With the Indian equity Benchmark Indices trading at historical high levels the secondary market place has been really buzzing. The way benchmark indices have defied all gravity over the past 15 months even the primary market space has also witnessed significant traction. Just to put the numbers in perspective there were 47 initial public offerings (IPOs) in 2020 and 64 offerings were made in 2021 (year till date).

With the kind of listing most of the IPOs had got, almost everyone on the street was running behind IPOs. To put the numbers in perspective, since the start of 2020 there are 15 IPOs that are still showing more than 100 percent gains. With happiest Minds showing more than 750 percent gains over the issue price. Now one thing we should understand is Happiest Minds opened with gains of 123 percent and then eventually moved northwards to create further wealth for the investors. We opine this should be considered as broader wealth creation. Most of the time what happens is only a few get subscriptions and then only a few of those manage to book profit at listing gains. To put it in simple words – though the returns generated by IPOs may indicate significant gains, not all retail participants are able to generate returns from the same. One scenario is also seen where few participants try to enter the trade on the listing day. Eventually getting stuck at higher levels.

It is true that in the past one year there were hardly such examples of failures, of late a few of the IPOs have failed to generate returns the way it was seen over the past one year. It is not that all the IPOs have failed. The likes of Zomato, Tatva Chintan and even GR Infra got great listings. However a Few failed to even garner listing gains and in some cases though marginal gains were witnessed, eventually the prices declined.

| Company

Name |

Issue Price

(Rs) |

Amount Raised

(Rs Crore) |

Open Price | Discount | CMP | Discount |

| Car Trade Tech | 1618 | 2998 | 1600 | -1.1 | 1500 | -7.3 |

| Nuvoco Vistas Corporation | 570 | 5000 | 471 | -17.4 | 530 | -7.0 |

| Windlass Biotech | 460 | 401.54 | 367 | -20.2 | 439 | -4.6 |

| Krsnna Diagnostic | 954 | 1213.33 | 1025 | 7.4 | 925 | -3.0 |

| Glenmark LifeSciences | 720 | 1513.6 | 751 | 4.3 | 710 | -1.4 |

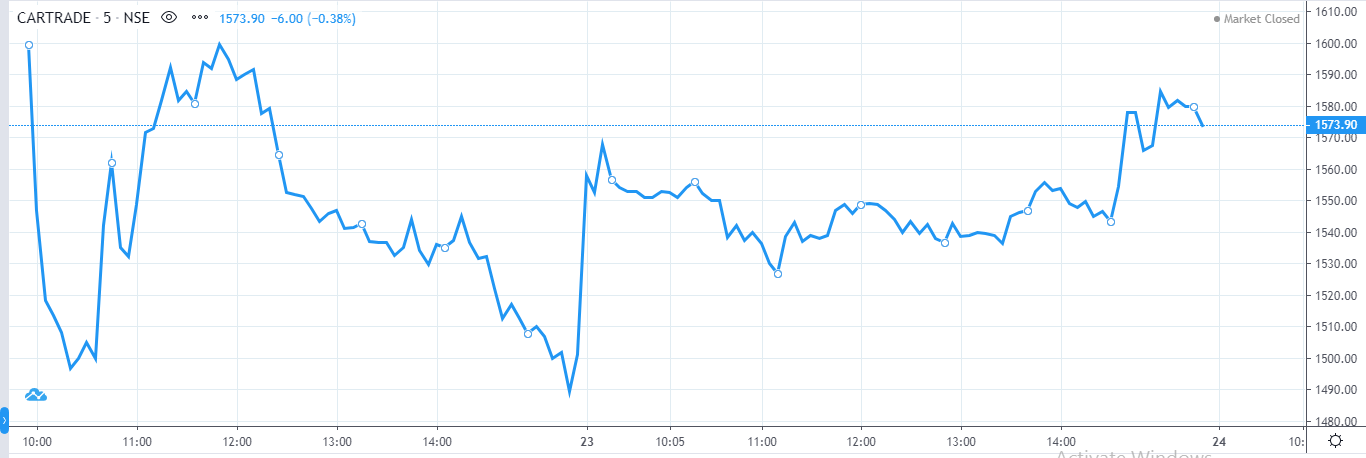

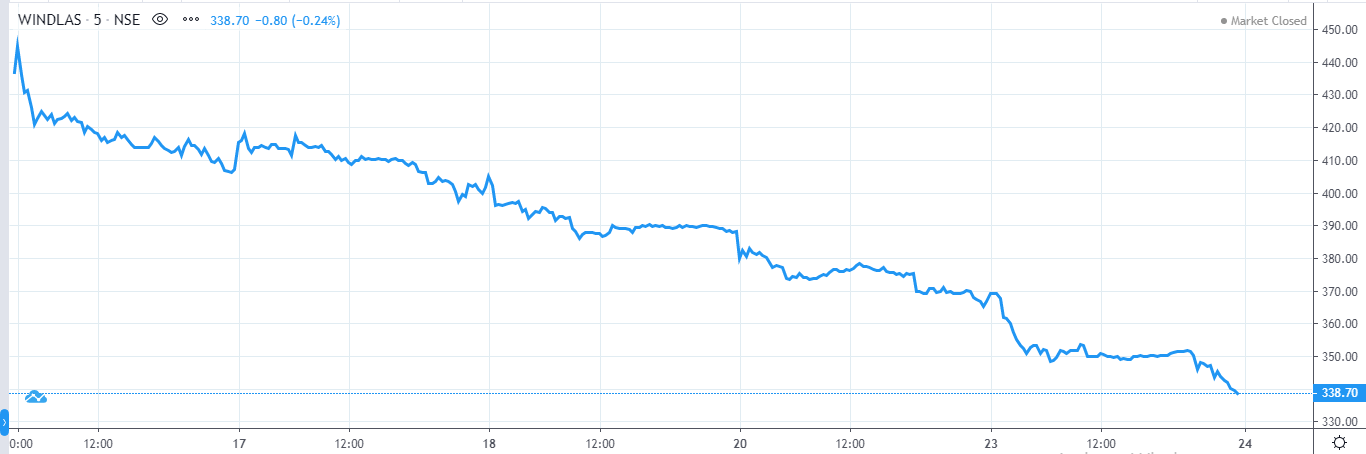

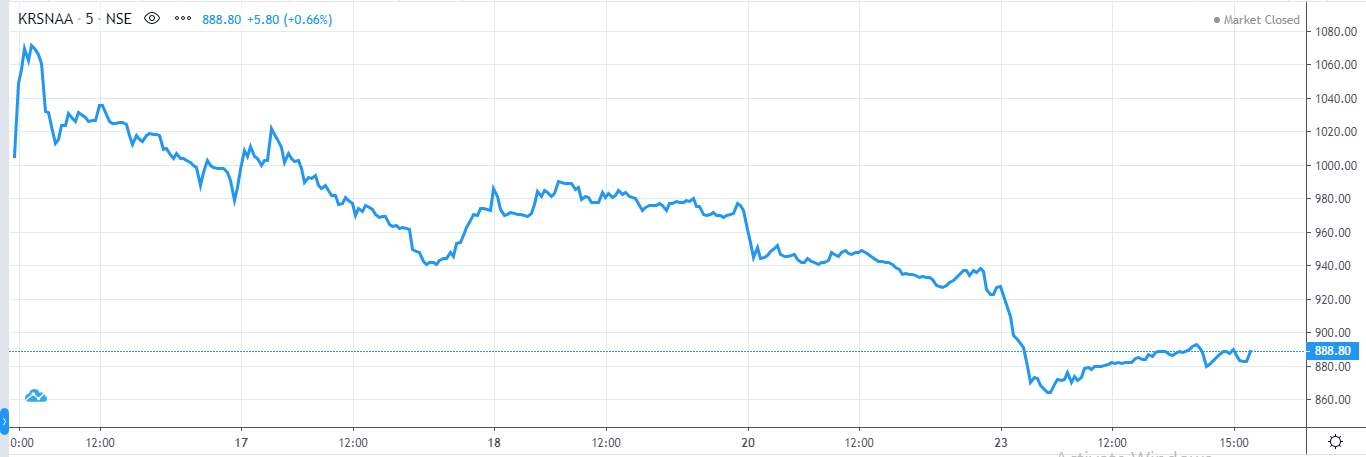

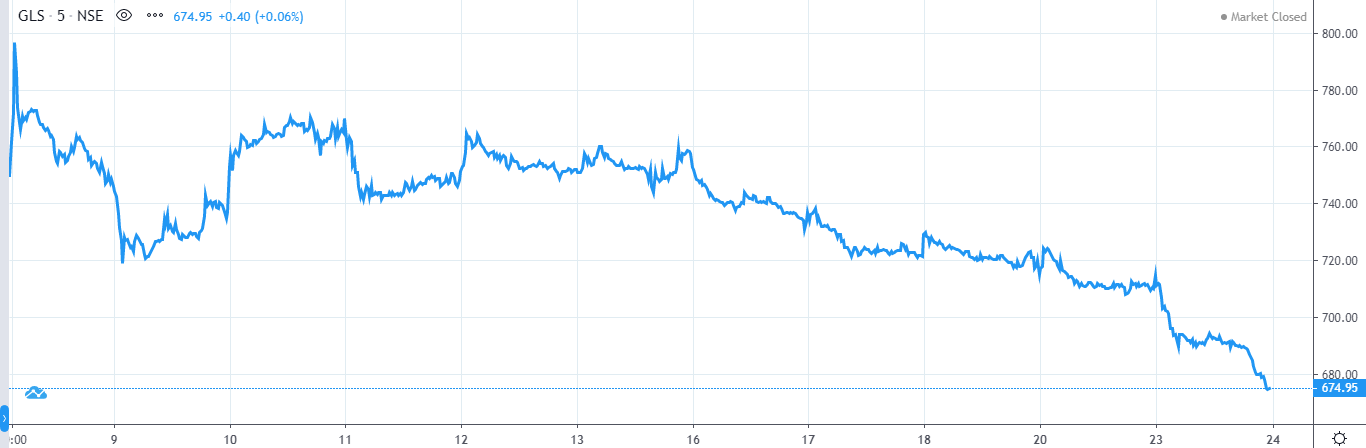

Now here we can see that at present CarTrade Tech is trading at a discount of more than 7 percent and even Nuvoco Vistas got listed at a discount. Overall there are five stocks still trading below the respective issue price. This was despite the fact that there was a very high over subscription seen.

| Oversubscription (x) | ||||

| Company | QIB | NII | RII | Total |

| Glenmark LifeSciences | 36.97 | 122.54 | 14.63 | 44.17 |

| Windlass Biotech | 24.4 | 15.73 | 24.22 | 22.44 |

| CarTrade Tech | 35.45 | 41 | 2.75 | 20.29 |

| Nuvoco Vistas Corporation | 4.23 | 0.66 | 0.73 | 1.71 |

| Krsnna Diagnostic | 49.83 | 116.3 | 41.95 | 0.98 |

Apart from this list there are a few instances where the scrip witnessed a good listing gain however eventually declined. This has resulted in few of the investors getting stuck at higher levels. So what should be the strategy of those who are stuck at higher prices?

There are reasons why everyone tries to get into the scrip even after the scrip got listed at a significant premium. And this has got to do a lot with recency bias. With the recently listed IPOs witnessing s good up-move everyone wants to own that stock at any cost. Completely forgetting that valuations are not fairer in the stock.

As we always say IPOs come with great efforts of marketing from the investment bankers and hence it requires similar kind of scrutiny and efforts to negate those special marketing efforts. To put it in the exact words of Benjamin Graham “There are two reasons for caveat. The first is that the new issues have special salesmanship behind them, which calls therefore for a special degree of sales resistance. The second is that most new issues are sold under favourable conditions, – which means favourable for the seller and consequently less favourable for the buyer”.

All in all, we opine that a few of those who got lucky to get allotment at the issue price may get benefitted from the listing gains. However the broader wealth creation has happened in only a few of the IPOs. Now there are few stocks where the listing has been below issue price or the stock is eventually trading below the issue price. Let’s take a look at the stocks and eventually try to get an answer about what to do with the stock at current levels?

As regards the business of the company, it is a multi-channel auto platform provider company. The company operates various brands such as CarWale, CarTrade, Shriram Automall, BikeWale, CarTradeExchange, Adroit Auto, and AutoBiz. The platform connects new and used automobile customers, vehicle dealers, vehicle OEMs, and other businesses to buy and sell different types of vehicles. The company offers a variety of solutions across automotive transactions for buying, selling, marketing, financing, and other activities. While the company has been profitable, there was one major negative with the offer. Promoters exiting the complete stake through offer for sale. If the promoters are exiting the business, it makes a negative impact. As expected the stock is trading at a discount to the issue price and we believe exiting the scrip seems to be a prudent decision.

Despite having multi-channel services offering, the stock seems to be fully valued or we can say overvalued. There are other better opportunities available and hence exiting the scrip (even at loss) seems to be the right strategy.

Windlas Biotech is one of the leading companies in the pharmaceutical formulations contract development and manufacturing organizations (CDMO) segment in India. The business operates in 3 verticals; 1. CDMO Products and services, 2. Domestic trade generics and Over-the-counter (OTC) market (nutraceutical and health supplement products), and 3. Export. Again the overall positive sentiment in the pharmaceutical sector the over subscription was as high as 22.44 x. However the stock failed to make any impact on the listing day and is now down by 25 percent as compared to the issue price of Rs 460. Is it a good buying opportunity at such a steep discount? The answer is clear NO! Better to stay focused on already listed space and larger pharma companies and not on smaller ones like Windlas Biotech.

Krsnna Diagnostic has been one of the leading diagnostic chains in India. With a so-called unique model of asset light business strategy and tie up with the government hospitals it has witnessed significant growth over the past few years. From a loss making unit in FY20 to a profitable one in FY21, the company seems to have made good of the opportunities during the Covid-19 pandemic. However, we believe the space has been getting crowded and with the exit of promoters of one of the larger players like Thyrocare (as Pharmeasy acquired a stake in Thyrocare), it seems not much growth would be left in the segment. Further the entry of private equity players who are ready to burn cash, the margins are likely to remain under pressure. We feel better to exit the scrip and look for other growth opportunities available.

Glenmark Life Sciences is the leading manufacturer of Active Pharmaceutical Ingredients (APIs). With Glenmark Pharmaceuticals being already listed and promoters being known, there was good traction visible for the IPO. With overall Subscription at 44.17x (Non Institutional Investors at 122.54x), the scrip was expected to make its impact on the listing day. However the scrip is now trading at 5 percent discount to the issue price. We believe good management bandwidth and business model would result in recovery over the next few quarters. Only those who are ready to keep the investment for at least 4-6 quarters, can stay invested in the scrip. Those looking for short term gains should exit the scrip and look for other momentum based opportunities

If we take a look at the other recent listings like Chemplast Sanmar and Aptus Value Housing Finance, here also the listing has been on the weak side. Rather there were questions raised about Chemplast Sanmar (which had got delisted years back at much lower price) on the delisting it had opted years ago. Here the issue got oversubscribed only 2x (against the huge oversubscriptions visible in other stocks). Though the specialty chemicals story is still being considered as a major growth investing opportunity, we feel there are other better placed companies available in the segment.

If we take a look at the other recent listings like Chemplast Sanmar and Aptus Value Housing Finance, here also the listing has been on the weak side. Rather there were questions raised about Chemplast Sanmar (which had got delisted years back at much lower price) on the delisting it had opted years ago. Here the issue got oversubscribed only 2x (against the huge oversubscriptions visible in other stocks). Though the specialty chemicals story is still being considered as a major growth investing opportunity, we feel there are other better placed companies available in the segment.

Similarly in the case of Nuvoco Vista Corp, it is part of Nirma Group and is among one of the largest cement companies and concrete manufacturers in India. We would suggest having some patience in the scrip and over the period of 4-6 quarters the scrip may provide decent returns owing to the vibrancy visible in the infrastructure space.

While we have spoken about the non-performers, there are few of the companies that got great listings. Like Zomato, GR Infraprojects, Clean Science and Technology and Krishna Institute of Medical Sciences. However as we Stated earlier, many have got Stuck at the higher prices as they entered the stock on listing day. In the above list, we feel Zomato and GR Infraprojects are fully valued and hence if you are making profit, the prudent strategy would be to book the same.

It is true that the IPOs have provided good returns over the period of the past 18 months. However it would be wrong to expect that all the IPOs would be having something kept for the table for retail investors. Remember no company is good or bad. It is the valuation that makes it look good or bad. Before investing in IPOs it is important to understand the valuations and business model. If both are providing comfort then only commit capital to the same.

Published on: Aug 31, 2021, 1:01 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates