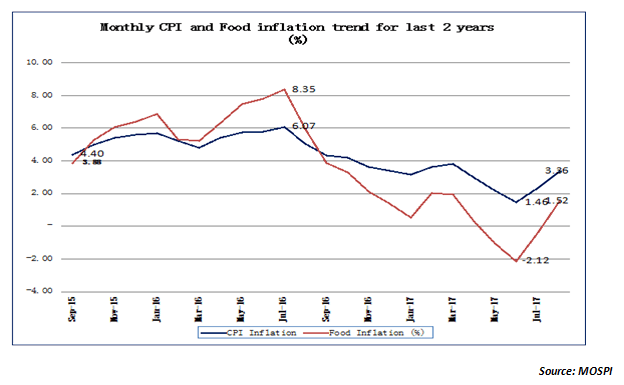

Retail CPI inflation for the month of August 2017 came in sharply higher at 3.36%. This is 100 bps higher than the inflation level in July and 190 bps higher than the level in June this year. This was a concern that the RBI had repeatedly expressed through the Monetary Policy Committee (MPC). In fact, the MPC had warned about upside risks to inflation in the June meet, which is beginning to manifest itself now. At 3.36%, the CPI inflation is getting rapidly close to the RBI comfort zone of 4%. The key question is what drove this inflation higher and what does it guide for the future trajectory of inflation and interest rates in India?

During the last 2 months, the CPI inflation overall has rallied from 1.46% to 3.36% and this has been largely driven by food inflation spiking from (-2.12%) to 1.52%. C ore inflation (which excludes food, transport and fuel) has moved up from 3.96% to 4.05% and therefore the bulk of the CPI inflation impact appears to come from food inflation alone. The impact on core inflation came largely from the impact of GST. The core inflation consists of items of daily usage including soaps, toothpastes and consumer items which have seen a higher impact of GST. The picture becomes a lot clearer when we break up the overall CPI inflation and chart its increase. Out of the 190 bps increase in CPI inflation between June and August, nearly 151 bps was accounted for by increase in food prices. While an 18 bps impact came from higher petrol and diesel prices, an impact of 9 bps came from housing related inflation. The balance 12 bps of inflation increase was accounted for by the impact of GST in the month of August.

As the chart above depicts, the spike in food inflation has been much sharper from lower levels. The trend of negative inflation continues in pulses with negative inflation to the tune of nearly -24%. The big shift has been driven by the quantum shift in vegetables from around -15% to a positive +6%. This shift has been visible in markets across India in the last few weeks as a combination of delayed rains in some parts and untimely flooding other parts created acute shortages. Additionally, weak cold storage infrastructure has worsened the problem as wastage has also increased substantially. The pressure on vegetables prices is likely to continue in September too. Cereals and sugar also contributed to higher inflation. Sugar has been seeing a global shortage and that has kept prices buoyant. Next month will also see the impact of import controls on select food commodities as well as the impact of higher MSP offered by the government to farmers. Food inflation promises to be elevated with a positive bias.

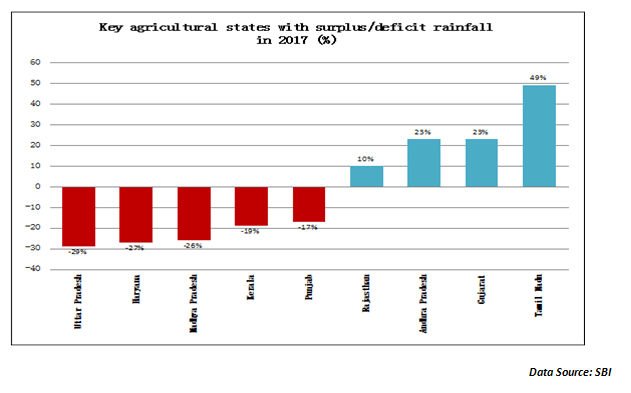

While the overall rainfall in India may have been around the normal range of 96 to 102% of the long period average (LPA), the big concern is the distribution of rainfall. Check out the chart below which captures the key rainfall deficit and rainfall surplus states…

The reason this chart is slightly worrying is that the deficit states in the above chart actually represent nearly 32% of the total sowing in the current year. There is one more subtle difference. Most of the deficit states are predominantly producers of food crops like wheat, rice, barley, gram, mustard etc. On the other hand, the rainfall surplus states are essentially producers of non-food crops and include the likes of oilseeds, spices, cotton and groundnut. That means that food shortage could become acute in the coming months and food inflation component could be headed higher.

In the August monetary policy, the RBI had reduced the repo rates by 25 basis points, although it had stayed away from shifting its monetary stance back from neutral to accommodative. The MPC was wary of the upside risks to inflation, and rightly so. There are a few important takeaways from the inflation point of view. Firstly, the deficit rainfall in the food crop states could actually apply pressure on food prices and create food shortages. That means inflation could actually go beyond the 4% mark in the next few months and that risk looks a lot more real now. Secondly, fuel inflation could get a leg up with Brent crude touching $54/bbl and Saudi Arabia planning further cuts in production to compensate for the falling in refining demand in the aftermath of Hurricane IRMA. Most likely, the RBI will refrain from any rate cuts in the October policy till there is clarity on the inflation front as well as the overall impact of GST. A lot will depend now on the language of the MPC in its forthcoming October meeting.

Published on: Sep 14, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates