In a landmark decision, the Bank of Japan (BOJ) recently announced the end of its eight-year-long experiment with negative interest rates, marking a significant shift in its monetary policy. This move, which is Japan’s first interest rate hike in 17 years, signifies the country’s departure from its prolonged focus on reflating growth through massive monetary stimulus.

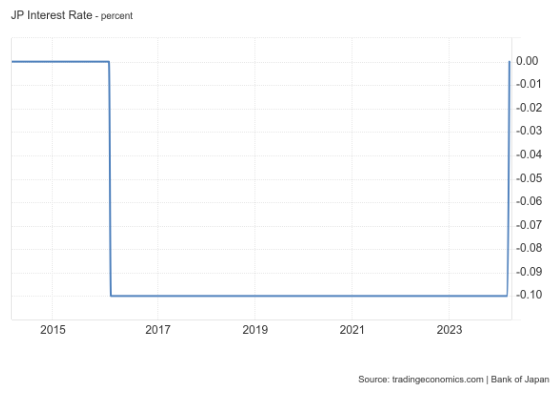

Since 2016, the BOJ had implemented a policy that imposed a 0.1% charge on some excess reserves held by financial institutions. However, the recent decision has seen the BOJ shift its policy rate to the overnight call rate, maintaining it in a range of 0-0.1%. Despite this change, the BOJ remains cautious, considering Japan’s fragile economic recovery, and is expected to proceed slowly with any further increases in borrowing costs.

Japan’s decision to exit negative rates marks the conclusion of an era where central banks worldwide employed unconventional monetary tools to stimulate growth. The BOJ’s move also signifies the abandonment of its yield curve control (YCC) policy, which had been in place since 2016 to cap long-term interest rates around zero.

While this decision is of significant symbolic importance, its immediate impact on the economy is expected to be minimal. The BOJ is likely to maintain loose monetary conditions to support growth, preventing a substantial rise in funding costs or household mortgage rates.

With inflation exceeding the BOJ’s 2% target for an extended period, many market players anticipated an end to negative interest rates. However, the focus now shifts to Governor Kazuo Ueda’s statements for insights into the pace of future rate hikes.

The stakes are high for Japan, as a spike in bond yields could increase the cost of servicing its massive public debt, the largest among advanced economies. Moreover, the BOJ’s decision could impact global financial markets, as Japanese investors may repatriate funds back to their home country, affecting overseas investments.

The BOJ’s decision to end negative interest rates and YCC marks a significant shift in Japan’s monetary policy. While the immediate impact may be limited, the long-term implications for Japan’s economy and global markets remain to be seen.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Mar 19, 2024, 2:22 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates