The Monetary Policy announced by the RBI on 07th June maintained status quo on repo rates. This was largely along expected lines. It was already factored into most estimates that any rate cut decision would predicate on a variety of other factors like the trajectory of CPI inflation, growth traction post-remonetization, health of the banking system and the global scenario. The following were the key highlights of the monetary policy announcement…

Background to the Monetary Policy…

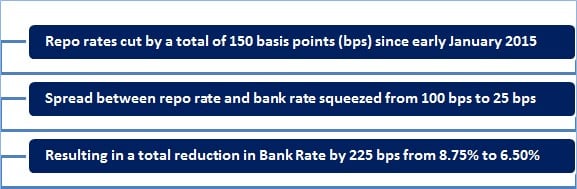

Since the beginning of January 2015 when the RBI embarked on a rate cutting program, the repo rates have been cut by 150 basis points. However the actual reduction in bank rates has been much higher. Let us understand the point through this chart…

As the chart above clearly indicates, even though the repo rates have been cut by just 150 basis points since January 2015, the RBI has also narrowed the spread between repo rates and the Bank rate from 100 bps to 25 basis points. This has effectively led to a reduction of 225 bps in the bank rate. With the banks cutting their MCLR by up to 90 basis points due to the surge in liquidity in the system post-demonetization, the transmission of the bank rate cut of 225 bps has almost been 100%. Hence the core issue that the RBI has been grappling with is lack of demand for loans rather than about inadequate rate cuts or absence of transmission. This is the background in which the monetary policy was announced and it is this background that has directed the debate on the outlook for future rates.

Inflation has certainly retreated, but for how much longer?

The RBI in its policy acknowledged that the inflation has come down sharply since the last monsoon and at 2.99% in April 2017 CPI inflation is surely within the comfort zone. But the RBI has also raised some red flags here. Firstly, the weak inflation may also be a function of weak demand and spending in the light of demonetization. Hence remonetization has the potential to reverse that trend and push inflation higher. Secondly, RBI feels that the low price of food articles is more due to a glut within India. As the government is poised to announce more attractive MSP for farmers and an open trade policy to encourage exports of food-grains, the food prices situation could change quite rapidly. Thirdly, the RBI has also expressed concern that the rising rural wages post the good monsoon and the payouts via OROP and 7CPC will be instrumental in leading to more buoyant demand from rural and urban areas. This could also create a demand pull on inflation. Finally, the RBI would also be keen to assess the impact of GST on inflation. In fact, GST is known to have spurred inflation in other nations and the RBI would have more data points on all these areas in the next 1 quarter.

Weak growth may be more of a lag effect of demonetization…

The RBI has also taken a note of the weak growth in Gross Value Added (GVA), which had fallen to a low of 5.6% in the fourth quarter of 2017-18. However, the RBI also believes that the first quarter may not have felt the full impact of remonetization and the next two quarters may be more indicative on this front. The RBI also projected that the sharply lower lending rates after demonetization will induce greater spending and consumption by rural and urban households leading to a pick-up in demand-led growth in the GDP. The recent Index of Industrial Production (IIP) numbers, apart from changing the base year, has also changed the constitution to make it more current meaningful. The RBI believes that this could also have a positive impact on growth. As we depicted in the chart earlier, the RBI has done its bit by cutting bank rates by as much as 225 basis points. Hence there was no immediate justification for the RBI to cut rates further with the hope of spurring growth in output.

RBI has rightly pointed out that the timing may not be right for a rate cut…

The RBI has rightly pointed that the revival in growth may not be purely an outcome of rate cuts. For rate cuts to translate into a pick-up in credit growth and in output there are some basic pre-conditions that need to be satisfied. There must be a revival in private investment which is not visible today as the entire private sector is already operating at ~70% capacity utilization. There is also the need to for the banking sector to get to grips with its NPA problem and become robust enough to expand their asset books. That may be only possible once the banking reforms are implemented in right earnest. The RBI is of the view that till the time these issues are not addressed, rate cuts may not serve the purpose.

Finally, there was a voice of dissent within the Monetary Policy Committee (MPC)…

After four consecutive monetary policies presenting 100% consensus, there was a note of dissent coming in from Dr. Ravindra Dholakia. In the previous MPC Dr. Dholakia had taken a more dovish approach to the aggressively hawkish approach adopted by Dr. Michael Patra. Of course, greater details will be known only when the actual minutes of the MPC are made public on 21st June. Certainly, this policy has set the tone for the RBI to consider becoming more accommodative in future policies. For that, we will have to await the next monetary policy in on August 02nd.

Published on: Jun 8, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates