Recently Motilal Oswal Mutual Fund filed DRHP to launch 5 mutual funds while just before that Tata Mutual Fund filed DRHP for 6 new funds. There is a long way to for the new fund offerings which give investors a wide spectrum to invest according to their preferences and sector allocation.

A New Fund Offer (NFO) is when an asset management company (AMC) launches a new mutual fund scheme. This gives investors a chance to subscribe to the fund’s units during its initial offering period. NFOs usually come with a new investment strategy, theme, or asset class, allowing investors to get in from the start.

During the NFO period, investors can buy the fund’s units at the offer price, which is often fixed (like Rs 10 per unit). AMCs sometimes run promotional campaigns to generate interest in the NFO, and these usually have a limited subscription period.

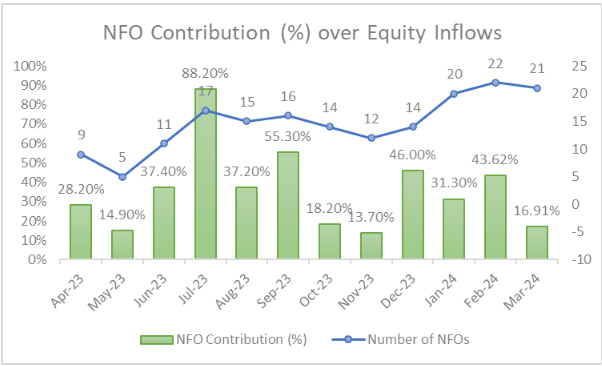

In FY24, around 176 new funds were issued, raising Rs 63,538 crore. According to an analysis, below is a breakdown of how funds raised via NFOs contributed to overall equity inflows month over month:

| Month | Number of NFOs | NFO Amount (Rs crore) | Total Equity Inflows (Rs crore) | NFO Contribution (%) |

| Apr-23 | 9 | 1,828 | 6,480 | 28.2 |

| May-23 | 5 | 483 | 3,240 | 14.9 |

| Jun-23 | 11 | 3,228 | 8,637 | 37.4 |

| Jul-23 | 17 | 6,723 | 7,626 | 88.2 |

| Aug-23 | 15 | 7,531 | 20,245 | 37.2 |

| Sep-23 | 16 | 7,795 | 14,091 | 55.3 |

| Oct-23 | 14 | 3,638 | 19,957 | 18.2 |

| Nov-23 | 12 | 2,136 | 15,536 | 13.7 |

| Dec-23 | 14 | 7,812 | 16,997 | 46 |

| Jan-24 | 20 | 6,817 | 21,781 | 31.3 |

| Feb-24 | 22 | 11,720 | 26,866 | 43.62 |

| Mar-24 | 21 | 3,827 | 22,633 | 16.91 |

| Total | 63,538 | 1,84,089 | – | |

Source: Fisdom Research

Source: Fisdom Research

When a new fund is introduced, it often draws fresh investments from investors. This increased buying activity can add liquidity to the market, especially if the NFO is large or attracts significant investor attention.

The launch of a new fund can reflect investor sentiment. If investors are confident about the market’s prospects, they may be more inclined to invest in new funds. On the other hand, a lack of interest in NFOs could indicate caution or pessimism among investors.

NFOs bring new players or offerings into the mutual fund landscape. Existing mutual funds may need to adjust their strategies or offerings to remain competitive in attracting investors’ funds.

Some NFOs are launched with specific themes or investment focuses, such as technology, healthcare, or sustainability. Depending on the sector, the introduction of these new funds can impact related industries and existing funds in those areas.

The above-mentioned impacts can not be tracked accurately but can be observed through inflow and outflow of funds.

Dreaming of financial freedom? Use our Mutual Fund SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Apr 19, 2024, 1:21 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates