In the ever-evolving landscape of electric vehicles (EVs), one company stands out for its remarkable journey to dominance—BYD. While Tesla often steals the spotlight, it was BYD that dethroned the EV giant in Q4-2023, marking a pivotal moment in automotive history.

Warren Buffet’s Bold Bet: Back in 2008, Warren Buffet made a strategic move by investing in BYD instead of Tesla. His bet paid off handsomely, yielding a staggering 30x return on investment. Berkshire Hathaway’s stake in BYD, initially valued at $232 million, burgeoned into a multi-billion-dollar asset.

In late 2021, Berkshire Hathaway held a significant 21% stake in BYD, valued at an impressive $7 billion at its peak. However, by February 2024, with BYD’s market capitalization soaring to $70 billion, Berkshire Hathaway had strategically reduced its stake to just under 10%. Despite the reduction, Berkshire Hathaway’s remaining stake in BYD still stands at over $3 billion.

BYD’s Rise to Prominence: BYD’s ascent to the top of the EV market was propelled by a combination of factors:

- Vertical Integration: Unlike traditional carmakers, BYD adopted a vertical integration strategy, manufacturing batteries, motors, semiconductors, software, and key components in-house. This not only provided flexibility but also shielded the company from supply chain disruptions, as evidenced during the semiconductor chip crisis.

- Early Battery Expertise: Leveraging its early expertise in lithium-ion battery technology, BYD supplied batteries to tech giants like Motorola and Nokia before venturing into the automotive industry. This head start facilitated the development of innovative battery technologies such as the Blade battery, enhancing performance and safety.

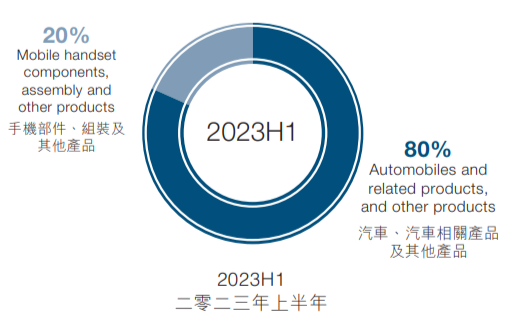

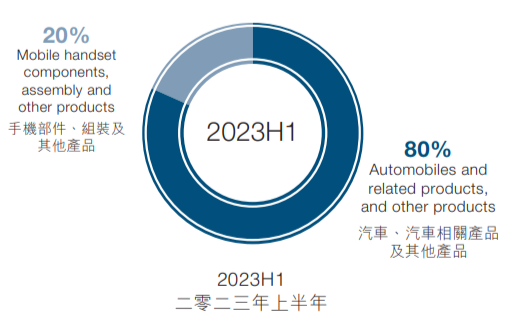

Segment share (Interim Report)

- Focus on E-Buses and Taxis: By targeting high-demand sectors like e-buses and taxis, BYD established a solid customer base and gained invaluable experience before expanding into the broader passenger vehicle market.

- Government Support: Benefiting from substantial tax exemptions and government incentives totalling $30 billion from 2009 to 2022, with an additional $100 billion in the pipeline for 2023-2027, BYD received crucial support to fuel its growth trajectory.

- Affordability and Value: Offering a range of EVs at various price points, starting from $10,000 to $15,000, BYD positioned itself as a more affordable alternative to Tesla, without compromising on quality. The company’s commitment to delivering better value at the same price point resonated with consumers worldwide.

- History of Innovation: Founded by Wang Chuanfu in the mid-1990s, BYD initially focused on rechargeable batteries before expanding into car manufacturing in the 2000s. This legacy of innovation and adaptability enabled BYD to thrive in the competitive automotive industry.

BYD’s Global Impact: Despite being dubbed “the biggest car brand you’ve never heard of,” BYD’s impact reverberates globally:

- In 2021, BYD emerged as the fastest-growing EV maker worldwide, capturing market share with six of the top-selling EV models in China.

- Beyond automobiles, BYD offers home energy storage solutions and builds monorails, exemplifying its commitment to sustainable transportation and infrastructure development.

- Operating in over 50 countries and exporting to markets like Australia, Brazil, and Israel, BYD’s influence extends far beyond its native China.

Conclusion

With Warren Buffet’s prescient investment and relentless focus on vertical integration, innovation, and affordability, BYD has cemented its status as a formidable contender in the global automotive industry. As the EV revolution accelerates, all eyes are on BYD to continue leading the charge towards a greener, more sustainable future.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.