Samco Special Opportunities Fund is an open-ended thematic equity scheme launched by Samco Mutual Fund on May 17, 2024. It aims to achieve long-term capital appreciation by investing in companies undergoing special situations like restructurings, turnarounds, mergers & acquisitions, and emerging sectors. The fund seeks to exploit potential mispricings and undervalued opportunities arising from these events. There is no entry load, but an exit load of 2% applies if you redeem or switch out of the fund within one year of investment. The minimum investment amount is Rs 5,000. The offer closes on May 31, 2024.

The investment objective of the Samco Special Opportunities Fund is to achieve long-term capital appreciation by investing in a portfolio of securities that are involved in special situations such as restructurings, turnarounds, spin-offs, mergers & acquisitions, new trends, new & emerging sectors, digitization, premiumization, and other special corporate actions. These situations often create mispricing and undervalued opportunities that the fund aims to exploit for potential capital appreciation.

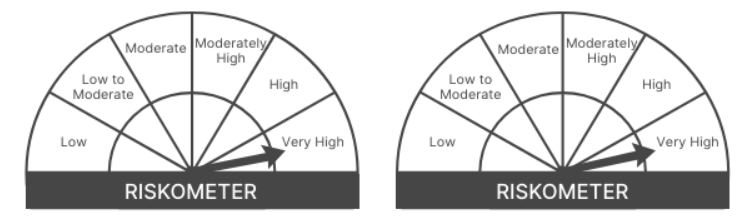

This NFO of Samco Special Opportunities Fund is suitable for investors who are seeking long term capital appreciation with actively managed thematic equity scheme that invests in stocks based on special situations theme.

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity & Equity related instruments of special Situations theme | Very High | 80 | 100 |

| Equity and Equity related securities of other Companies | Low to

Moderate |

0 | 20 |

| Debt Securities and Money Market Instruments | Moderately High | 0 | 20 |

The performance of the Samco Special Opportunities Fund is benchmarked against the NIFTY 500 TRI.

Mr. Paras Matalia

Paras Matalia, 29, serves as the Fund Manager and Head of Research – Equity at Samco Mutual Fund. With a B.Com and a C.A. qualification, he brings nearly 6 years of experience in capital markets to the table. In his pivotal role at Samco Mutual Fund, Matalia has been instrumental in analyzing investments and constructing the fund portfolio, leveraging his expertise to drive the equity research efforts of the firm.

Mr. Umeshkumar Mehta

Umeshkumar Mehta, 49, holds the positions of Fund Manager and Chief Investment Officer at Samco Mutual Fund. His extensive educational background includes a B. Com, C.A., and PGDBA. With over 20 years of experience in the financial services industry, Mehta possesses a profound understanding of price and value dynamics. He is also a prominent speaker and writer, frequently contributing to chartered account forums and business schools, where he shares his deep insights into financial markets.

Mr. Dhawal Ghanshyam Dhanani

Dhawal Ghanshyam Dhanani, 28, is the Dedicated Fund Manager for overseas investments at Samco Mutual Fund. He holds a B. Com and a C.A. degree. Dhanani began his career as an equity research analyst at Samco Securities Ltd. and has accumulated over 5 years of work experience, with more than 3 years dedicated to capital markets and investment research. He is recognized for his in-depth analysis of business models and the computational intricacies of various Indian companies, contributing significantly to the firm’s investment strategies.

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as on – 14-05-2024 in % | ||||

| 2024 | 2023 | 2022 | 2021 | 2020 | ||||

| Tata Housing Opportunities Fund | 02-09-2022 | 565.65 | 2.35 | 3.81 | 39.16 | – | – | – |

| ICICI Prudential Housing Opportunities Fund | 18-04-2022 | 2561.04 | 2.01 | 6.39 | 30.61 | – | – | – |

| HDFC Housing Opportunities | 06-12-2017 | 1430.61 | 2.19 | 9.25 | 39.17 | 13.13 | 29.95 | 2.95 |

| Taurus Ethical Fund Reg | 06-04-2009 | 172.95 | 2.45 | 9.36 | 28.4 | -2.32 | 28.88 | 28.14 |

| Baroda BNP Paribas Business Cycle Fund | 05-09-2021 | 519.66 | 2.45 | 9.38 | 30.98 | 1.44 | – | – |

| Union Innovation & Opportunities Fund | 06-09-2023 | 642.64 | 2.32 | 9.42 | – | – | – | – |

| ICICI Prudential India Opportunities | 05-01-2019 | 19072.35 | 1.65 | 10.03 | 36.19 | 19.53 | 49.29 | 7.3 |

| Franklin India Opportunities | 05-02-2000 | 3459.54 | 1.91 | 17.57 | 53.56 | -1.86 | 29.65 | 27.34 |

| Equity: Thematic-Others | – | – | – | 10.06 | 31.11 | 2.04 | 40.19 | 22.16 |

Data as of May 14, 2024

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: May 17, 2024, 11:36 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates