The People’s Bank of China (PBOC) is the central bank of the People’s Republic of China. It is responsible for monetary policy, banking regulation, and the issuance of currency where the PBOC is situated in Beijing.

LPR (Loan Prime Rate) serves as a benchmark interest rate, representing the most favourable borrowing terms extended by commercial banks to their top-tier customers. Other lending rates are derived from this benchmark by adjusting it upward or downward in increments of basis points.

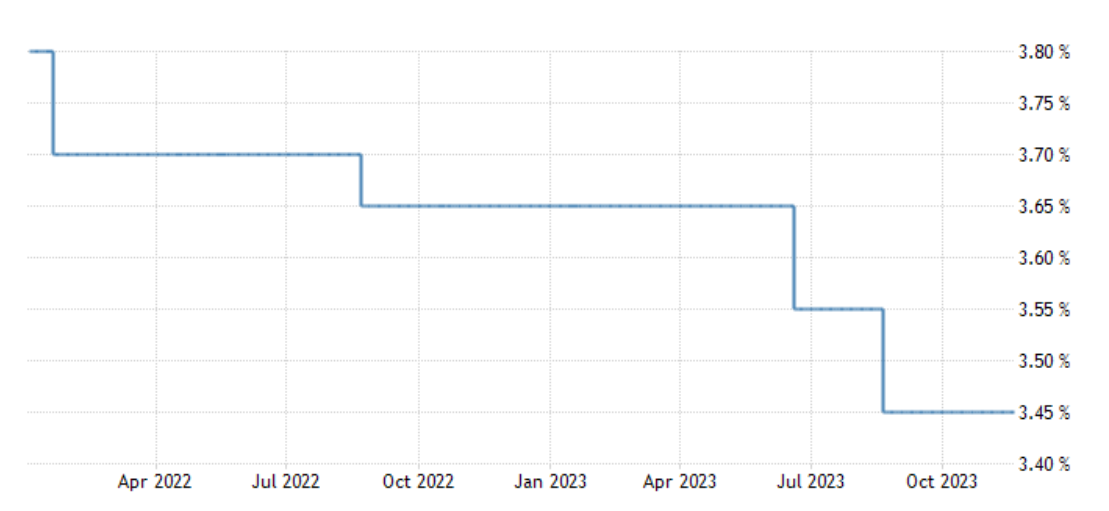

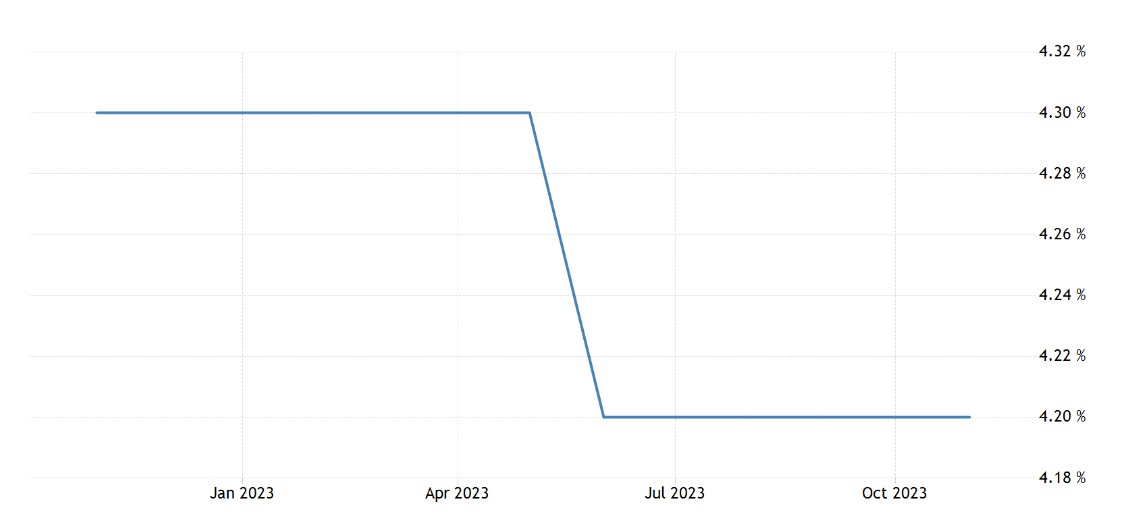

Currently, the one-year LPR stands at 3.45%, while the five-year LPR is set at 4.20%. Last week, the People’s Bank of China maintained the Medium-term Lending Facility (MLF) rate at 2.5%, providing 1450 billion yuan of liquidity injection into the financial system. It is expected that the PBOC may keep the rants unchanged as the MLF rate was kept unchanged.

The relationship between the MLF and the LPR is that the MLF rate is a key input into the calculation of the LPR. In general, the LPR is set slightly higher than the MLF rate to ensure that banks have a profit margin when lending to their customers.

Market expectations are virtually unanimous that the PBOC will leave both the one-year and five-year LPR unchanged today. This decision aligns with the central bank’s cautious approach to monetary policy amid ongoing global economic uncertainties.

The PBOC uses the LPR to guide interest rates in the Chinese economy. When the PBOC wants to stimulate the economy, it will lower the LPR. When the PBOC wants to cool the economy, it will raise the LPR.

The LPR is a very important interest rate in China. It is used to set the interest rates for many loans, including mortgages. When the LPR goes up, it means that it becomes more expensive to borrow money. This can have a ripple effect across the economy, making it more expensive for businesses to invest and for individuals to buy homes.

On the other hand, when the LPR goes down, it becomes cheaper to borrow money. This can encourage businesses to invest and individuals to buy homes, which can boost the economy. The PBOC changes the LPR based on its assessment of the economy. If the economy is growing too quickly, the PBOC may raise the LPR to cool things down. If the economy is growing too slowly, the PBOC may lower the LPR to stimulate growth.

The LPR is a key tool that the PBOC uses to manage the Chinese economy. It is an important indicator of the health of the Chinese economy.

Today on November 20th, 2023 the PBOC is about to set new LPR for one and five years which are currently standing at 3.45% and 4.20%. The below charts shows this history of one-year LPR changes and five-year LPR changes.

Source: TRADINGECONOMICS.com

Source: TRADINGECONOMICS.com

The process of determining the LPR involves a collaborative effort among 18 selected commercial banks in China. These banks, a blend of domestic and foreign institutions, submit their daily interest rates to the PBOC. To ensure fairness and reduce the potential for manipulation, the PBOC excludes the highest and lowest rates submitted. The remaining rates are then ranked, and the median rate emerges as the LPR.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 20, 2023, 12:48 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates