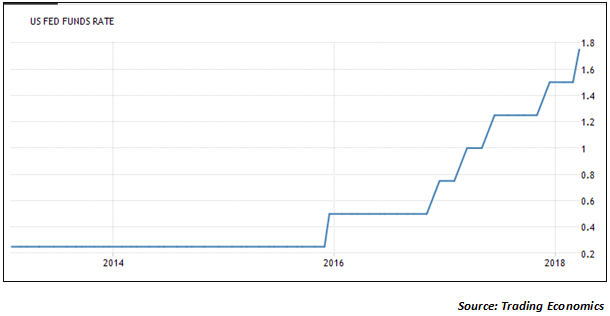

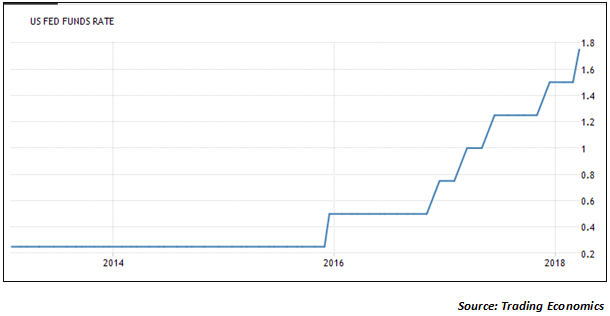

When the US Federal Reserve meeting concluded on Wednesday, there was little by way of surprise as the 25 basis points hike was already factored in. The debate was more over whether the Fed would guide for 3 rate hikes or 4 rate hikes during the calendar year 2018. With this hike, the Fed has hiked the Fed Funds rate by 150 basis points since the beginning of 2016. The chart below captures the trajectory of the Fed Funds rate.

Effectively, the Fed Funds rate has moved up from the range of 0.00-0.25% in the beginning of 2016 to the range of 1.50-1.75% after the latest rate hike. The policy was also significant as it was the first policy announced by Fed Chief Jerome Powell after taking over from Janet Yellen. So, what were the key justifications for the 25 basis points rate hike?

How the 25 basis points rate hike was justified?

The US Fed has given the following justifications for the hike in Fed rate by 25 basis points in its March Fed meet…

- The economic activity in the US has been rising at a moderate rate and the US is expected to get closer to 2.7% GDP growth in the midst of the world economy getting to 3.9% growth. That is likely to create a virtuous cycle of spending and liquidity and the rate hike would be just about sufficient to take care of that.

- The second important trigger for the Fed Funds rate was the labour data. The unemployment rate of 5% is normally treated as tantamount to full employment in the US. For quite some time the unemployment has been at around 4% and that has also been a key trigger for the Fed to keep hiking its rates. However, wages are yet to pick up in a big way.

- The third factor, and perhaps the most important factor, that impacted the decision was the inflation number. While the Fed had originally indicated at 2% inflation target for justifying rate hikes, the actual inflation has fallen short of that level due to weak food and oil prices in the recent past.

- Finally, the joker in the pack could be the inflation number. Growth and labour market conditions could still be relatively stable. Why is inflation relevant? There are 3 reasons for the same. Firstly, the tax cuts already proposed by Donald Trump are likely to add nearly $1.3 trillion to liquidity in the system which will be inflationary. Secondly, the $300 billion spending program that has already been announced could also have a virtuous effect on liquidity and spending. Finally, the latest decision by the Trump government to impose 25% duty on steel and 10% on aluminium could also lead to higher imported inflation. All these factors could combine to actually keep Fed Fund rates in an upward trajectory.

What are the Fed projections on key economic data?

The interesting statement of the Fed is that it has agreed to keep liquidity accommodative even while maintaining the upward trajectory of the Fed Fund rates. That means in terms of tapering of the liquidity in the form sale of bonds may not happen aggressively for now. On the economic projections front, the US Fed is projecting higher inflation higher levels of employment but lower levels of GDP growth. But the overall Fed funds trajectory is now likely to go beyond the original target fund rates. Let us look at the specifics of the Fed forecast.

- The GDP is projected at 2.7% for 2018 but it is likely to taper to 2% by 2020. The long run GDP is expected to taper off at 1.8% as per the Fed projections.

- The unemployment rate which is already below 4% is likely to go as low as 3.6% by 2020 although in the long run it is expected to stabilize at around 4.5%.

- The inflation rate is expected to hit a high of 2.1% from the 1.8% it is seeing currently and the import duties could do the trick for hiking inflation.

- We finally come to the long term Fed Funds rate. The Fed Fund rates are expected to touch a peak rate of 3.4% by 2020 before stabilizing in the long run at around 2.9%. While the long run projection is lower than the originally projected 3%, it is interesting that the rates could see a sharp spike by 2020. That certainly opens up the doors for possibly 4 rate hikes in 2018 as against the originally planned 3 rate hikes.

What are the implications for India?

If the Fed opts for 4 rate hikes instead of 3 rate hikes then it is likely to be negative for the Indian markets. It could also mean that the RBI may have to look at a possible hike in repo rates to ensure that the yield differential is maintained and India does not suffer debt portfolio outflows. It has been seen in the past that any rate hike by the US Fed has been negative in the short run but positive for India markets in the medium to long run and hence rates may not be the issue. That is because rate hikes by the US are a signal that the US economy is growing. The real issue for India to contend will be what happens to the trade war between the US, EU and China. If retaliation becomes the theme then we could see a spiralling of trade wars and currency wars. That could be much worse than Fed hikes. That is what Indian markets need to actually prepare for!