Over the last couple of year, domestic mutual funds have emerged as potent players in the equity and the debt markets. Mutual funds which were getting negative inflows till April 2014 have been seeing a spurt in retail inflows into equity funds. With other asset classes like real estate, gold and debt hardly giving returns post inflation, equity seems to be the only clear option for most Indian investors. That brings us to the key question; do mutual funds really influence markets as much as FIIs do? For that, let us look at the monthly flows data of FIIs and Mutual funds as disclosed in the NSDL reporting.

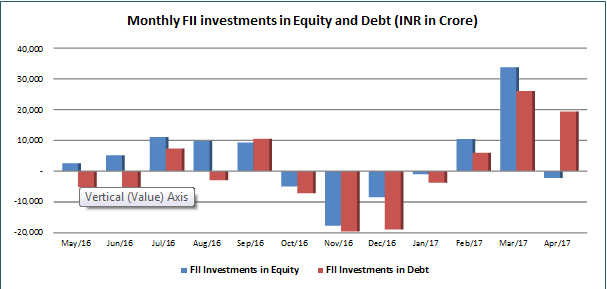

The chart above captures the monthly flows of FIIs into Indian equity and debt over the last 12 months. If you intuitively compare the flow numbers of the FIIs with the Nifty movement during the same period, there appears to be a direct correlation between the two. Post the Union Budget in 2016, FIIs turned net buyers in equities on reformist expectations. That was the period when the Nifty rallied sharply. Post October, FIIs turned net sellers in equity and debt in the aftermath of the Fed rate hike expectations and worries over demonetization. It was during this period that markets were extremely tepid. However, post February 2017, when FIIs turned aggressive buyers in debt and equity, the Nifty rallied to a new high. This has been the typical situation over the last 15 years, wherein the FIIs have exerted an inordinately high influence on the market levels.

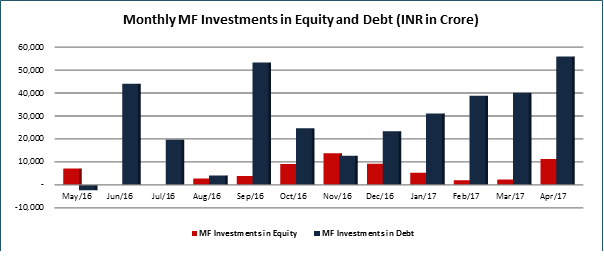

Let us now focus on the mutual fund action and its impact on the Nifty. In the first half of 2016, domestic mutual funds were largely tepid buyers but FIIs were aggressive buyers which resulted in a runaway rally post the Union budget 2016. In the post demonetization period, MFs continued to be aggressive buyers in equity and debt. But the Nifty remained tepid to weak. However, it must be conceded that had it not been for the support of the domestic mutual funds, Indian markets could have cracked really sharply under the onslaught of FII selling during that period. To that extent domestic MFs have played a role in shielding the market; even if not in influencing it.

Why do FII flows exert more influence on the Nifty movement?

There are 5 key reasons for this phenomenon, which explains why the FIIs exert a greater influence on the Indian market movement…

The crux of the story is that, as of now, FIIs continue to exert more influence on the Indian equity markets. But the experience of the second half of 2016 indicates that sharp inflows from mutual funds have been instrumental in providing a support to markets. That by itself may be a good starting point for mutual funds to exert greater influence on Indian equity markets.

Published on: May 23, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates