Alternative Investment Funds (AIFs) have witnessed a historic milestone as investment commitments surpass Rs 10.84 lakh crores for the first time, indicating a growing appetite among affluent investors for higher returns. This article explores the factors driving this surge in investments and the regulatory landscape influencing the AIF industry.

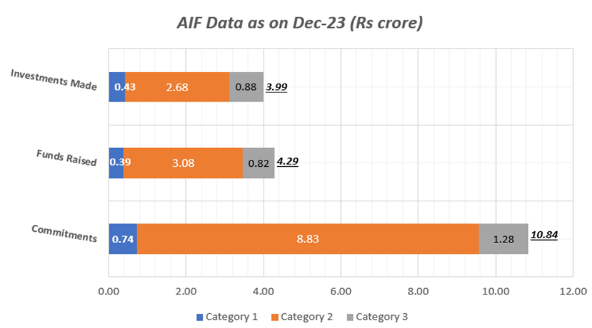

As of December 2023, investment commitments received by AIFs soared to Rs 10.84 lakh crore, marking a remarkable 13.6% increase quarter-on-quarter and a substantial 40% rise year-on-year

Data from the Securities and Exchange Board of India (Sebi) reveals that AIFs have raised approximately USD 51.3 billion (Rs 4.29 lakh crore), with a significant portion directed towards Category II AIFs engaging in both debt and equity investments.

Recent changes in taxation, particularly the alteration in taxation of debt mutual funds and market-linked debentures in Budget 2024, have spurred interest in AIFs focusing on private credit. Moreover, the AIF industry has undergone regulatory adjustments, including dematerialisation for funds exceeding the threshold and revamps in fee structure, benchmarking, and valuation norms.

Despite the surge in investments, concerns loom over recent restrictions imposed by the Reserve Bank of India (RBI) on investments from banks and non-bank financial companies (NBFCs). The directive requiring banks and NBFCs to liquidate or provision their investments in AIFs with debtor connections aims to curb loan evergreening practices, potentially impacting the pace of inflows into AIFs.

Sebi has proposed several changes for the AIF industry, including allowing pledges in infrastructure assets and ‘exclusion’ for certain investors by managers to prevent circumvention of regulations. These proposals aim to enhance transparency and accountability within the AIF sector while ensuring compliance with regulatory standards.

The surge in investment commitments underscores the growing preference for alternative investment avenues among high-net-worth individuals seeking higher returns. AIFs offer tailored investment products with a minimum ticket size catering to affluent investors, contributing to the industry’s rapid growth.

However, concerns over regulatory restrictions, particularly the RBI’s directive impacting investments from banks and NBFCs, pose challenges to the sustained growth of AIFs. While regulatory changes aim to foster transparency and mitigate risks, they also introduce complexities that may influence investor sentiment and fund inflows.

Conclusion: The AIF industry’s record-breaking investment commitments reflect its increasing relevance in the investment landscape, driven by the quest for higher returns and tailored investment solutions. Despite regulatory challenges, the industry remains poised for growth, provided it navigates evolving regulations and sustains investor confidence.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Feb 23, 2024, 5:45 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates