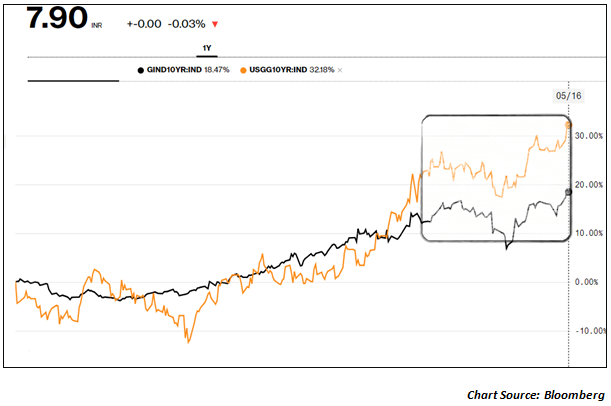

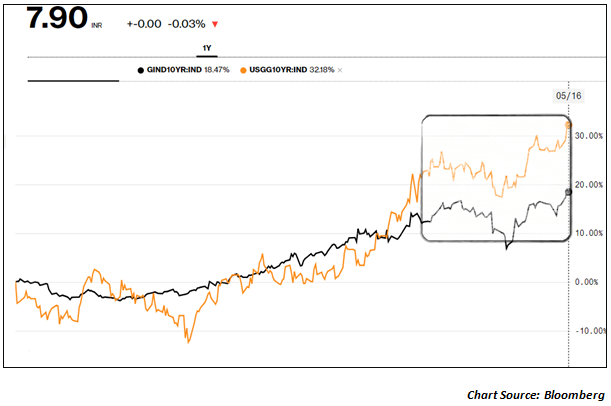

From the time the minutes of the last monetary policy were announced in the third week of April 2018, the bond yields on the 10-year benchmark have gone up sharply and are now inching closer to the 8% mark. There are two explanations for this sharp rise in bond yields. Firstly, the higher inflation implication due to higher Kharif prices and higher crude oil prices is one trigger for the rising yields. Secondly, the US 10-year benchmark has already crossed the 3% mark and it is expected that the RBI may hike rates to keep the yield differential intact. That will prevent rapid capital outflows of the kind we saw in 2013 at the peak of the currency crisis. Check the chart below:

Obviously, the bond yields in the US are rising much faster than in India in the last 1 year. Even other economies like Germany have seen a rise in 10-year bond yields at a rate faster than India. This has opened up the possibility that the RBI could also hike rates by 25-50 basis points in this calendar year. What would be its implications?

Implications of the RBI hiking repo rates this year

There is a conservative target of the RBI hiking rates by 25 basis points during the year and a worst case scenario of rates hiked by 50 basis points. What will be the implications of such a rate hike by the RBI?

- A rate hike by the RBI is not good news for bond funds. That is more true of long duration bond funds that are more vulnerable to the fall in price of bonds as a result of rising yields. Debt fund holders could see depreciation in their fund NAVs. Also PSU banks that are holding on to large portfolio of government bonds in their portfolio will have to provide for losses on their bond holdings. At a time when these banks are already reeling under the impact of NPAs, the rate hike could add a new dimension for the Indian banks.

- A rate hike could stall the nascent recovery in the IIP and the PMI. We have seen the IIP and the PMI showing signs of a nascent recovery. Especially, sectors like HCVs, capital goods are showing a revival in demand and that could be indicative of a recovery in the capital cycle. At this juncture, any decision by the RBI to hike rates could increase the cost of funds and slowdown the capital cycle recovery.

- A rate hike by the RBI will be negative for equity valuations. Why would that happen? For starters, you value companies based on projection of future cash flows. Then these cash flows are discounted to present value to arrive at an indicative price for the stock. The future cash flows are discounted back based on the Weighted Average Cost of capital; which is a combination of the cost of equity and the cost of debt. Higher interest rates will increase the cost of debt and therefore depress valuation of equities.

- There is another interesting angle to this which is the issue of bond yields versus earnings yields. Bond yield is the interest rate divided by the price. When rates go up the bond yields also go up. This is normally compared to the equity yield which is the ratio of EPS to stock price. That can also be looked at as the inverse of the P/E ratio. So if the P/E ratio is 20X then the equity yield will be around 5%. If the bond yield is around 300 basis points more than that then it can lead to outflows from equity into debt. This is in the case of FPIs.

- A rate hike by the RBI will also be instrumental in making debt costlier for Indian companies. For example a blue chip company like Reliance Industries has been borrowing short term funds at 100 basis points higher than last year. Mid cap companies will see a bigger hit on their borrowing costs. For companies with low interest coverage ratios, this could be an additional problem as it could substantially add to the financial risk. Also fresh borrowings will now happen at a much higher cost.

- Finally, there is a currency angle to this entire debate even if the RBI chooses not to hike rates. One option with the RBI is to keep rates constant but let the INR depreciate. That should compensate for the rate hikes but it will create a new problem for importers and foreign currency borrowers. That is a strategy the RBI could adopt and that is something analysts need to be cautious about.

All is not so bad if rates are actually hiked. A study in the US has proved that if the rate hikes are a reaction to higher inflation and growth, then rate hikes can actually be value accretive or the economic over the next 3-5 years. Here is hoping it really works out in practice!