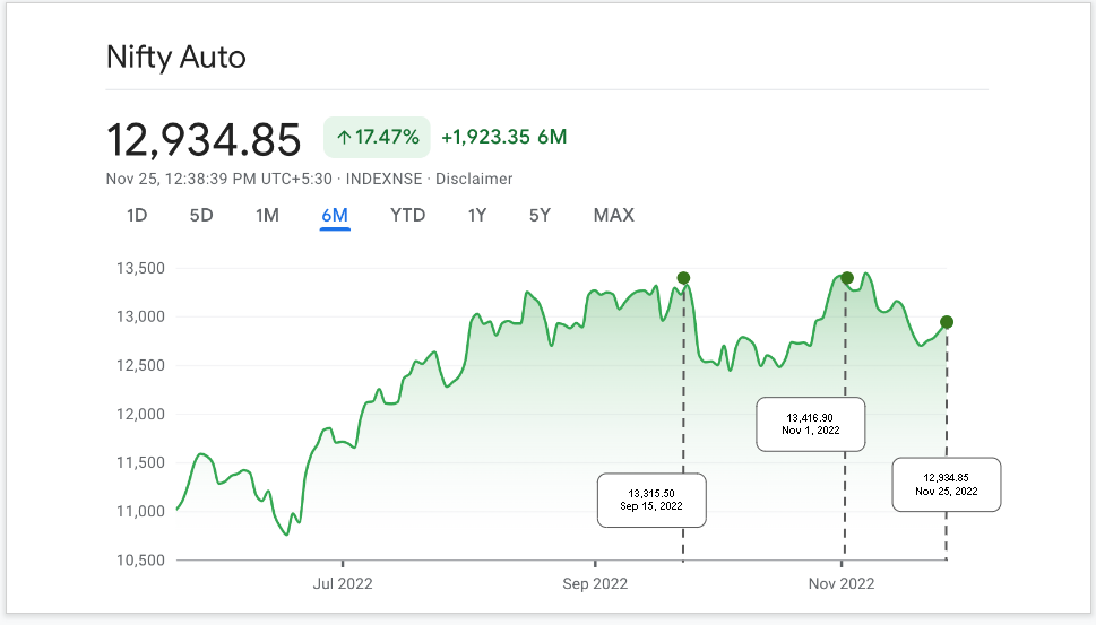

Though in the month of September we saw a rise in Nifty Auto stock, however, in the month of November, it has gone down marginally. In the month of September, it reached an All-Time High of 13,315.50. In the month of November, it has come down to 12,934.85.

For those of you who would like to know more, let’s understand what is Nifty Auto Index?

This index is specially designed to analyse and review the performance and the behaviour of the automobile segment in the financial marketplace. The index comprises 15 tradable companies that are listed on the exchange. The index consists of 4 wheelers, 2 & 3 wheelers, Auto Ancillaries and tyres.

The index is computed using the free float market capitalisation method. Here, the index level reflects the market value of the total free float of all the stocks to a particular base market capitalisation value.

Nifty Auto Index can be helpful in various ways such as benchmarking fund portfolios, launching of index funds, ETFs and structured products.

| Company’s Name | Weightage (in %) |

| Mahindra & Mahindra Ltd. | 19.93 |

| Maruti Suzuki India Ltd. | 19.20 |

| Tata Motors Ltd. | 13.44 |

| Bajaj Auto Ltd. | 8.46 |

| Eicher Motors Ltd. | 7.45 |

| Hero MotoCorp Ltd. | 5.86 |

| Tube Investments of India Ltd. | 3.75 |

| TVS Motor Company Ltd. | 3.65 |

| Ashok Leyland Ltd. | 3.52 |

| Bharat Forge Ltd. | 3.02 |

Being one of leaders of the most diversified automobile company of India, the brand has a presence across 3 wheelers, 2 wheelers, PVs, Cvs, tractors & earthmovers.

P/E ratio (TTM): 15.34

EPS (TTM): 42.5

Profit in 2022: ₹2,772.7 crore

Formerly known as Maruti Udyog Company, Maruti Suzuki Limited is an Indian automobile manufacturer. It sells sedans, hatchbacks, SUVs and MUVs in India through its Arena & Nexa channel and pre-owned certified cars through True Value.

P/E ratio (TTM): 45

EPS (TTM): 124.7

Profit in 2022: ₹2,112.5 crore

Bajaj Auto, a part of Bajaj Group, is the prime manufacturer of motorcycles and three-wheelers in India. It has crossed revenue of Rs.34,428 crores in 2022.

P/E ratio (TTM): 17.6

EPS (TTM): 124.7

Profit in 2022: ₹1,719.4 crore

Tata Motors group has a diversified portfolio of cars, sports utility vehicles, trucks, buses and defence vehicles. It operates in 8 countries: India, the UK, South Korea, South Africa, China, Brazil, Austria and Slovakia.

P/E ratio (TTM): -19.3

EPS (TTM): -28.2

Profit in 2022: -₹944.6 crore

The company is a prominent player in the Indian automobile industry. The firm is also a global leader in middleweight motorcycles.

P/E ratio (TTM): 39.7

EPS (TTM): 61.3

Profit in 2022: ₹656.9.6 crore

The above stocks can benefit from the rise of ATH (All Time High) in automobile stocks. However, investing in the stock market can be a risky matter. Thorough research is advisable before you invest in a stock. If you are ready to take the first step, open demat account with Angel One and start investing.

Disclaimer This blog is exclusively for educational purposes. The securities quoted are exemplary and are not recommended.

Published on: Sep 15, 2022, 4:18 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates