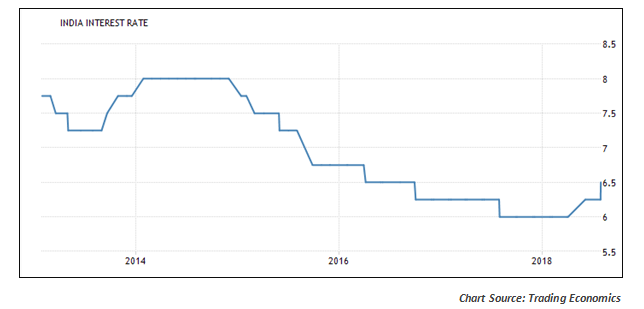

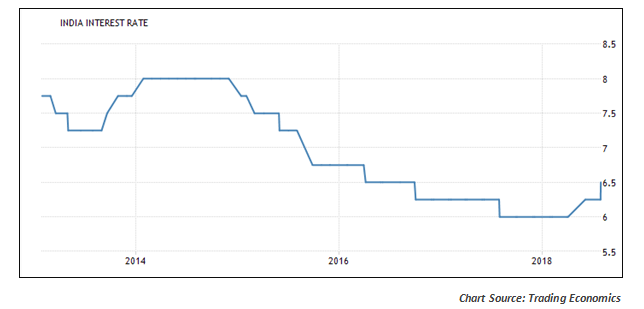

While the bond markets had factored another rate hike during calendar year 2018, they had really not bargained for two rate hikes in succession. But, that is exactly what the Monetary Policy Committee (MPC) did on August 01st. After a 2-day meeting, the MPC decided to effect the second 25 basis point hike in the repo rate in less than 2 months. This effectively takes the rate to 6.50%.

Let us first look at some of the key highlights of the announcements made by the MPC

- The repo rate has been hiked by 25 basis points taking the official repo rate to a level of 6.50%. Repo rates are up by 50 basis points in the last 2 months.

- The reverse repo rate, which is pegged at 25 basis points below the repo rate, gets automatically enhanced to 6.25%.

- The marginal standing facility (MSF) and the bank rate, which are pegged at 25 basis points above the repo rate, get fixed at 6.75%.

- The cash reserve ratio (CRR) remains unchanged at 4% and the statutory liquidity ratio (SLR) remains untouched at 19.50%.

- Interestingly, the MPC has maintained its stance on the monetary policy as neutral and has not given any hawkish signals in its August monetary policy.

Macros did justify a front-ending of the rate hike

Broadly there were five reasons for the MPC to push through the rate hike in August itself, instead of waiting for more data points in the next few months.

- The CPI inflation has already touched a level of 5% in June and is showing further signs of strain. The MPC has estimated the inflation outlook to get more hawkish.

- RBI projections for GDP growth for the next 4 quarters are closer to 7.5% while its outlook for inflation is towards 5%. That is nearly 100 basis points higher than the RBI comfort level on retail inflation rates.

- The RBI expects that the potential for food-driven inflation may heighten in the months ahead. Even assuming that there will be above normal monsoons, the assured MSP of 150% is likely to be inflationary. HRA payouts are another key inflationary factor.

- Fuel is a key component of the inflation basket. While Brent Crude appears to have stabilized in the range of $73-$75/bbl, there are clear upside risks from any geopolitical disruptions to supply, as in the case of the Bab-al-Mandeb Straits.

- Lastly, the rupee has been lent support around the 69/$ level by the RBI. But lower forex reserves at $405 billion and a rising import bill imply that the RBI cannot continue to sell dollars for much longer. Front ending a rate hike will automatically take care of that.

That explains why the markets were still quite sanguine about the hike…

While the June rate hike was a unanimous vote among the 6 members of the Monetary Policy Committee, August MPC meet had one dissenting voice in the form of Dr. Ravindra Dholakia who called for status quo on rates in the August policy. However, there could be 5 indications that the policy rate hikes may have been front-ended on the side of caution.

- The Nifty, which normally reacts negatively to any rate hike, recovered most of its losses for the day and closed flat on Wednesday. Of course, there was some reaction on the rate sensitives but that appears to be done and dusted.

- Another indicator was the INR, which has already strengthened by over 100 bps from its lowest level.

- But the best indication came from the 10-year bond yields, which tempered lower to 7.70%. Normally, 10 year bond yields tend to go up when repo rates are hiked. In June, the yields had gone briefly above the 8% mark after the rate hike. What the benchmark bond indicates is that the worst may be over for the year in terms of yield risk.

- The MPC has maintained its monetary stance as “Neutral” despite the rate hike. Had it altered its view to factor in hawkishness, the markets may have probably worried a little more.

- Finally, the markets were already building in a status quo from the US Fed. Accordingly, the Fed has maintained status quo on rates in its August policy, which could further strengthen the RBI’s need to balance growth with price stability.

In a nutshell, the decision to front-end the rate hike may be a bet by the RBI that the impact of fuel and food may not be too steep on overall inflation. The current rate scenario prepares for up to 5% inflation by next year. The signal is that unless inflation threatens to go above that level, the RBI will not be too keen on further rate hikes. That may be the key takeaway for the financial markets in India!