The 4% rule is a retirement planning guideline that suggests: You can safely withdraw 4% of your retirement corpus annually (adjusted for inflation each year) to ensure that your money lasts.

It originated from a 1994 study by William Bengen, a U.S. financial planner, based on historical data of U.S. stock and bond returns. The assumption was that if a retiree withdraws 4% of their corpus in the first year and adjusts the amount annually for inflation, their money would likely last through retirement.

Suppose you want to retire with ₹10 lakh annual expenses.

Read More: Is Your Savings Account Losing You Money? A Look at Inflation, Opportunity Cost, and Low Interest Rates.

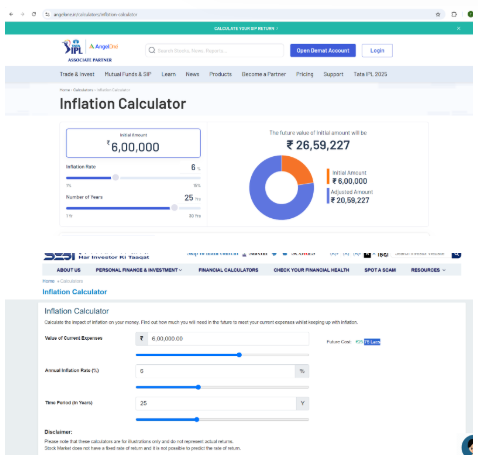

You’re 30 today, and your monthly expense is ₹50,000 (₹6 lakh/year). You want to retire at 55, and assume inflation at 6%.

At age 55, your annual expenses will be based on the inflation rate of 6%:

₹25.75 lakh/year

Using the 4% rule, the required corpus =

Corpus=₹25.75 lakh/0.04 = ₹6.44 crore

So, you would need ₹6.44 crore in retirement savings to safely withdraw ₹25.75 lakh/year under the 4% rule.

Most people mistakenly assume ₹6 lakh/4% = ₹1.5 crore, which will run out quickly due to inflation.

The 4% rule is too simplistic for Indian retirement planning. It ignores:

Instead, Indians should consider a more dynamic withdrawal strategy or use goal-based planning tools tailored to inflation-adjusted expenses and longevity.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. This does not constitute a personal recommendation/investment advice. It does not aim to influence any individual or entity to make investment decisions. Recipients should conduct their own research and assessments to form an independent opinion about investment decisions.

Investments in the securities market are subject to market risks, read all the related documents carefully before investing.

Why we have taken SEBI’s calculator

Reason being there was a stark difference between the two, attached is the screen shot.

Published on: May 5, 2025, 3:36 PM IST

Team Angel One

We're Live on WhatsApp! Join our channel for market insights & updates