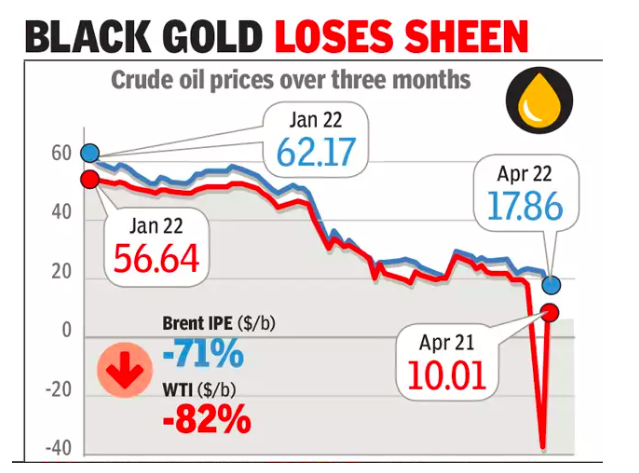

Crude oil prices went into a free fall on April 20, 2020, sending ripples across the world. The US crude oil price fell into negative territory for the first time ever, even as the coronavirus pandemic dried out demand globally. On that historic Monday, the price of a West Texas Intermediate (WTI) barrel, which is the US oil benchmark, hit an unprecedented low of minus $37.63 a barrel. Also, Brent crude, which is the European and key global benchmark, was trading around $26 a barrel. The following day, ie, Tuesday, Brent settled at $22.41 per barrel.

So, what’s the impact of crude oil price crash in the Indian context?

India is the world’s third largest importer of oil, and over 80 per cent of the country’s oil resources are through imports. This crash in crude oil prices has come when India, like much of the world, is battling a pandemic, and is in a lockdown. The crash means India will have a much lower oil import bill. This will help the economy at a time when India needs more funds to battle the implications of the lockdown. For each $10 per barrel drop in oil prices has an impact on the import bill and the current account deficit (CAD) by a little over 0.4 per cent of the GDP. This is why any drop in oil prices matters for India. A crash in crude oil price will also keep inflation at bay. Low crude prices can also be useful for India to raise any oil-related taxes to make up for losses. Lower oil prices could also help cut input costs for farmers, and make funds available for other spending.

Since crude is used in segments such as transport, lubricants, plastics, FMCG, paint and tyre manufacturers, petrochemicals, low prices could have a positive impact on these sectors.

Inadequate storage capacity

However, for India to take maximum benefit of the crude oil price crash, the country needs more storage capacity. India’s storage capacity is at 39 million barrels, while its neighbour China has a capacity of 550 million barrels. Japan has a capacity of 528 million barrels, reports suggest. India’s current strategic petroleum reserves or SRPs are at Visakhapatnam, Mangaluru and Kadur, and can together hold enough storage to cover nine days in case of any disruption. The three reserves cumulatively are over half full. In comparison, Japan has a storage cover of 198 days in case of any disruption.

Another flip side for India from the crude oil price crash is that India actually doesn’t benefit from US WTI crude futures. India’s major purchases are based on Brent crude prices. Also, some more pain owing to the crash in global oil prices is being felt by Indian upstream oil firms, whose profitability may be impacted.

Weakening rupee

While there is the possibility of India seeing a lower oil import bill, there is another problem that may offset this gain — that of the Indian rupee losing ground. The rupee, which is around Rs 76 per dollar, has fallen by 7 per cent since the beginning of the year, and this could offset gains from prices of falling crude.

The drop in crude prices won’t make an impact on the common man, in spite of the drop in the price of the Indian Basket, which is a weighted average of Dubai, Oman and Brent crude, which touched around $20 per barrel on April 17. Because of the lack of demand, there won’t be any drop in retail fuel prices. Even a huge drop in prices of fuel won’t necessarily push consumers to use more oil in the current scenario.

The verdict: A mixed bag

To sum up the crude oil price crash impact, there are both pros and cons for India. The big positives are that any drop in crude price has an impact on the current account deficit or CAD, and India’s oil import bill. It also helps keep inflationary tendencies at bay. On the negative side, state-run oil producers may be negatively impacted. Also, India has a relatively lower storage capacity, which poses a dampener in its efforts to take advantage of the crash in prices.

As any individual investor or trader, it is important that you keep track of world events and see what their impact on your investments could be. You could start trading or investing in stocks by opening a demat and trading account on Angel One, which will give you access to advanced and seamless online platforms. You could even use the broking app on your smartphone to get all trading-related updates and information at the click of a button. Thanks to a demat and trading account, you can access realtime updates and latest research reports in order to make informed investment decisions.

Published on: May 1, 2020, 9:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates