A global leader in infrastructure since 1981, this company manufactures Transmission & Distribution structures (towers & poles) and Pipes & Fittings. They stand out for their vertically integrated operations, encompassing structure rolling, manufacturing facilities, a dedicated tower load testing station, and even transmission line EPC services, ensuring total control and quality across the entire process. As a national leader in the Polymer Pipe industry, the company, operating under the brand ‘Skipper’, offers an extensive range of top-quality pipes and fittings for various sectors.

The company has a market capitalization of Rs 3,286 Cr and is currently trading at a price-to-earnings ratio of 45.8. Its return on capital employed is 11.9%, and its enterprise value to EBITDA is 13.2. The company has a debt-to-equity ratio of 0.91 and has seen a sales growth of 12.5% over the past three years.

Geographical Presence

With a national footprint and international tentacles reaching across Africa, Australia, the Middle East, South & South East Asia, South America, and Europe, the company operates on a global scale, exporting its products to diverse corners of the world.

Product Portfolio

This company operates in three key areas: Infrastructure, Engineering, and Polymer.

Manufacturing Capacities

The company operates four manufacturing facilities and a Transmission Line Testing Station, with a total manufacturing capacity of 362,000 MTPA. It has segment-wise capacities of 300,000 MTPA for Engineering Products and 62,000 MTPA for Polymer Products.

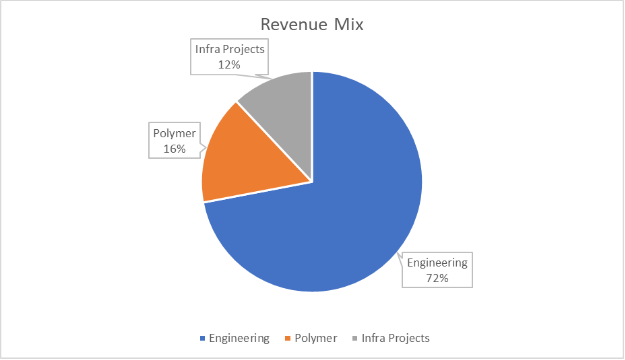

Revenue Mix for 9M FY24

Geographical Split FY23

Client Base

Reliance Jio, Power Grid Corporation India Ltd, Tata Projects, etc., maintain a vast distribution network of 20,000 retailers in eastern India for their polymer segment.

Q3FY24 Financials

The company’s revenue for Q3FY24 grew by an impressive 80% year-over-year (YoY) to Rs 802 crore, representing a 4% increase compared to the previous quarter (QoQ). While profit after tax (PAT) saw a slight dip of 5% QoQ, it skyrocketed by 157% YoY, reaching Rs 18 crore. The operating profit margin (OPM) remained consistent at 10% YoY. This indicates strong overall financial performance with consistent profitability and significant YoY growth in revenue and PAT. The trailing twelve months earnings per share (TTM EPS) stands at Rs 6.34.

Segment-wise Order Book

Key Highlights

Key Growth Drivers

| Key Growth Driver | Description |

| Order book for Engineering & Infrastructure segment | 3.7 times the sales of FY’23, ensuring revenue visibility for the next 3-4 years. |

| Surge in global inquiries and benefiting from China plus one trend | The company is benefiting from the increasing demand for its products and services from global customers. |

| Robust order backlog | The company has a strong order backlog, which indicates that there is continued demand for its products and services. |

| Jal Jeevan Mission initiative | The government’s Jal Jeevan Mission initiative is expected to boost demand for PVC pipes and fittings, which will benefit the company. |

| Strong balance sheet and improving profitability | The company’s strong balance sheet and improving profitability will support its growth initiatives. |

| Increase exports and elevate global positioning | The company is looking to increase its exports and elevate its global positioning. |

| Strengthening customer relationships | The company is strengthening its long-standing relationships with customers, which will help it to grow its business. |

Industry Outlook

On September 1, 2023, the demand for electricity in India reached a peak of 239.97 GW. In January 2024, the sector utilisation of thermal power reached 72.2%.

The need for additional transmission networks will rise as a result of local and international investment in T&D infrastructure for renewable energy sources.

By 2030, India wants to generate 500 GW of electricity from renewable sources and invest Rs 2.4 trillion to construct around 50,890 CKM of transmission lines.

Future Anticipation

Shareholding Pattern

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Feb 14, 2024, 5:14 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates