Over the last few weeks there have been some key data points that have raised concerns over the pace of rate cuts adopted by the RBI. It may be recollected that back in February 2017, the Monetary Policy Committee (MPC) had shifted its monetary stance from “Accommodative” to “Neutral”. Over the last few quarters there have also been some real concerns about falling GDP growth rate. For example, the GDP growth rate for the first quarter ended June 2017 has come in at a low of 5.7%, which is a full 100 basis points lower than the Chinese rate of growth. While this fall in growth can be partially attributed to the demonetization, there is obviously more to it than meets the eye.

The question therefore is whether the RBI has a fit case for cutting rates when the next monetary policy comes up in October this year? There are 3 key factors to consider before the RBI can take a view on rates going ahead…

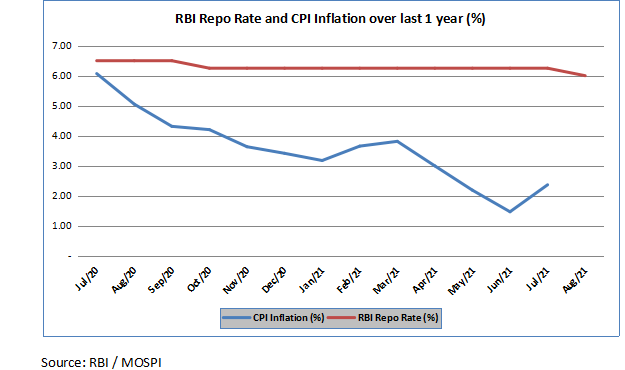

As the chart above indicates, the CPI inflation has fallen sharply post June 2016 after a combination of a good monsoon and a record Kharif output started pushing food inflation down. The non-core inflation also stayed subdued due to weak oil prices despite the OPEC trying to influence prices through supply cuts. This has a created a huge dichotomy in the system wherein the inflation has fallen by nearly 400 bps but the repo rates (the RBI signal for interest rates) has come down by just 50 basis points during the same period. Even if you consider that there was another 50 basis

reduction in the bank rate due to a compression of the spread between bank rate and the repo, it is still very inadequate compared to the fall in inflation.

Till the middle of 2016, the biggest complaint of the RBI was that the transmission was not taking place as banks were passing on just 40-45% of the repo rate cuts to the end consumer. However, that situation has changed drastically after the demonetization exercise. The demonetization resulted in nearly Rs.7 trillion worth of additional deposits coming into the system. Since banks had to pay interest on these deposits but credit growth was not picking up, the banks were in a spread dilemma. The only answer was to cut rates and most banks cut their MCLR by up to 100 basis points in the aftermath of demonetization. This ensured that almost 100% of the rate cuts since January 2015 had been effectively passed on to the end customer. The bottom –line is that there is a strong case for the RBI to cut repo rates aggressively from these levels.

The sharp fall in GDP growth for the first quarter to 5.7% and GVA at 5.6% show an impact that is much larger than just demonetization. Had it been an impact of demonetization then we should have seen a bounce post January as that was when the remonetization effort had started off. However, that has not been the case. Growth has been apparently constrained by 2 key factors. Firstly, the high levels of real interest rates are making commercial borrowing unviable. Look at the yield on the 10-year bond, which is at 6.5%. The inflation is currently hovering at an average of 2%. That means even the most blue chip rated borrower, the government of India, is borrowing at a real interest rate of 4.5%. That kind of a real interest rate is just too high to be sustainable. Industry is obviously borrowing at a much higher real interest rate and at that rate, it is obviously not viable.

There is another downside risk here. High rates are attracting hot money flows into debt and FIIs have pumped in nearly $52 billion in the last 1 year into Indian debt. That is keeping the rupee too strong and impacting exports negatively. A sharp cut in interest rates will actually hit two birds with one stone!

One of the factors that has constrained the RBI from cutting rates was that the Fed may adopt a hawkish position and that could narrow the spread between India and the US and lead to risk off buying. However, that may not be a serious worry for the RBI. The US GDP growth for the full year is likely to be nearly 100 bps lower than the global average growth according to the IMF. Inflation is way below the 2% mark and the latest labour data for August is indicating a fall in new jobs created and a rise in unemployment to 4.4%. While the actual approach of the Fed is still not known, the bias will be more towards postponing rate hikes at least till the middle of 2018. That gives sufficient room for the RBI to cut repo rates, especially considering the cushion of high real interest rates in India…

What the RBI needs to do is to consider a rate cut of 50 bps instead of the token 25 bps. That is what Dr. Ravindra Dholakia (MPC member) has suggested. That can have a 3-pronged impact. It will bring down real interest rates sharply, encourage industry to borrow and also make exports more attractive by weakening the INR. The ball is in the RBI’s court and like it did in January 2015, it need not wait for the Policy Date to communicate its rate action!

Published on: Sep 7, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates