The Indian currency has demonstrated remarkable stability in comparison to its emerging market counterparts this quarter. This stability can be primarily attributed to significant inflows into the country following its inclusion in the bond index. These inflows, amounting to nearly $10 billion, have played a crucial role in maintaining the currency’s stability.

Indian currency is fairly stable and other pairs are under pressure

| Currency | Code | Jan-24 | 08-Apr-24 | Change |

| Brazil | USDBRL | 4.85 | 5.07 | -4.3% |

| India | USDINR | 83.23 | 83.32 | -0.1% |

| China | USDCNY | 7.12 | 7.25 | -1.7% |

| Russia | USDRUB | 89.24 | 92.51 | -3.5% |

While the Indian currency has remained stable, other emerging market currencies have faced challenges. The Brazilian real, for instance, has depreciated by 4.3% this year, making it the worst-performing currency. As of April 6, 2024, one U.S. dollar was equivalent to approximately 5.07 Brazilian real. The real decline can be traced back to the economic and financial recession triggered by the COVID-19 pandemic, which led to a 16% depreciation between March 2 and May 28, 2020.

The Russian ruble has also experienced depreciation, losing 3.5% of its value this year. Despite being one of the most volatile emerging market currencies, the ruble’s recent decline is primarily due to trade sanctions and plummeting export earnings, rather than sanctions affecting the central bank and individual financial institutions.

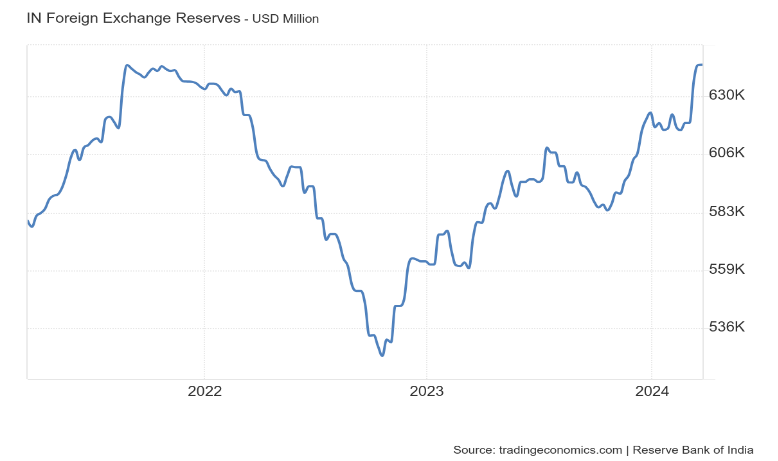

In comparison, the Indian rupee has maintained stability, showcasing the resilience of the country’s economy and currency. India’s forex reserves, standing at around $640 billion, are close to their late 2021 peak, indicating robust financial health and bolstering investor confidence.

For investors, understanding currency dynamics is crucial. While some currencies face volatility and depreciation, others, like the Indian rupee, demonstrate stability and resilience. Factors such as economic policies, global economic conditions, and geopolitical events can all influence currency performance.

Conclusion

In conclusion, the currency market offers a fascinating glimpse into the global economy’s complexities. Understanding these dynamics is essential for investors in the currency market.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 8, 2024, 6:16 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates