You have definitely come across the concept of Interest Rates in many areas of your financial transactions. Since interest rate refers to the cost of borrowing, you may get worried if the interest rate on your loan goes up or get excited if it drops down – Isn’t it? But have you wondered what factors actually impact the movement of interest rates? Let’s take a look at the most common of these influencers.

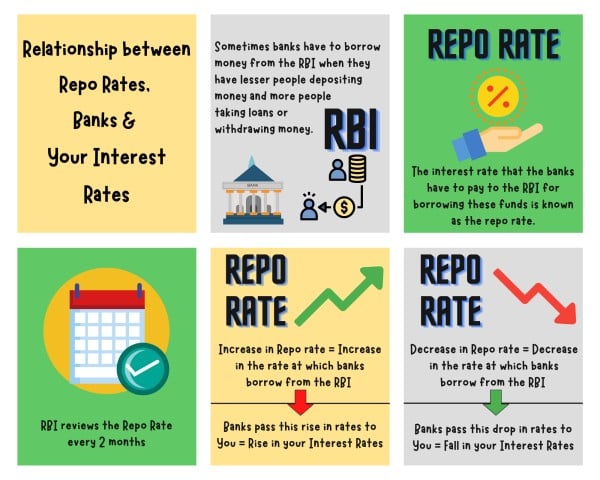

Let’s first understand the relationship between Repo Rate, Banks, and Your Interest Rates.

This brings us to the main point: Why does the RBI change the repo rate? What causes it to increase or decrease the repo rate?

Prevailing Economic Conditions are the primary influencer of interest rates and whether they are increased or decreased. However, some factors play an essential role in shaping the current economic conditions and, in turn, influencing the interest rates.

In a growing economy, higher disposable incomes mean increased affordability for goods and services. However, due to an increase in demand, the prices of goods and services increase → resulting in Inflation!

As a remedy, the RBI or central bank tries to nudge up the interest rates in the economy so that people will reduce spending and increase saving (since saving becomes more profitable as interest rates go up). As the proportion of the saving population increases, the inflation rate moderates.

The same happens in reverse in a recessional economy.

To fulfill their fund requirement, corporations mainly borrow from financial institutions or pick funds from the stock market via equity expansion channels such as – IPOs or FPOs. In case the markets are bullish, companies would prefer to go for equity expansion. However, companies would find it more beneficial to borrow funds from financial institutions during a poor market cycle.

The demand for borrowing, in turn, influences the prevailing interest rates.

The world today is a global community. Hence, the economic conditions of international markets also impact interest rates locally. In addition, foreign investors who lend to domestic companies or invest in the domestic market also contribute to the local market’s money supply and lending dynamics. Hence, any international occurrence in the home country of these foreign investors will also impact the lending pattern locally.

A fiscal deficit means the government has spent more money than it has collected from taxes and other revenues. A higher fiscal deficit impacts not just the government but all our financial lives. To manage the deficit, the government borrows from the market. However, when the government borrows more, it overshadows the borrowing population and, in turn, pushes up the interest rates for everyone.

Other than the factors mentioned above, Demand & Supply for money, Foreign exchange rates, RBI objectives, and global macroeconomic situations also impact your local interest rate. Interest Rates affect more than just our financial lives. Understanding what factors cause interest rates to change is essential since they impact your spending pattern, repayment ability, and living standards.

(This blog is exclusively for educational purposes)

Published on: Jun 21, 2022, 6:00 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates