The Reuters consensus estimate for GDP growth for the first quarter ended June 2017 was slightly lower at 6.6%. However, the GDP growth for first quarter announced on 31st August was nearly 100 basis points lower than the Reuters consensus. For the quarter ended June 2017, the MOSPI announced India’s annualised GDP growth at 5.7% with the Gross Value Added (GVA) growth at 5.6%. Before getting into the granular details of the GDP growth, it needs to be remembered that GDP growth was one of the key advantages that the Indian economy enjoyed over China. In fact, just a year back when China was growing its GDP at 6.5%, India was growing its GDP at 7.5% making India the natural magnet for foreign portfolio investments and FDI flows. So what really queered the pitch for GDP growth?

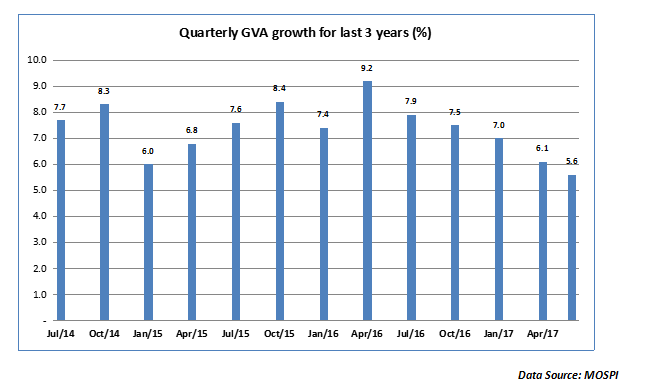

As the chart above indicates, the GVA has clearly shown a downtrend for the last five quarters after peaking out in the April 2016 quarter. While a slowdown in global trade and weak domestic demand were partially responsible for this downtrend in GVA growth, there were two factors that actually put pressure on the GDP numbers…

How demonetization and GST put pressure on GVA…

The long term benefits of the demonetization move and the GST implementation were never in doubt. The Indian economy will, most likely, reap the benefits of greater financial transparency and lesser frictions to trade over the next 3-5 years. But in the short term, the impact on the GDP is definitely visible. Let us consider demonetization first. Apart from focusing on digitization and transparency, demonetization also had the collateral impact of crunching the cash economy. In India sectors like jewellery, construction, financing and cement typically operate substantially on a cash basis. All these sectors got impacted by demonetization. Demonetization incapacitated the cash in the system; slowing spending and investments by the SME segment. As we shall see later, it was the SME sector that actually accounted for a sharp fall in the GVA. Even larger companies were asking their treasuries to go slow on spending plans and inventory accumulation, which also had its impact on the overall growth.

The implementation of Goods & Services Tax (GST) also had its impact on the overall GVA numbers. GVA is all about production of goods and services in the economy. Since GST was to be launched effective July 01st, most manufacturers had begun to cut down on their production from May onwards. The intent was to focus the months of May and June on offloading the inventory rather than on fresh production. There was also an element of uncertainty as rates of GST were not finalized by the GST Council till the very last week. This uncertainty resulted in companies going deliberately slow on output and that showed its impact on the GVA number.

What were the key sectoral drivers for the GVA numbers in Q1?

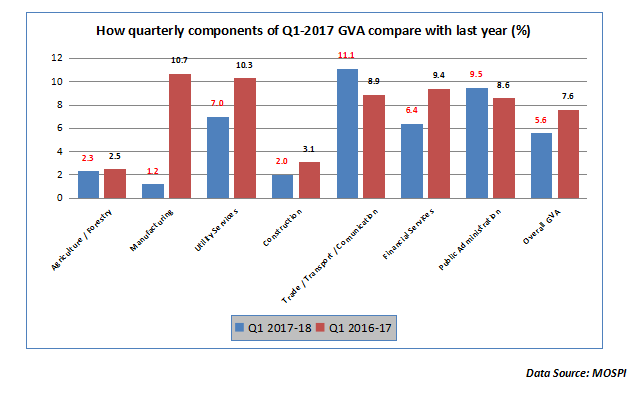

The comparative chart of the key components of GDP/GVA gives a clear picture where the pressure is coming from during the first quarter. The GVA for the first quarter is down by a full 200 bps in the last one year from 7.6% to 5.6%. The biggest fall has been in the area of manufacturing where the growth has fallen from 10.7% to 1.2%. In India, the private sector accounts for over 75% of the manufacturing output. If the PSUs are excluded, the private sector actually showed negative growth. The maximum pressure on manufacturing came from the SME sector which bore the brunt of the demonetization. Construction and financial services also got negatively impacted due to a mix of demonetization and the shift to GST. In fact, the positive cues for the quarter came from trade and communication which can be attributed to a global pick up in trade as well as the creation of a wider communication market by the launch of Reliance Jio. The other beneficiary has been public services where the government has the control on the purse strings. The question is whether this is a one-off trend or a signal of a broader slowdown?

Fortunately, this is likely to be more of a short-term phenomenon…

The good news is that this impact on GVA may be more of a temporary nature. The short term disruptions of demonetization and GST are already well known and documented. Unlike China or other commodity-driven BRICS countries, the challenge for India is not structural. On the contrary, demonetization and GST will help address many of the structural problems in the Indian economy. Additionally, there are some positive trends in the Indian economy. Consumer inflation has stabilized at a lower plane and that will keep growth going. Also, the banks are sitting on billions of fresh deposits post demonetization and that can be a fuel for credit growth in future. Over the next 2 quarters, we could also see a revival in capital formation combining with a pick-up in demand which will have a salutary impact on GDP growth. The GDP numbers, at least, leave us with the optimistic feeling that things should fall in place over the next couple of quarters.

Published on: Sep 1, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates