JPMorgan has announced it will include Indian government bonds in its highly monitored emerging market debt index. This move is expected to trigger substantial capital inflows into the world’s fifth-largest economy, potentially amounting to billions of dollars.

Not only will it bring inflows into the economy, but it will also enhance liquidity in the Indian Bond market. Furthermore, it is expected to bolster the global reputation of Indian Government Bonds.

This move by JPMorgan has brought some positivity to the broader indices, halting the continuous decline of the past two days. Yesterday, the indices faced challenges in gaining ground throughout the session. Furthermore, the PSU index is also trading 2.2% higher than the previous closing level today.

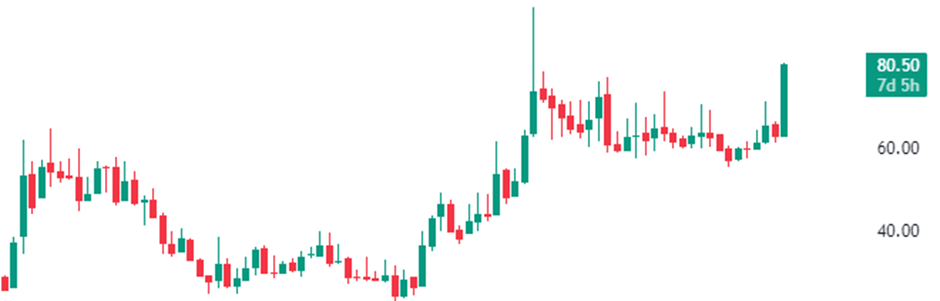

PNB Gilts stood out during the morning intraday session. The stock opened trading at Rs 75.89, which is 12% higher compared to the previous day’s closing price of Rs 65.96 per share. As of writing this article, the stock is trading at Rs 80, representing an 18% increase from its previous closing price. Moreover, it surged by 19% during the intraday session.

What’s more, it has reached its 52-week high price today, with its 52-week high and low prices being Rs 81.55 and Rs 55.25, respectively. With a market capitalization of Rs 1447 crore, the stock has demonstrated outstanding performance in recent periods, delivering a 27% return within a month. Furthermore, it has generated an impressive multibagger return of 396% over a decade.

PNB Gilts primary activities include supporting the government’s borrowing program through underwriting government securities issuances and trading in a range of fixed-income instruments, including government securities, Treasury Bills, State Development Loans, Corporate Bonds, Interest Rate Swaps, and various money market instruments such as Certificates of Deposits and Commercial Papers.

The Company was established as a wholly owned subsidiary of Punjab National Bank with an initial paid-up capital of Rs 50 crore. The net worth of the Company has increased from Rs 50 crore to Rs 1305.69 crore. It is the only listed primary dealer in India and the public shareholding in the company is 25.93 %.

In the June quarter of FY24, the company’s revenue from operations experienced a significant increase of 56% YoY, rising from Rs 283 crore to Rs 443 crore. The company reported an operating profit of Rs 430 crore, compared to an operating profit of Rs 71 crore in the corresponding quarter last year, resulting in an operating profit margin of 97%.

Meanwhile, the net profit of the company amounted to Rs 58 crore, contrasting with the net loss reported by the company of Rs 89 crore during the corresponding quarter last year. In the last quarter of FY23, the company reported a profit of Rs 13 crore.

Here is the chart presentation of the company’s shares on the monthly time frame:

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 22, 2023, 12:02 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates