Undoubtedly, the two consecutive sessions of the Modi government have proven to be beneficial for the country in terms of growth, with various new initiatives propelling the nation to new heights. While we won’t cover the specific changes made by the government during these sessions, we will explore the overall performance of the primary market where companies list themselves to raise funds for their expansions.

The craze for IPOs among investors was undeniable. Investors not only subscribed to IPOs heavily but also made significant wealth by holding these shares in their portfolios until now.

During both sessions of the Modi Government, a total of 1264 companies came up with their IPOs to raise funds and get listed in the market. Additionally, the total amount raised by these IPOs during the same period was Rs 5.37 lakh crore.

From these IPOs, not only did public investors benefit, but also the government’s portfolio value of the listed PSU IPOs registered a significant growth of around 34%. Let’s delve deeper into it.

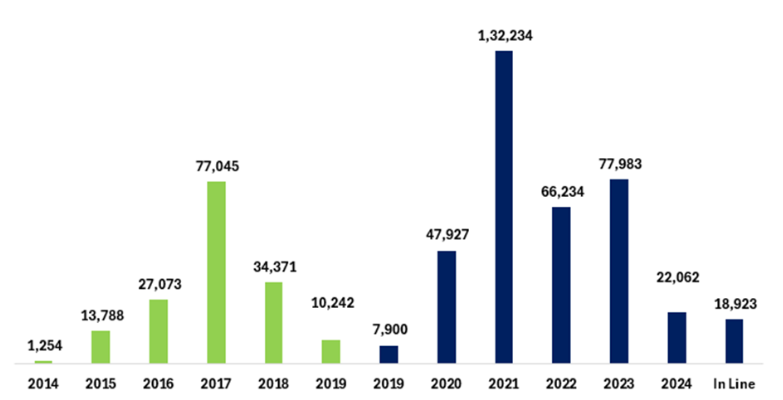

The above chart illustrates the total amount raised through IPOs every year since the beginning of the Modi Government’s tenure to lead the country. The green bars represent the first session of the Modi Government, while the blue bars depict the second session.

A total of Rs 1.64 lakh crore was raised in the first session of the current government, while this amount grew by around 2.27 times or 128% in the second session, reaching a total of Rs 3.73 lakh crore raised by companies through IPOs.

In the first session, the highest amount raised was in the year 2017, totaling around Rs 77,045 crore, while in the second session, the highest amount raised was Rs 1.32 lakh crore.

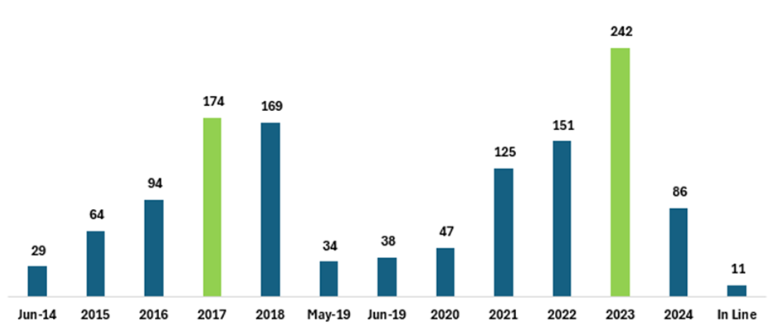

The above chart depicts the total number of IPOs listed in the Indian market each year during the overall tenure of the Modi Government. In the first session, the highest count was registered in 2017, with 174 IPOs, which also coincides with the highest amount raised during the year, as discussed above. In the second session, the highest number of IPOs was raised in 2023, reaching 242, while the highest amount raised was in the year 2021, with just 125 IPOs during that year.

In this section, we are going to analyze the PSU companies that raised money through IPOs. We will compare the listing day gains to the final offer price, as well as assess the current performance based on yesterday’s closing price of these stocks.

Analyzing the data, it appears that PSU companies’ IPOs were not IPO-friendly. Despite grabbing attention from investors and witnessing significant subscription rates, a majority of the IPOs listed at a discount, disappointing investors who had applied with hopes of reaping listing gains. Among the 16 PSU IPOs, 10 or 62.5% IPOs listed at a discount, while 5 showed gains, and 1, RVNL, debuted flat at the offer price on the listing day.

Collectively, all the PSU companies raised a total of Rs 57,280 crore during the Modi Government’s sessions, with 16 companies being listed in the Indian markets. The highest amount raised was by LIC, totaling Rs 21,008 crore. Despite being the biggest and much-awaited IPO, the stock debuted in the market at a discount and still, as per yesterday’s closing price, has not yet delivered the desired returns based on its popularity.

The smallest IPO in terms of size was MSTC Limited, with only a Rs 212 crore IPO. Despite listing at a discount on the listing day, it has eventually delivered an impressive multibagger return of over 600% compared to the final offer price.

However, in terms of current performance, investors from three companies, namely General Insurance Corporation, New India Insurance, and Ircon International, are still experiencing negative returns despite being listed on or before September 2018. This means over 5 years have passed, and they are still delivering negative returns.

The only stock listed with over a 100% premium was IRCTC, which made handsome returns for its shareholders even after listing. Furthermore, RVNL, despite listing flat on the listing day, has generated exceptional wealth for its shareholders by delivering around a 1266% return during the same period. Additionally, Garden Reach Shipbuilders leads the list by delivering a remarkable multibagger return of around 1388% during the same period over its final offer price.

| COMPANY | IPO MONTH | ISSUE SIZE | OFFER PRICE (Rs) | LISTING PRICE (RS) | % GAI/LOSS ON LISTING | CMP AS ON 18 APR (Rs) | % GAIN/ LOSS AS ON 18 APR (Rs) |

| COCHIN SHIPYARD | Aug-17 | 1442.01 | 432 | 435 | 0.69 | 1,077.95 | 149.53 |

| GENERAL INSURANCE CORPORATION | Oct-17 | 11175.48 | 912 | 850 | -6.80 | 331.15 | -63.69 |

| NEW INDIA ASSURANCE COMPANY | Nov-17 | 9600 | 800 | 748.9 | -6.39 | 220.1 | -72.49 |

| BHARAT DYNAMICS | Mar-18 | 960.94 | 428 | 370 | -13.55 | 1,811.05 | 323.14 |

| HINDUSTAN AERONAUTICS | Mar-18 | 4144.06 | 1,215.00 | 1,169.00 | -3.79 | 3,677.85 | 203.28 |

| MISHRA DHATU NIGAM | Mar-18 | 438.38 | 90 | 87 | -3.33 | 412.5 | 358.33 |

| RITES | Jun-18 | 460.51 | 185 | 190 | 2.70 | 653.2 | 253.08 |

| IRCON INTERNATIONAL | Sep-18 | 470.49 | 475 | 412 | -13.26 | 220.95 | -53.48 |

| GARDEN REACH SHIPBUILDERS & ENGINEERS | Sep-18 | 344.69 | 118 | 104 | -11.86 | 864.7 | 632.80 |

| MSTC | Mar-19 | 212.04 | 120 | 115 | -4.17 | 861 | 617.50 |

| RVNL | Mar-19 | 481.57 | 19 | 19 | – | 259.65 | 1,266.58 |

| IRCTC | Sep-19 | 645.12 | 320 | 644 | 101.25 | 992.75 | 210.23 |

| MAZAGON DOCK SHIPBUILDERS | Sep-20 | 443.69 | 145 | 216.25 | 49.14 | 2,158.75 | 1,388.79 |

| IRFC | Jan-21 | 4633.38 | 26 | 25 | -3.85 | 141.9 | 445.77 |

| RAILTEL CORPORATION OF INDIA | Feb-21 | 819.24 | 94 | 104.6 | 11.28 | 364 | 287.23 |

| LIFE INSURANCE CORPORATION OF INDIA | May-22 | 21008.48 | 949 | 867.2 | -8.62 | 960.85 | 1.25 |

Conclusion

In conclusion, the analysis of IPOs during the Modi Government reveals a mixed bag of outcomes. While the primary market witnessed robust activity, with significant funds raised and notable gains for some stocks like IRCTC (on the listing day) and Garden Reach Shipbuilders, challenges persisted, particularly for PSU IPOs. Despite high investor interest, many PSU IPOs listed at discounts, leading to disappointment among investors on the listing day. However, eventually, the majority of the stocks delivered remarkable returns to those who kept trust in the company’s performance. Overall, the IPO landscape under the Modi Government reflects both opportunities and challenges and also hopes for the future, at its best.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 19, 2024, 6:22 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates