The MOSPI announced the fourth quarter GDP along with the GDP for the full fiscal year 2016-17. The actual GDP numbers did come in lower than street expectations, which is probably indicative of the fact that the lag effect of demonetization and the consequent liquidity crunch is still continuing. While the quarterly GDP number for the fourth quarter does look a tad disappointing, the full year GDP is almost on par with expectations. Also, the remonetization effect is apparently taking a little longer than originally anticipated.

Of late, there has been a growing shift in macro measurement from the usage of Gross Domestic Product (GDP) to Gross Value Added (GVA). The advantage with using the GVA is that is strips the impact of indirect taxes and subsidies and hence gives a better picture of the actual grown in output.

So what exactly are the numbers speaking?

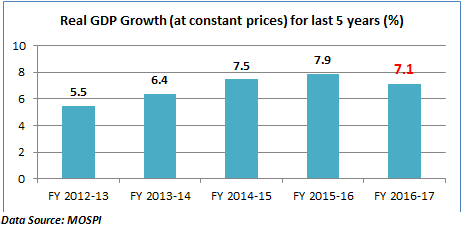

The Real GDP (GDP measured at constant prices) has shown a clear deceleration in the fiscal year 2016-17. The pressure in the fourth quarter Jan-Mar clearly came from the after effects of demonetization, which specifically impacted sectors like construction and financial sector which have strong externalities for the Indian economy.

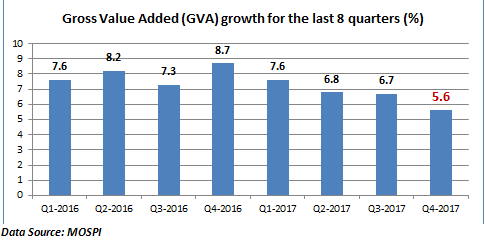

The above chart clearly indicates that the GVA is showing a consistent downtrend since the last 5 quarters. This also indicates that a greater thrust is coming from the government in the form of public services, defence and administrative welfare services, which is also borne out by the data. In fact, public services have been the biggest contributors to the overall GDP in the last 1 year.

Which sectors propped up the GVA for the fourth quarter?

The good news came from the agricultural front. Agricultural growth for the fourth quarter bounced back sharply to 5.2% compared to just 1.5% in the fourth quarter of last year. Even for the full year, the agricultural growth at 4.9% has come in as a blessing in an otherwise disappointing quarter. The higher agricultural output was driven by a strong Kharif output which grew by 9% on a YOY basis due to strong monsoons in 2016. Also the government efforts to pin down on the supply chain inefficiencies and undertake structural measures have helped the agricultural sector. The second major sector that actually helped the GVA in the positive territory was services where the government has taken the lead. Thus services like defence, administrative services, welfare services and other public services have seen a growth in excess of 11%. In a nutshell, the government initiative has played a key role in holding up the GVA in the fourth quarter. The actual number could have been much worse had it not been for the significant contribution made by the public services sector followed by the agricultural sector. A good monsoon and higher rural incomes imply that agriculture will continue to contribute in a big way in the coming year also.

Which sectors applied pressure on the GVA in the fourth quarter?

While manufacturing continues to show positive growth, the pace and momentum has surely slowed down. The growth in Manufacturing GVA was just 5.3% in the fourth quarter of 2017 compared to 12.7% in the previous year. This is contingent on 2 aspects. Firstly, the combination of unused capacity and weak credit lending has resulted in a fall in manufacturing growth. This is largely a demand issue and the good thing is that when demand picks up output can be increased without too much of an effort. Mining also slowed to 6.4% from 10.5% in the previous year.

Two sectors applied pressure on the GVA due to the negative impact of demonetization. The finance sector grew at just 2.2% in the fourth quarter compared to 9% in the corresponding period last year. Similarly, construction saw (-3.7%) de-growth compared to 6% growth last year. While construction sector was hit by the squeeze on cash movement, the attack on black money also brought down the demand for real estate properties. The financial services are facing a double whammy. On the one hand, the PSU banks are facing a major growth crunch due to the mountain of NPAs in their books. On the other hand, the NBFCs and MFIs are facing the pressure of a cash crunch as they normally handle the last-mile credit activities, which are largely cash driven. Both these segments are expected to revive once the full impact of remonetization kicks in.

Now, let us look at the positive side of the whole story!

The GDP story for the fourth quarter has its own share of positive cues. Let us look at some of them.

Last, but not the least, Indian economy is seeing a combination of slightly weaker growth and tepid inflation. This combination offers the perfect combination for the RBI to give up on its slightly hawkish policy with respect to rates and actually consider a rate cut in the coming policies. With the US Fed playing the game cautiously, the RBI may have a strong reason to cut rates either in the June policy or the August policy. That could be the big positive takeaway for the markets!

Published on: Jun 2, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates