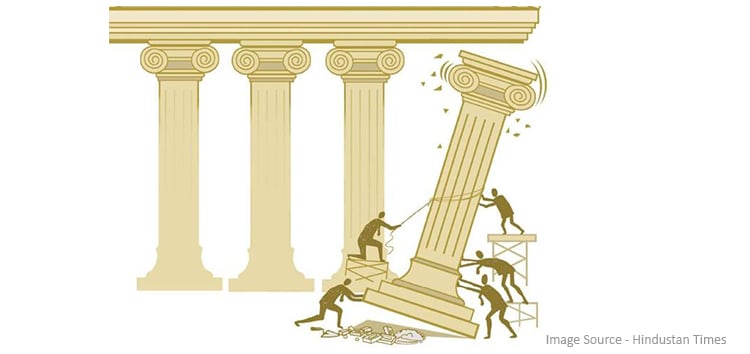

The Cabinet on August 23rd gave an in-principle approval for initiating the process of merger of PSU banks. The idea has been under discussion for the last few months and the reasons are not far to seek. Firstly, there is a lot of duplication in the network and operations of most of the PSU banks and hence having so many banks did not add much value. Secondly, banking is increasingly becoming a business that is technology driven and less dependent on geographical presence. Therefore, having so many PSU banks with presence across the length and breadth of India was not required. Lastly, if PSU banks have to survive they need size and a solid balance sheet. In the current situation, this is difficult on a standalone basis considering the weak credit growth and high level of NPAs. The answer lies in merging these PSU banks into smaller clusters to make them more nimble and more competitive. It is in this light that the Cabinet approval needs to be seen.

During the last financial year, SBI took the lead in consolidation by merging its listed subsidiaries into the parent. Apart from the five associate banks that still had non-SBI shareholding, SBI also absorbed the Bharatiya Mahila Bank. In the process SBI could create a much larger banking entity and also get rid of duplication of network. More importantly, it has also helped SBI to consolidate its HR, admin, risk management and other support services in the process reducing costs. But the biggest advantage from the merger comes on the treasury front. The parent SBI was able to earn higher yields on its treasury due to its clout and size but each of its associate banks had a separate treasury desk which was sub-optimal in size. The integration creates a centralized treasury, which will result in higher yields on treasury activities for the merged entity as a whole. It is this kind of synergy that is sought to be achieved through the merger of other PSU banks.

The big trigger for this in-principle approval for merger of PSU banks comes from the high level of NPAs. In fact, for the fiscal year ended March 2017, the Gross NPAs of the PSU banks has crossed 12.5%. Even within the gamut of PSU banks, there are banks like SBI and Canara Bank where the Gross NPAs are lower than 10% while in case of IDBI Bank the Gross NPAs are as high as 24%. All said and done, an industry level Gross NPA of 12.5% is unsustainable and the fiscal burden of capitalizing these banks will be a huge drag on the fiscal responsibility; which the government has religiously adhered to. For the current fiscal year, the government has committed Rs.10,000 crore for capitalizing banks, which is obviously going to be inadequate. While bankruptcy laws and tighter control over banks can work up to a point, that is not the answer to 12.5% gross NPAs. That is where bank mergers fit in!

The Cabinet has clarified that the merger initiative will come from the bank boards and hence will be entirely business driven. But the hints are there of the broad structure that these bank mergers will follow. At one level there will be the relatively stronger national level banks with lower NPAs and higher capital adequacy. These include banks like Punjab National Bank, Bank of India, Bank of Baroda and Canara Bank. These banks would typically be called up to acquire banks as they have the balance sheet strength to absorb a larger asset base. At a second level, there is also the plan to create regional power houses. For example, banks like Canara Bank, Vijaya Bank and Syndicate Bank could consider a possible merger considering their predominant presence in Karnataka and Rest of South India. Similarly, Allahabad Bank and UCO Bank are both based out of Kolkata and they could be merged to create economies of scale in the Eastern Region. There are sceptics who believe that merging two weak banks may not add much value. Similarly, merging a strong bank with a weak bank may end up enervating the stronger bank. But these are issues that will have to be addressed along the way.

According to experts, the merger of banks will create teething problems. Firstly, merging banks and deriving efficiencies out of two similar networks will be easier said than done. Secondly, for bank mergers to be really effective there will have to be large scale rationalization of costs. That will include costs in terms of infrastructure, common facilities and manpower. With elections looming in less than two years the manpower issue could be the big challenge for the government. It is not just about reduction of manpower. There are massive retirements coming up across PSU banks in the next 4-5 years. The rationalization should not result in shortage of quality of manpower which will defeat the very purpose of these mergers.

For now the final details are still awaited but the process appears to be quite straight forward. Firstly, the consolidation plans presented by the individual bank boards will be examined by a Group of Ministers (appointed by the PM). Secondly, once the approval is received from the Group of Ministers the banks will have to abide by RBI and SEBI regulations. There are likely to be special exemptions to make the process smoother. At least, the government has affirmed that the merger process will be driven by commercial considerations rather than being thrust on banks.

In a way, the whole idea of a handful of national level banks and a few strong regional banks was first mooted by the M Narasimham Committee in 1998 and ratified by the P J Nayak Committee in 2014. It is, perhaps, to the credit of this government that it is trying to action a long-standing idea!

Published on: Aug 28, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates