The Indian IPO market helped raise nearly $2 billion during the financial year 2016-17. It is estimated that in the coming year 2017-18, the IPO market will help raise nearly $5.5 billion worth of fresh money. IPO booms are nothing new to India. We have seen IPO booms in 1992, 1994, and 1999 and again in 2007. Each of these IPO booms resulted in excesses in the market and eventually ended up destroying wealth of investors. That is why, as the IPO market has picked up over the last 2 years, the question of whether we are again sitting on an IPO bubble is back in circulation. Actually, there are 5 reasons this IPO boom is likely to last much longer and may not end up the way previous IPO booms ended…

Over the last couple of years, there has been a surge of liquidity from Foreign Portfolio Investors (FPIs) into Indian markets. FPIs have infused nearly $10 billion into equities since January 2017 and nearly $21 billion in debt since January 2017. $31 billion is a lot of money and this surfeit of liquidity gets compounded because domestic mutual funds have also infused nearly $8 billion into equities since the beginning of 2017. All this liquidity needs to find productive avenues to invest; otherwise investors will end up buying the same stocks resulting in asset inflation. Asset inflation means stock prices of frontline companies will move up due to excess demand even when fundamentals are not supportive. A robust IPO market ensures that FPIs and MFs get an additional avenue to deploy funds which is evident from the institutional oversubscription that we get to see for most of the IPOs. This is something that will sustain the IPO markets much longer.

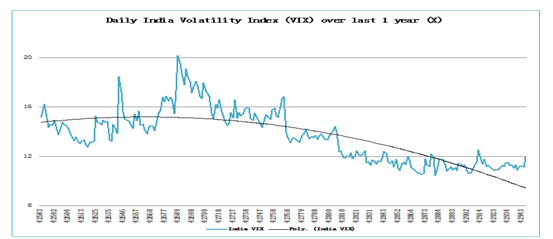

While market P/E valuations are at 23X trailing 4-quarter earnings, we are still below previous market tops. The P/E ratios of the Nifty Index were at 29X in 2008 and at 27X in 2010. Also, we are currently close to a bottom of the earnings cycle as against previous occasions when we were at the top of the earnings cycle. Reasonable valuations are also supported by the volatility index (VIX) which continues to remain at a 1-year low. In fact, as long as the VIX hovers around this level, any major disruption in the market looks highly unlikely. This is also indicative of the fact that the IPO market may not exactly be in boom phase. In fact, on the previous two occasions when the IPO boom unravelled in 2008 and 2010, the VIX had gone up to unsustainable levels.

As the trend-line of the VIX chart indicates, the low volatility is normally a sign of a stable market with positive bias. Thus any volatility-induced disruption of the IPO market looks unlikely.

One of the major highlights of the IPOs since the last 2 years has been the attractive listing of good quality IPOs. This has resulted in healthy buying interest from HNIs. Now, most of the HNIs opt for the funding route and hence the post-listing performance needs to cover the interest cost also. In a majority of the quality issues, the HNI interest has been largely due to the very healthy post listing performance by IPOs.

In case of retail, there is a major shift towards equity. It is estimated that nearly $75 billion of Indian retail money will go into equities in the next 3 years. The trend is already visible from the collections of equity mutual funds and the growth in SIP folios. Active retail participation is essential to ensure that IPO rallies are not only healthy but also sustainable over the longer run.

An IPO boom is where almost any IPO tends to list at a hefty premium creating a false aura of assurance in the IPO market. The IPO market in the last 2 years has been a lot more discerning and selective about the IPOs. That is reflected in the post-listing price performance. For example, over the last one year there have been IPOs like D-Mart, Shankara Building Products, AU Small Bank Finance and CDSL, which have given very healthy post-listing performance. The likes of BSE and HUDCO have been above average performers post-listing. However, there have also been laggards like GTPL Hathaway, S Chand & Co, CL Educate etc where the stocks are quoting at a discount to their IPO price. So, this is not an across-the-board mania that we are seeing. As long as stock markets are selective, the market does not need to be overly worried.

There is No Alternative (TINA) is a strong case for the IPO markets. With bond yields low, interest rates set to go down further, gold investments capped and real estate under scrutiny, equity is likely to be an obvious magnet for investors in India. IPOs, with their recent allotment regulations, are more in favour of small and retail investors. This is a great incentive for retail investors to participate in IPO markets. Forget about all the above factors. TINA, by itself, could be a key driver for the IPO markets in India. At least, it will ensure that the IPO story lasts for much longer this time around. Investors will surely have a reason to celebrate!

Published on: Aug 28, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates