The trade data that came in for the month of August continued the trend of monthly trade deficit staying above the $11 billion mark. For the first five months of the fiscal, the trade deficit has come in at $63 billion and India looks set to cross $150 billion of trade deficit for the full year. That should surely give the government some real thinking to do.

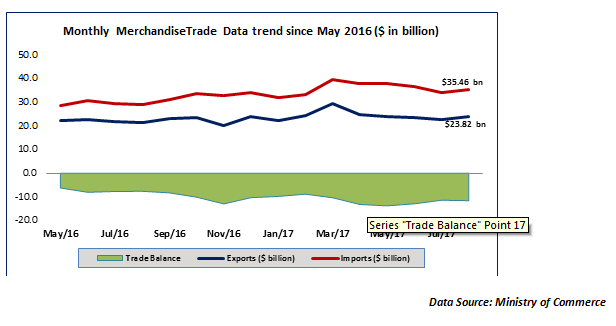

As the chart above indicates, the trade deficit has continued to widen over the last 1 year. During the current fiscal year, India has already touched a total fiscal deficit level of $63 billion in just the first five months of the year. While Imports are continuing to grow at a rapid rate, exports are really struggling to keep pace, and that is largely to do with a strong rupee which is favouring the growth of imports over the growth in exports.

Exports for the month of August 2017 came in at $23.82 billion. Theoretically, this represents a 10.3% growth over last year but that is not too relevant as the previous year had seen one of the low points in global trade and hence the base effect has played its role. During the month of August, exports of petroleum products and chemicals grew by over 30% while engineering goods grew by 19%. The real worry is that the exports of pharmaceuticals have been flat with just 4% growth and the pressure of FDA investigations is clearly showing. Even textile exports which was one of the focus areas for the export push, has grown at just about 0.56%. Weak growth in exports is largely a function of a strong rupee which has traded at an overvalued REER for too long. We have reiterated this point time and again and even eminent economists like Dr. Shankar Acharya have dwelt on the need to focus more on weakening the rupee to prop up exports.

Imports for the month of August stayed elevated at the level of $35.46 billion. For the month of August, the imports of crude were up by 14.22%, which is understandable considering the stronger crude prices globally. Electrical goods imports were up by 27% and machinery imports were also up by around 19%. But the big worry is that gold imports for the month of August were up by 69%. Part of this can be attributed to the fact that last year was a weak year for gold imports due to tepid demand and a jeweller’s strike. All the same, the Indian economy can ill-afford such a massive growth in gold imports. Remember, that gold imports are an unproductive import and, unlike machinery or electrical goods, they do not add to domestic productivity. That is why a rise in gold imports is worrisome. The RBI and the government may have to seriously look at either reducing the level of gold imports, attaching export obligations or give special incentives for soaking up domestic gold supply. This is an area that commands immediate attention.

The trade deficit concern…

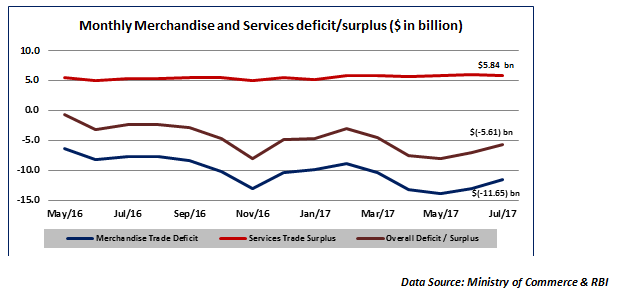

The trade deficit for the month of August 2017 has come in at $11.64 billion. This is almost on par with the previous months but it needs to be remembered that in the current fiscal year the trade deficit has already crossed the $63 billion mark. If this run is maintained, then India may close the full year with a trade deficit in excess of $150 billion. That will represent a sharp growth of 50% over the full year trade deficit that we saw in the previous fiscal. But that is not the real worry! The real worry is that the services export sector has actually stagnated and that is not able to compensate for the rising merchandise trade deficit. That essentially means that the current account deficit is widening. Let us understand the impact of this overall deficit from the perspective of India’s macros.

As the chart above shows, the services trade surplus has been constant at around $5.8 billion each month. Services exports are largely accounted for by software exports and that sector has been in trouble due to a compression in global IT spending. The problem is that the trade deficit has widened consistently with the result that over the last 1 year the overall deficit has widened from almost Zero levels to closer to the $6 billion per month level.

Why is the overall deficit so important? It reflects the current account deficit that the government needs to bridge through FPI flows / FDI flows. Additionally, the current account deficit ratio (CAD/GDP) has been steadily deteriorating. At the current rate, we may end the year with an overall deficit of around $65 billion. That will be nearly 2.5% of the GDP. That means; the CAD would have deteriorated from 0.4% of GDP in August 2016 to 2.5% of GDP by August 2017. We have seen previously in 2013 how the rising CAD as a percentage of GDP led to a run on rupee assets. That must be something the Ministry of Commerce and the RBI must be really cautious about!

Published on: Sep 21, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates