While we have already discussed the under performance of Realty companies, real estate companies have also failed to execute large and ambitious projects. If we take a look at the past few large projects like Lavasa (HCC), Sahara City and few others like large projects from Unitech and Jai Prakash Associates not only created doubt about the execution capabilities but also the ability to sustain severe financial burden created because of large projects. All in all it not only resulted in severe losses to the companies, even the investors lost their confidence. This was despite the fact that Government policy initiatives were favourable for the realty companies for long term but created burden for real-estate companies in short term. While large execution has been a challenge, there are certain other factors as well that keep the investors away from the equity instrument of the realty sector.

There is historical evidence of failure to deliver on ambitious projects.

Real estate companies have a very complex holding structure. There are several subsidiary companies formed through joint ventures or tri-party agreements. . While the consolidated results are available to an investor, to find irregularities from more than 100 subsidiary companies is surely a daunting task. Add to that the complex accounting standards and policies opted by realty companies – it is really a complex process to come out with exact expected numbers and estimates. To be very specific, there is usually a mismatch between proceeds received from the customer and the amount booked by the company in results.

Again the quarterly results and yearly results are not a right parameter to analyse realty companies. The net present value of its assets (saleable land bank – all liabilities). However the cash flow is what gets affected and hence the results analysis is important. Over the past few years the realty companies have failed to generate cash flows. In the other sectors the accounting policies are simpler. And as we say simpler things naturally the investor interest is higher.

One factor we look at before investing is, if the company has a larger presence in the market. Unlike the other sectors where the products can be manufactured at one place and distributed to pan India or even exported, real estate has got a mobility issue. It has been a geographical play since day one. There is no realty player who could be considered to have a Pan India presence. DLF has worked in clusters in NCR, Oberoi Realty has a presence in Western India (Godrej Property has presence has presence across India) and the rest are also segregated in different clusters. As a result the presence has been limited to a particular region. All in all this has made the realty industry a very fragmented sector dominated by unorganised players. Some amount of consolidation has happened, however it further made the already complex subsidiary kind of structure further more complex. Add to that the factor that real estate has no such standardisation enjoyed by equity markets and gold. As a result there is no parity between the two dwelling units in similar locality.

While many would immediately argue that, there is Real Estate Regulation Act (RERA) present. However we believe, though there is some comfort drawn by the customers or home buyers – there are still many lee ways available. The way there are regulatory bodies in Equity markets (SEBI), Insurance (IRDA) and even PF segments (PFRDA) – there is no regulatory body for the realty sector.as result the complete authenticity of the RERA is questioned. Further not all states come under the RERA and hence can’t be considered as a best regulatory act.

Just to put some examples of lee way possible, the RERA is not applicable if the project has got up to 8 dwelling units or the size is 500 sq. mt. In Some cases the loophole is utilized and builders have built 20 units as the area was less than 500 sq. mt.

Further the RERA has only added to the cost (ultimately borne by the end users) and there is no speeding up the process. We know few of the projects that can be completed within 24 months, have been given delivery date in 2025-26. This is just like utilising the loop holes. Though the no regulatory body factor is negative for investing in the physical asset class, it also has an impact on the equity instrument as well.

We all know that the ambitious projects and debt raised for the same (at exorbitant rates) was a major issue faced by the realty players. After biting something more than what they can chew in 2007-08, the realty companies are still facing debt issues. A lot of restructuring has happened, most of the companies have already got rid of the non-core assets (and in many cases sold core assets to pay for the wrong move to go for non-core Assets), but the debt burden still remains a dragger on its performance.

Real Estate companies have never been able to strike a right balance between residential and commercial segments. They have been shifting the focus from one segment to another based on the demand parameters. However there has been the right kind of success that any of the companies achieved. It is true that the Real Estate Investment Trust (REIT) has managed to help some of the companies to monetise assets.

One of the most important parameters we consider for analysing a company is management quality or promoter background. Thanks to the various legal processes that run through building a realty business, promoters have lots of litigation pending with them. Hence there is a presumption about real estate promoters not being clean. Add to that the consistent under performance of the realty companies on the bourses, the management bandwidth is usually questioned.

Affordable housing is one segment that has helped the sector witness some positivity. A lot of developers are growing in this segment as well, however this has got its own challenges as well. The issues like scarcity of land, lack of infrastructure and basic amenities and lengthy statutory clearance & approval process are the three major challenges. Lastly private participation is lower in semi urban and even in few urban areas. There are 30 basic regulatory approvals required for the affordable housing projects. This clearly indicates that the dependency of the developers on the approvals is high. In such cases the sector (higher government interference) does not enjoy premium valuations. We have seen how the sugar sector and even the energy sector have never managed to enjoy premium valuations.

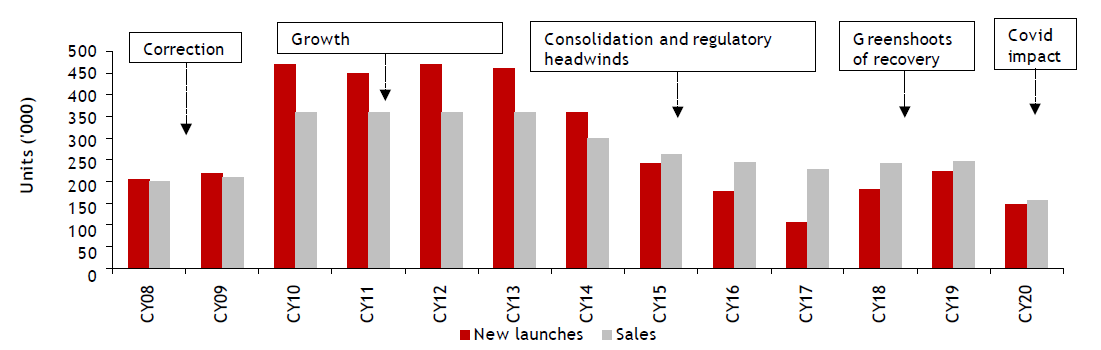

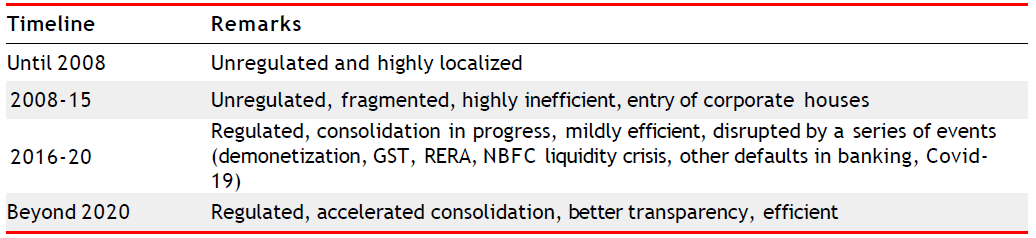

While we have spoken about the factors that are affecting the valuations of the realty companies there are few positives emerging as well. The consolidation narrative is driving the sector re-rating. Slowly and steadily the sector valuations have evolved from promised execution to actual execution. Over the period the things are changing, the larger players with strong brand names are enjoying better valuations. The less leveraged balance sheets, transparent management and speedier execution are important parameters to enjoy better valuations. Rather most of the companies would try to monetise the brand and not the land. Luxury and premium segment would mean better valuations going ahead.

Published on: Aug 31, 2021, 1:15 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates