The monetary policy announced by the RBI on 07th June may have maintained status quo on rates, but there are certain distinct advantages that are implicit for the rate sensitives. When we are referring to rate sensitives here, we are restricting ourselves to banks, NBFCs and housing companies. While auto companies are also theoretically rate sensitives, we are excluding that as there are too many other variables that are critical in determining auto demand. For the banking and the housing sectors there were some distinctly positive cues from the monetary policies. Let us understand them a little better…

Inflation trajectory has been lowered…

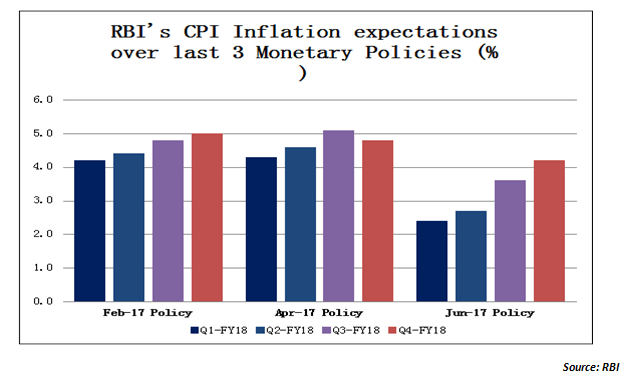

The RBI’s inflation expectations for the fiscal year 2017-18 have been sharply lowered in this monetary policy. For example, the inflation expectation for the first half of the fiscal has been lowered from 4.5% previously to a new range of 2.0-3.5%. Similarly, the inflation expectations for the second half of the fiscal have been lowered from 5% previously to a range of 3.5-4.5% in the latest monetary policy announcement. The chart below captures how the inflation expectations have been toned down by the RBI over the last 3 monetary policies…

As the chart above indicates, the inflation expectations for the four quarters of 2017-18 have been consistently coming down over the last 3 credit policies. The near term expectations have fallen much sharper compared to the farther period expectations. That is more because the RBI is still expecting that the impact of remonetization and higher demand-pull from OROP and 7CPC will exert upward pressure on CPI inflation.

The crux of the matter is that while the RBI has not changed its stance back to accommodative, the inflation expectations over the four quarters clearly point towards weakening inflation during the year. Unless the inflation data shows a sharp spike, which looks unlikely in the light of the IMD’s monsoon estimates, the RBI should be on track for cutting rates by 25-50 basis points during the current fiscal year. That will be a major positive for the banking and the housing sector. From the perspective of banks, the excess liquidity will ensure that these rate cuts will be seamlessly passed on to the end-customer. This will also provide a boost to the government goal of housing-for-all.

There has been a 50 bps cut in the SLR…

The statutory liquidity ratio (SLR) is the safety net that the banks maintain with the RBI to take care of any eventuality in liquidity. The SLR had been at 21.5% last year and as per the RBI internal policy was reduced by 25 bps each quarter to 20.5% by March 2017. In the June policy, the RBI has further cut the SLR by 50 basis points to 20%. What exactly will be the impact of this SLR cut on the banks?

SLR basically reduces the liquidity available with the bank and therefore restricts their lending capacity. Therefore, theoretically, a reduction in SLR should spur growth in lending. However, it may be slightly more complicated than that. Most banks are already holding on to SLR securities to the tune of 27-28%, which is about 7% above the current minimum statutory requirement. That is more because there is no credit off-take from industry and hence banks prefer the safety and stability of government bonds. However, if bond yields were to fall further and industrial credit demand picks up, then this 50 bps cut in SLR will actually begin to have its impact on credit growth of banks. While the immediate impact may be negligible, it is a very important signal sent out by the RBI that it wants banks to focus more on credit growth.

The policy has given a boost to the housing sector too…

With the government giving a big thrust to housing-for-all and for low cost housing, the RBI has also done its bit in the policy. To begin with, the RBI has reduced the amount of capital that banks need to set aside for housing loans given. This is being done by reducing the risk-weights for the purpose of capital adequacy. For loans in the category of Rs.30 lakh to Rs.75 lakh, the risk weight has been standardized at 35% from a range of 35-50% earlier. Similarly, for home loans above Rs.75 lakhs, the risk weight has been reduced from 75% to 50%. This move should encourage banks to be more aggressive in lending for housing.

Additionally, the standard asset provisioning rate for all categories of home loans has been reduced from 0.40% to 0.25%. This should reduce the cost of home finance and spur banks to lend more for housing. The Loan to Value (LTV) ratios has been slightly tweaked to make it more favourable for the borrower.

In a nutshell, the RBI monetary policy has taken some key steps which could be quite important from the growth and profitability of banks and housing companies. How all this gets translated into stock market returns remains to be seen!

Published on: Jun 20, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates