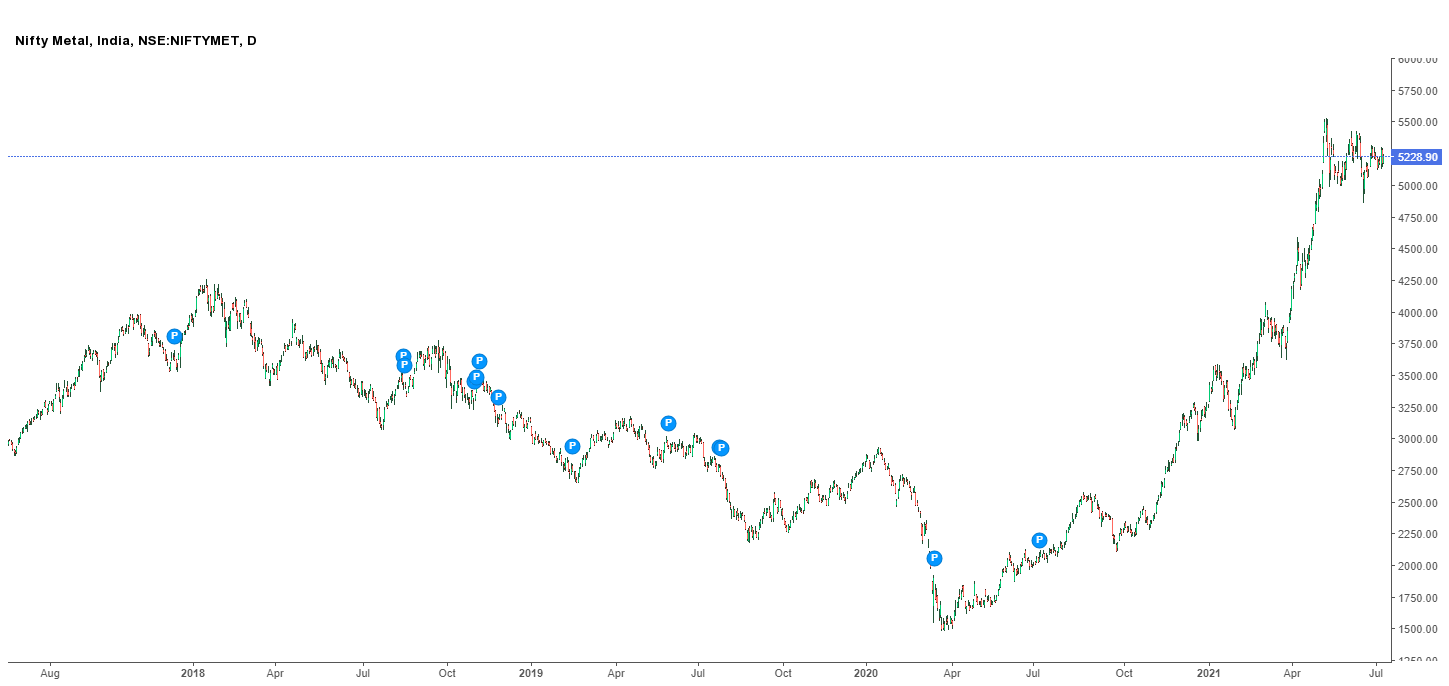

The steel sector is one old economic sector that has seen a lot of economic peaks and troughs. No wonder this cyclical sector is keenly followed by the investor fraternity. As stated earlier, the division has witnessed many cycles of expansion and contraction over the centuries. Also, if one manages to understand the series of steel- the wealth creation would be significant. If we take a look at the movement of the Nifty Metal Index – it is visible that the last year has been remarkable for the overall sector. Not only the domestic companies but the global scenario has also improved over the past year. As expected, a witnessed improvement on the operational front (backed by positive situations on the international as well as domestic front) a significant improvement has been visible on the financial front as well. As everyone knows, the steel Sector had been witnessing a lull for a long time, and as a result, a few of the companies had to face liquidation as well. Naturally, a few of those were taken over by the larger companies. Things have changed for the better, and even the companies that faced liquidation and eventual takeover have also posted strong operational and financial performance. No Wonder the investors were quick to reckon the same, and the Nifty Metal Index clearly shows how this sectoral Index has consistently moved northwards. It is now termed as one of the best supercycles for the Indian Steel sector. Backed by such a strong supercycle, few companies managed to turn profitable in FY21 compared to losses in FY20. We take a detailed look at the companies that managed a turnaround in FY21. However, before that, let’s take a look at how the Indian steel industry is poised now.

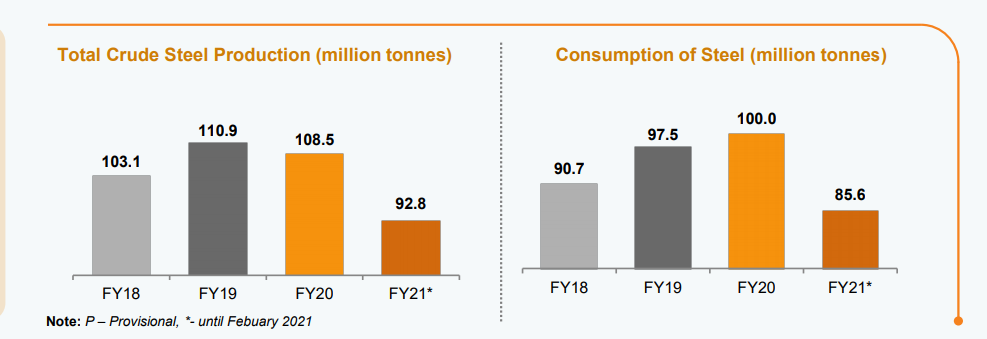

India has a total manufacturing capacity of 144 million tonnes, stands to be the second-largest player globally. It is next only to China that has a capacity of 996.30 million tonnes. If we took a look at the Indian steel manufacturing and demand growth, the scenario was complicated over the past few years owing to slower Capex growth, slower infrastructure growth, and lastly, lull on the global steel demand front. As a result, a lot of Indian manufacturers were reeling under debt pressure. While a few were taken over by large players – a few faced liquidation, and then were taken over by other bidders. The following chart clearly shows that slowly the production and consumption has increased consistently. However, the realizations were lower, and hence the margins, as well as profitability, remained under pressure.

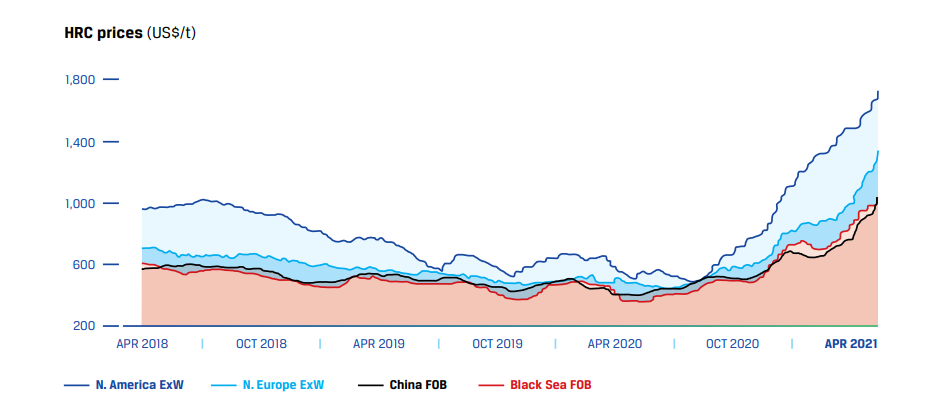

As regards the prices, the following chart clearly shows how the prices remained under pressure and only started to improve in the second half of CY2020. Along with improvement on the global price front, the government of India also provided sops in terms of import duties (supporting the sustenance of domestic prices).

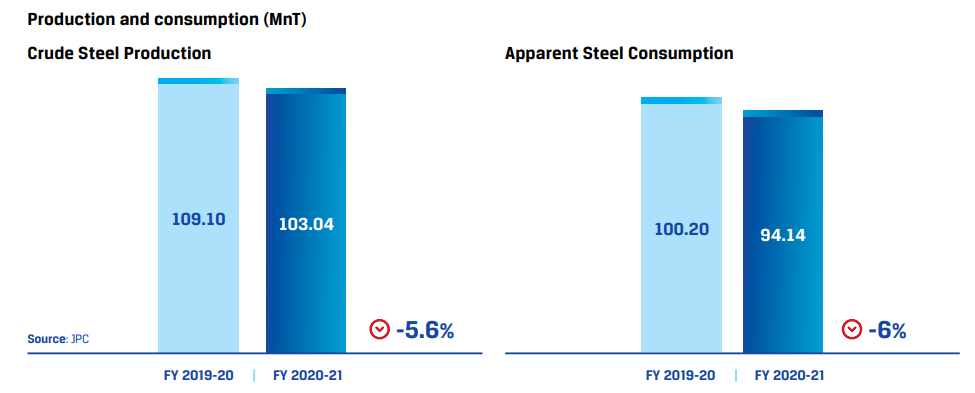

Such positive factors helped the companies post good volumes and even solid financial performance as well. As regards India production and consumption, the following chart shows consumption has declined marginally in FY21. However, it was on the back of Covid related restrictions. But the price improvement has resulted in better financial performance for FY21.

Such positive factors helped the companies post good volumes and even solid financial performance as well. As regards India production and consumption, the following chart shows consumption has declined marginally in FY21. However, it was on the back of Covid related restrictions. But the price improvement has resulted in better financial performance for FY21.

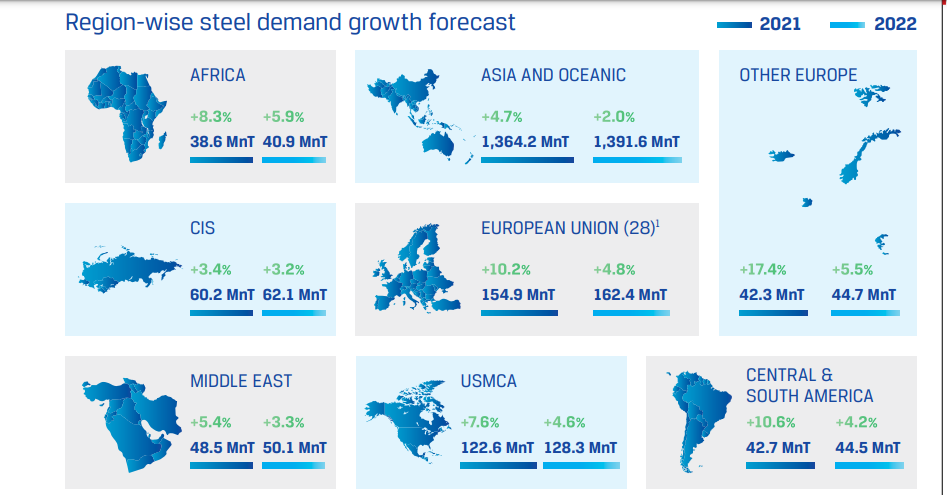

If we took a look at the overall performance of the steel sector, various factors are likely to help the division grow further. Starting from China leading the recovery and the US witnessing stimulus lead recovery. Rather than the following infographic indicates how the demand drivers are supposed to be going ahead. Following regional demand growth forecast clearly shows demand (domestic as well as global) is likely to sustain going ahead also.

We all know Steel is a cyclical industry, the leading manufacturers believe that this time it would be a supercycle. There are various factors behind such claims from the manufacturers. In simple words, in the past century, the world has witnessed supercycles, post key events such as rapid industrialization in the USA, rearmament before World War, re-building economies post the world war, and sharpest upcycle powered by China industrialization, among others, lasting anywhere between 5-15 years. Supercycles coincide with large-scale urbanization and industrialization, and massive infrastructure spends.

Currently, the global environment is characterized by supply inelasticity, demand Surge, improved market sentiment, and large-scale public expenditure on commodity-intensive infrastructure. And we believe that Steel as a commodity is a natural beneficiary. One of the leading manufacturers in India says the global energy transition towards renewables provides a tremendous opportunity for the steel sector, with demand expected to rise 7x to around 100 million tonnes from the renewable division only (Kindly refer to Page Number 29 of JSW Steel Annual Report FY21). With India focusing on infrastructure, rapid urbanization, and renewables – the Indian steel sector is also set for substantial growth ahead.

While we have listed down the various factors indicating the supercycle of steel, we are also providing a list of companies that posted substantial operational performance in FY21 and managed to turn around in FY21.

We have followed a rigorous method by focusing on parameters such as Net sales, PBDIT, and Net Profit. While sales figures are important as they reflect how the demand for products or services is moving, PBDIT figures guide us on how the company is performing, at the operational level and its efficiency. As for net profit, it clearly shows how much remains for shareholders. As stated earlier, we have ranked the companies on three parameters viz – Net Sales, PBDIT, and Net Profit. However, the general criteria remain that there was a loss in FY20 at the PAT level and profit in FY21 at the PAT level. The following tables show the ranking and performance of the different steel manufacturing companies.

Use EBITDA/Tonne as a measure; only utilize companies holding a market cap of 1000 cr, cannot show Vedanta as steel is not a significant segment.

The first few on the list are JSW Ispat Special Products, Tata Steel Long Products, and Tata Steel BSL. The common factor for these three companies is – they were taken over after their poor financial performance. New management has shown results, and investors were quick to reckon the same. While we have provided the chart of Tata Steel BSL, the other two charts are not included due to the shorter history on the bourses. However, the returns have been good on the bourses for the other two as well.

Other large companies that have managed to post a turnaround are Jindal Steel and Power (JSPL). In the case of JSPL, the lower raw material prices and the better realization helped the company post strong performance. Despite posting Rs 1259.89 crore unusual loss, the PAT for FY21 stood at Rs 3633.56 crore as against a loss of Rs 109.17 crore in FY20. Margins’ improvement on the back of operating leverage was another noticeable factor.

If we look at the current scenario, one may feel left out from the wealth creation that followed in the steel Stocks over the past year. However, as we mentioned previously Indian steel sector is expected to witness a supercycle, and hence the leaders are expected to post strong financial performance in FY22 as well. The larger players hold the key, and therefore one should do well to keep the exposure to the larger players. In mid-sized steel companies – it is better to opt for selective scrip.

Published on: Aug 31, 2021, 1:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates