on a single section, instead of having to open a separate window to track their investments in each asset class, such as stocks or mutual funds. However, the navigability of all this information had to be perfect as well to prevent you from drowning in a sea of information.

With this in mind, we came up with the Super Portfolio, designed to bring together the real-time performance data of all your investments on a single page.

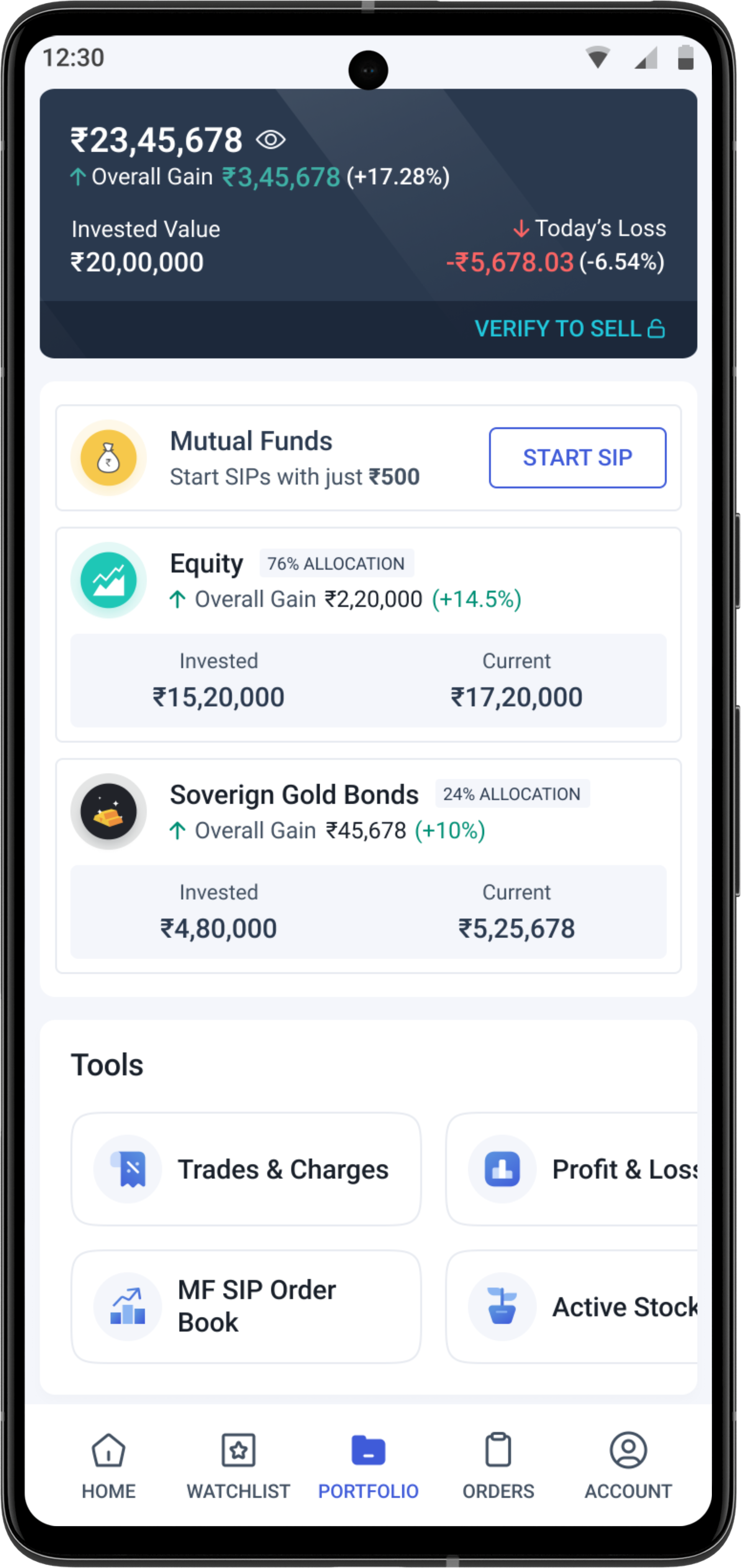

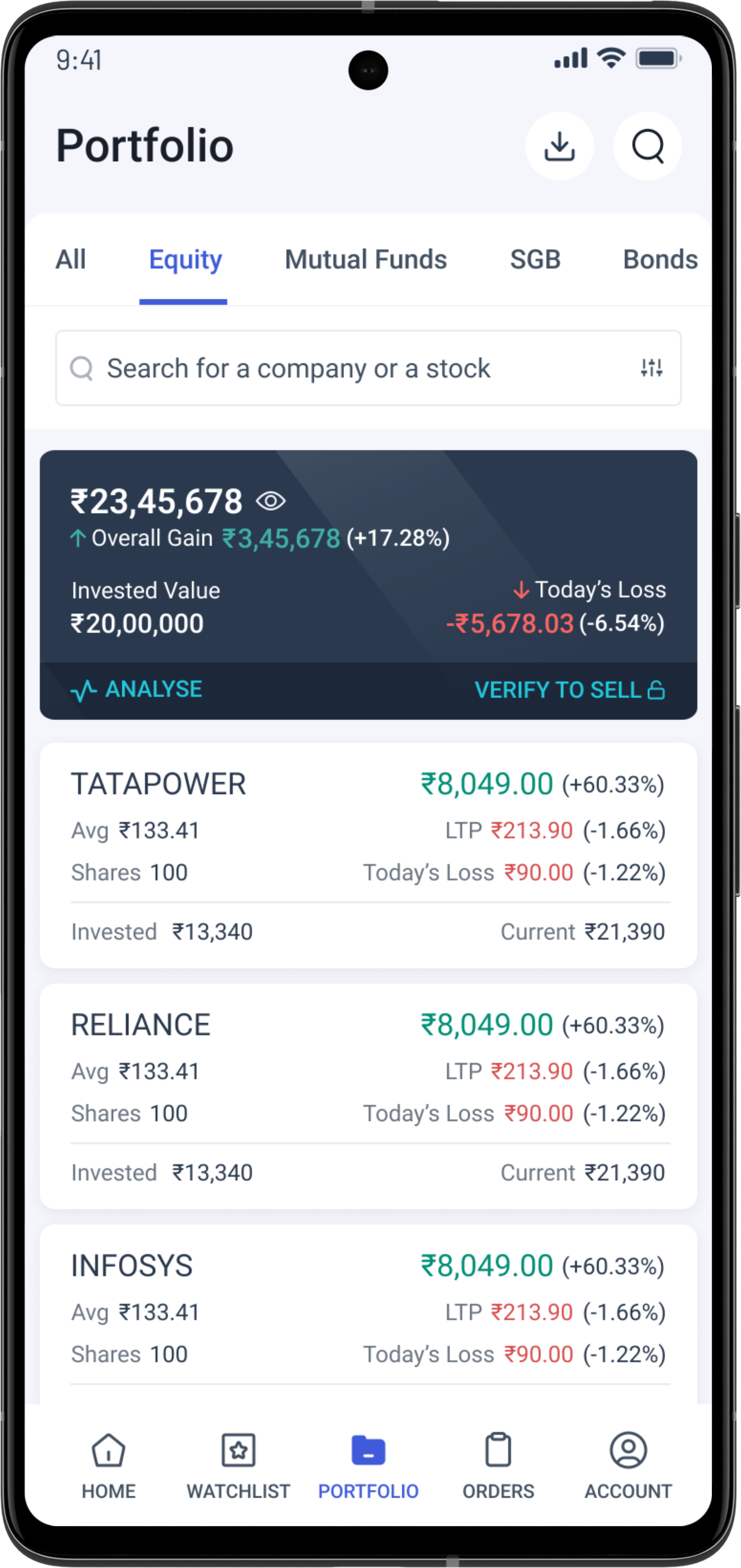

Earlier, clicking the ‘Portfolio’ tab at the bottom of the Android app would show you only the equity assets in your portfolio. However, after the introduction of the Super Portfolio, this page will be divided into the following tabs –

You can start exploring your Super Portfolio from the section titled ‘All’ under your ‘Portfolio’. Here you can find the performance of your overall portfolio via the following information –

In case you do not have investments in a particular asset class, you will be given a direct link to start investing in it.

Fig.1: Initial Portfolio screen under the ‘All’ tab along with quick links under ‘Tools’ (left) and equity holdings page (right).

From ‘All’, if you scroll right, you will be able to view all of your equity holdings specifically. Similarly, scrolling further right will take you to pages exclusively for your Mutual Funds and SGBs.

In both the sections on Mutual Funds and SGBs, you can see, on the top card, a summary of the performance of the asset classes. This includes the invested value and the overall gains/losses in that particular asset class (including both primary and secondary investments for SGBs).

Note: We will soon be adding other sections such as bonds and advisory portfolios to this list in the coming weeks. However, Super Portfolio is currently available for the Android version only. The iOS and web apps will have this feature soon.

With a wider range of your investments now easily accessible, next to each other on the same platform, your overall portfolio will always be at your fingertips henceforth.

You will no longer have to navigate the disparate sections of the app via the Home page (e.g. for Mutual Funds and SGB) to track the performance of your investments in those asset classes.

You will also be able to access the following sections directly from the main page of Portfolio –

But hey, we are not done with new features in the Portfolio yet! Here are some more ways in which your Portfolio has become a better tool in your investment process.

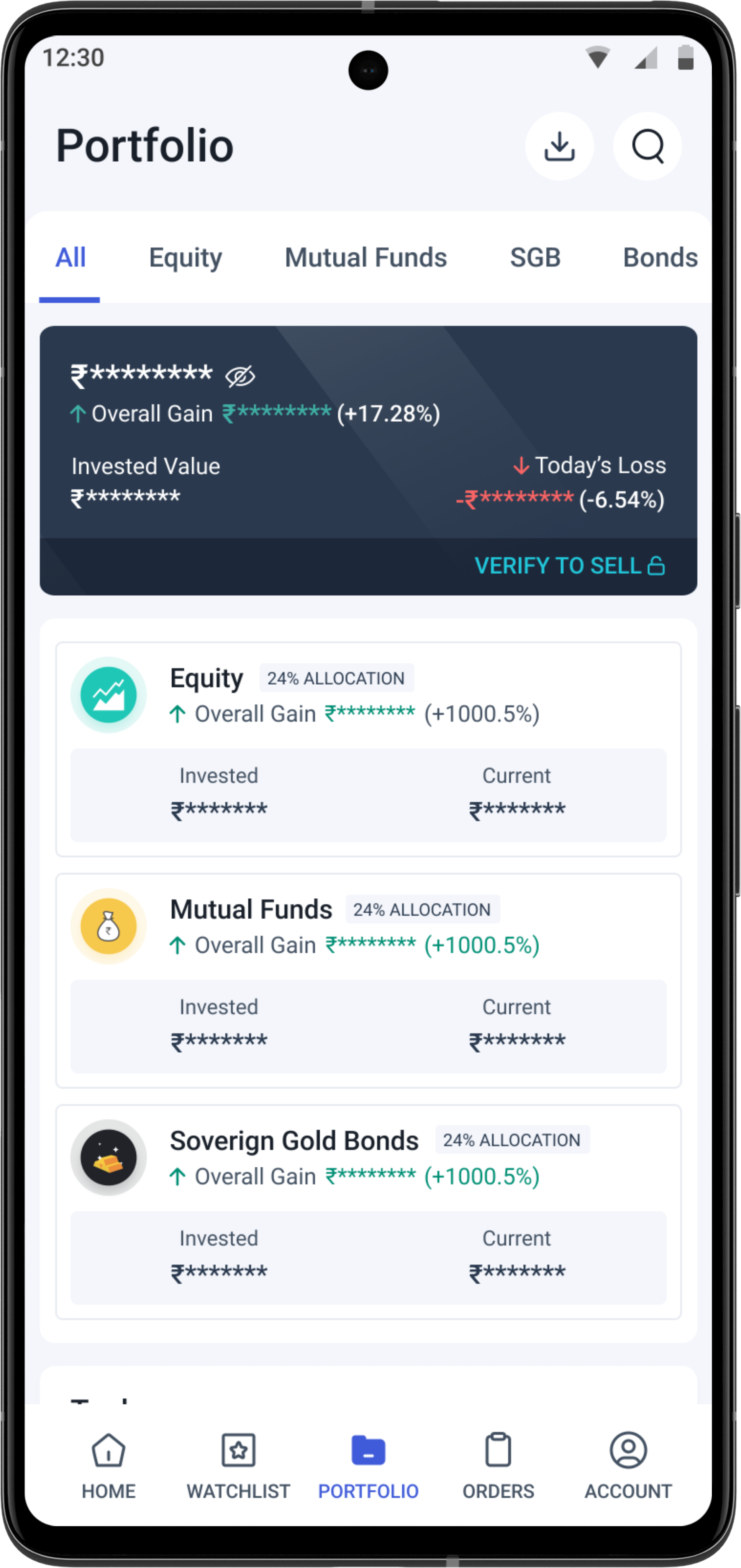

Sometimes you may wish to use offline reports and screenshots of your portfolio for sharing with others or for your own use. However, while doing so, you may still want to hide some key data points for purposes of privacy. The Angel One app now offers the facility where you can choose to hide key numbers of your portfolio on the app as well as downloadable reports on the same.

Under the new app version, you will now get an option on your ‘Portfolio’ page to hide and then unhide all the critical information via a single click. This option will be available on the summary card on your Homepage as well.

When a user clicks to hide the information, the following information will be represented with ******:

On the Summary card,

On the Scrip level, all the above data will be hidden, as well as the quantity of assets held (quantity hidden by 3 asterisks *** instead of 5). Also, the asset’s LTP (i.e. Last Traded Price) and percentage changes in both LTP and Unrealised Gain/Loss will be visible.

On Holding details, all the aforementioned data will be hidden, as well as the absolute values of realised gains/losses. However, the percentage value of the realised gains/losses will still be visible.

Fig. 2: Hidden information on the Portfolio

Of course, you can easily click on the unhide button to open up the hidden information. Hiding your details from the home page will also hide those details in the Portfolio page as well and vice versa.

Even while downloading the portfolio, you will be given the choice to download a masked portfolio, whereby the above information will be masked.

Next, we will look at some of the changes made on your standard Portfolio Analyser.

The following improvements have been introduced to your Portfolio Analyser –

Finally, beyond the Portfolio, we have some additional feature improvements across the app, waiting for you!

Some of the other exciting features also getting released this week include the following –

Update your Android app to the latest version today and start experiencing the benefits of an investing platform that supports the expansion and diversification of your portfolio like no other! You can also join the Angel One Community and follow our blog for further updates.

Published on: Jun 23, 2023, 10:16 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates