During the week, the Tatas have called a special meeting on September 21st to consider converting Tata Sons from a Public Limited company into a Private Limited Company. This decision needs to be seen in the light of the recent differences that cropped up between the Tatas and the Mistry family leading to the eventual ouster of Cyrus Mistry from the post of CEO of Tata Sons.

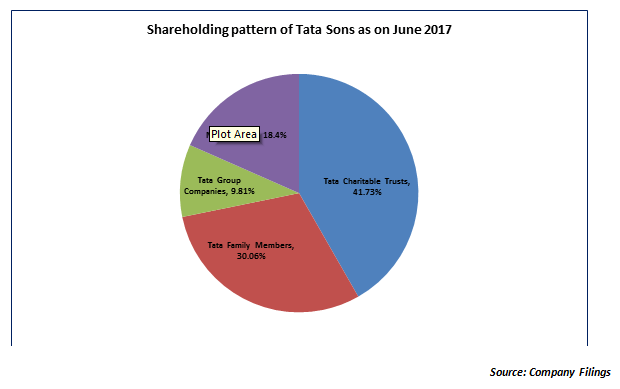

The ouster of a CEO from an Indian company is nothing news and we have seen scores of such instances in the past. However, the reason this decision to oust Cyrus Mistry came in the limelight is because the Mistry family holds over 18% stake in Tata Sons. There is a long history of relationship between the Tatas and the Mistry family. This relationship started off with a loan given by the Mistry family to Tatas in the old days when they were strapped for cash. The Tatas could not repay the loan at that point of time but later agreed to convert the loan into equity in Tata Sons. That is how the Mistry family became an 18.4% shareholder in Tata Sons.

For a long time Tata Sons had chosen to remain as a private limited company. It was only in 1975 that the Tata Sons converted itself from a private limited company to a public limited company. The proposal to convert Tata Sons back from a public limited company to private limited company will be put to vote on September 21st. The Mistry group has already objected to this and have called upon the National Company Law Tribunal (NCLT) to intervene and stop the meeting. The Mistry family’s concerns are not difficult to understand. Once the company is converted back from being a public limited company to a private limited company, then there are can be severe restrictions put on transfer of shares to external parties. Currently, the Mistry family has been exploring the possibility of monetizing its stake in Tata Sons by selling the stake to an external buyer. That will become impossible as the Mistry family will not be able to sell their stake without the support of the Tatas. That is because the Tatas still have a major say in the board of Tata Sons because of their majority indirect holdings through the Tata Trusts.

The Indian Companies Act specifically precludes holding company ownership through trusts. The government had consciously made some exceptions in case of businesses that were in existence even before the time India became independent. That is how the Tatas have continued their control of Tata Sons through the trusts. There are 2 grey areas here. According to the Mistry family, their stake in Tata Sons is to the tune of 18.4%, which makes them a very significant minority shareholder. However, the contention of the Tatas is that one also needs to consider the potential dilution from subsequent the issue preference shares. According to the Tatas, if the dilution due to preference share issues is also considered then the ownership of the Mistry family could be as low as 2.5% in Tata Sons. Secondly, Tatas may personally be smaller owners in Tata Sons but the majority ownership still rests with Tata Trusts where Ratan Tata remains the principal stake holder. This already gives an advantage to the Tatas in dealing with the Mistry family in the Tata Sons affair.

To understand whether this proposal to convert Tata Sons into a private limited company can be pushed through, one needs to understand the ownership structure of Tata Sons…

Effectively, the Tata Family owns 81.6% of Tata Sons as per the company filings. If the subsequent preference dilution is considered then their effective stake must be much higher. However, that is not too clear at this point of time. The resolution to convert the company back to private requires the approval vote of 75% of the shareholders, which is something the Tata Group should be able to manage considering their control over nearly 81.6% of the voting power in Tata Sons. The other challenge is the NCLT approval which is also required before converting Tata Sons back into a private limited company. We need to understand why the NCLT becomes very important in this case.

There are 3 basic issues for the NCLT to examine in this case…

The Tatas have set the ball rolling. How the Mistry family and the NCLT react will decide the future course of events.

Published on: Sep 21, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates