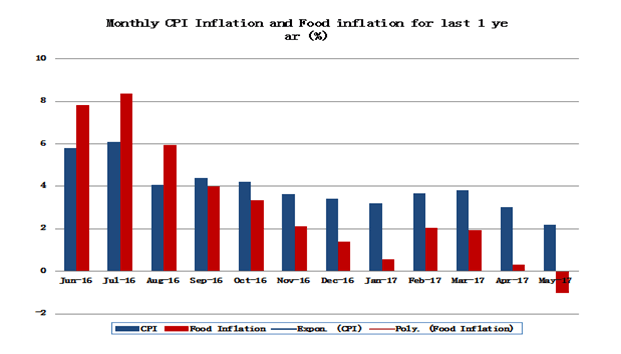

With retail inflation coming in at just 2.15%, we have touched a 5-year low on retail inflation. Low inflation has largely been driven by negative food inflation in the month of May 2017. The impact of food inflation gets more pronounced as it constitutes nearly 50% of the overall CPI inflation. The chart below captures the trend in CPI inflation and food inflation over the last 1 year.

The highlight of the May 2017 data is that for the first time in the last 1 year, the food inflation has dipped into negative territory. While it has held CPI inflation down to just 2.18%, the downside risk is that it could worsen the condition of farmers, who are already in the streets agitating against non-remunerative prices for their crops. In fact, in the last one year the production of pulses is sharply up but the prices of pulses are down sharply on a YOY basis. This year, despite expectations of good monsoons, most farmers may not be really enthused to expand the production of pulses as they are losing money on each quintal of pulses sold. But, first a look at the nuances of the CPI number announced for the month of May 2017…

How the CPI number panned out overall…

The CPI inflation for the month of May came in at 2.18%. This is lower than the CPI inflation number of 2.99% in April 2017 and a much higher figure of 5.76% in the year-ago period. This was largely driven by food inflation at -1.05%. While we shall look at the components of food inflation separately, it is instructive to note that rural inflation and urban inflation are now almost at par with each other. In the previous calendar year, the rural inflation was at least 200 basis points higher than the urban inflation. That gap has been narrowed down to an almost negligible level. While this appears to be a positive trend, there is a counter argument. It is estimated that a large part of the fall in rural inflation can be attributed to weak rural demand after the demonetization late last year. Most rural centres are still predominantly run on cash and the demand for food from these areas saw a genuine shrinkage. The surplus crop last year also led to a glut in the rural and urban centres leading to a sharp fall in food prices. Let us look at food inflation in greater detail.

How food inflation trended in the month of May 2017…

What exactly drove the negative food inflation of -1.05% in the month of May 2017? There are really no surprises. The big negative contributions to food inflation came from pulses and vegetables. For the month of May 2017, vegetables inflation came in at (-13.44%) while inflation on pulses came in at (-19.45%). Both these items have been seeing negative inflation for over 6 months in succession. While pulses are facing the worst glut in recent times due to overproduction by farmers, vegetables are more a case of distress sale in most mandis due to prices being non-remunerative. Other than pulses and vegetables, all the other key categories like Cereals, Milk, oil and sugar displayed above-average levels of food inflation.

How non-core inflation stacked up in the month of May 2017…

The fact that CPI inflation is still above 2% despite food inflation being less than -1% can be largely attributed to the pressure applied by non-core inflation. In fact, over the last few MPC meetings, the 6 members of the MPC have consistently used sticky non-core inflation as the key justification for not cutting repo rates. Some of the key components of non-core inflation like clothing, housing, fuel, lighting, education, transport and health all showed a sticky level of inflation above the 4% mark. This largely made up for the weak food inflation. In fact, the non-core inflation is highly vulnerable to the prices of petrol and diesel. The reason non-core inflation has been sticky has been that when the government duties are added to the landed cost of crude, the consumers have not really got any meaningful relief on the fuel inflation front. That situation is unlikely to change meaning that non-core inflation will continue to drive overall inflation on the upside.

Does it open the gates for another rate cut by the RBI?

The CPI inflation at 2.18% surely makes a case for the RBI to cut rates. After all, over the last 4 MPC meetings the big concern has been about inflation. So will the RBI consider a rate cut in its August policy? The following factors will drive the RBI decision…

At the current juncture, there are too many variables in the rate decision of the RBI. A rate cut in August does look likely but a lot will also depend on how the Fed guides on US monetary stance; both with respect to rates and the tapering of the bond portfolio. That could be the key metrics to watch out for!

Published on: Jun 20, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates